Bitcoin trades beneath $76K price foundation, however on-chain knowledge reveals no main promoting strain.

Bitcoin has fallen beneath the common buy value of one in every of its largest company holders. After greater than 5 years of regular accumulation, Michael Saylor’s mixture place now sits underwater. Market response has centered on the scale of the unrealized loss. Broader knowledge, nevertheless, suggests present situations stay inside Bitcoin’s regular volatility vary.

Saylor’s Bitcoin Place Underwater as Derivatives Threat Builds

In line with studies from Arkham, Michael Saylor’s Technique has purchased about $54.52 billion value of Bitcoin since mid-2020. The common buy value for this funding is round $76,027 per coin.

BITCOIN IS MORE THAN 10% BELOW SAYLOR’S AVERAGE PRICE

After 5 and a half years of shopping for Bitcoin – Saylor has bought a complete of $54.52B BTC at a mean value of $76,027.

The value is presently 12.4% decrease than his common – that means that Saylor is presently sitting on an… pic.twitter.com/0kGcGk3agm

— Arkham (@arkham) February 19, 2026

With Bitcoin now buying and selling about 12.4% beneath that degree, his unrealized loss is estimated at roughly $6.7 billion. Whereas the greenback quantity seems giant, the proportion decline remains to be comparatively small by Bitcoin’s historic requirements.

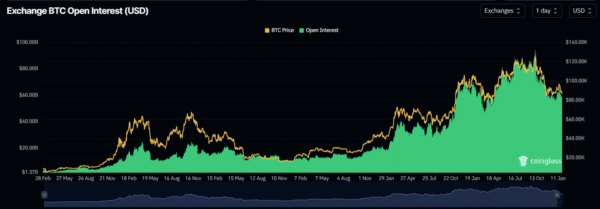

Alternate open curiosity remains to be close to the excessive finish of its historic vary, even after the current drop in value. Throughout the rally towards $100,000, open curiosity elevated shortly. Nevertheless, as spot value pulled again, derivatives positions didn’t fall on the similar tempo.

Picture Supply: CoinGlass

Because of this, many positions stay open out there, thus contributing to cost swings. Assuming the OG coin Bitcoin reclaims the $76K mark strongly, quick sellers could also be compelled to shut positions. And this sharp rise might push costs increased.

Then again, if key help ranges break, lengthy positions may very well be liquidated. On this case, promoting strain might enhance.

The present market construction reveals that deleveraging is just not but full. In previous mid-cycle pullbacks, open curiosity normally dropped extra sharply. Nevertheless, that sort of reset stays absent. Because of this, many leveraged positions are nonetheless lively, which implies value swings might stay sturdy within the quick time period.

On-Chain Knowledge Exhibits No Pressured Promoting as BTC Pullback Stays Inside Cycle Norms

Pockets clusters linked to Saylor’s treasury present sturdy inner connections. Giant related addresses counsel centralized management and chilly storage separation.

As well as, outbound transfers look like inner actions or safety changes. Up to now, there aren’t any clear indicators of funds shifting to alternate wallets. And as such, the chance of compelled promoting stays low.

Bitcoin has typically skilled 20%-40% declines throughout broader bull markets. In full bear markets, costs have fallen by 70% or extra. In contrast with these strikes, a 12.4% drop beneath a five-year common price seems comparatively small.

On the similar time, the present pullback from current highs nonetheless suits inside regular mid-cycle ranges. Extra so, value conduct doesn’t appear like previous main breakdowns. As a substitute, volatility knowledge factors extra towards consolidation than panic promoting.

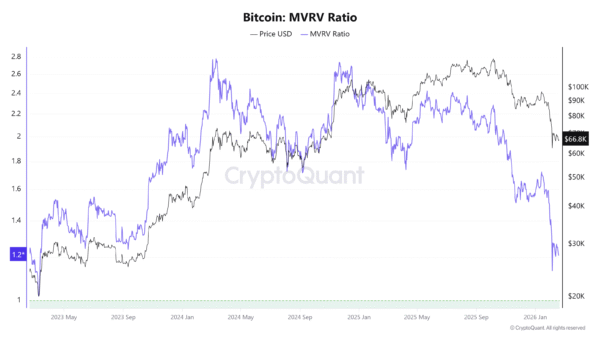

The MVRV ratio, which compares market worth to realized worth, has fallen from earlier excessive ranges. The studying is nearer to impartial ranges, which factors to a standard reset.

Picture Supply: CryptoQuant

In the meantime, knowledge from Coinglass reveals that long-term holder provide remains to be near cycle highs. When skilled holders enhance their provide, it normally reveals confidence. In previous cycles, sharp drops on this metric got here earlier than main tops.

Nevertheless, present knowledge doesn’t present large promoting from long-term holders. A big unwind like earlier peaks has not appeared. With this in thoughts, present conduct seems extra like a slowing of demand than a full exit from the market.

Saylor’s Bitcoin Place Faces Paper Loss as Market Exams Key Ranges

Retail traders typically focus primarily on the scale of the greenback loss, whereas institutional traders place extra weight on long-term time horizon and regular market volatility. From that perspective, 5 and a half years of regular shopping for spans a number of bull and bear cycles, which modifications how short-term losses are considered.

Bitcoin typically strikes 20% to 30% throughout broader uptrends. For that purpose, a 12% hole beneath the common price doesn’t routinely sign that the technique has failed. Custody stays steady, and the capital behind the place seems positioned for the long run reasonably than short-term buying and selling.

Market path now will depend on three key elements. A transparent drop in open curiosity might scale back promoting strain and calm volatility. A robust transfer again above $76,000 might shift short-term momentum increased. Then again, a break beneath key help ranges might set off further liquidations and enhance draw back strain.