Arkham Intelligence says bitcoin mining operations linked to the UAE’s Royal Group are sitting on roughly $344 million in unrealized revenue, excluding vitality prices.

Arkham attributed about 6,782 BTC to wallets related with UAE royal-linked mining exercise, valuing the holdings at roughly $453.6 million on the time of research. The agency mentioned the implied revenue displays the distinction between present bitcoin costs and estimated manufacturing prices, although it famous the determine doesn’t account for electrical energy and operational bills.

Arkham’s onchain knowledge additionally factors to a gradual tempo of mining output.

Over the previous seven days, the UAE-linked wallets produced round 4.2 BTC per day, suggesting ongoing industrial-scale operations. The analytics agency added that the UAE seems to be retaining most of its self-mined bitcoin, with the final recorded outflow from the wallets occurring roughly 4 months in the past.

The findings underscore how the UAE has pursued a unique path from many different governments with giant bitcoin positions.

Whereas international locations resembling the USA and the UK maintain vital reserves largely tied to regulation enforcement seizures, Arkham mentioned the UAE’s accumulation has been pushed primarily by home mining exercise.

The UAE’s mining push traces again to 2022, when Citadel Mining, an entity linked to Abu Dhabi’s royal household, established large-scale operations on Al Reem Island. That very same yr marked a broader regional effort to draw digital asset infrastructure, supported by capital from state-connected corporations.

In 2023, Marathon Digital Holdings and Abu Dhabi-based Zero Two introduced a three way partnership geared toward creating 250 megawatts of immersion-cooled bitcoin mining capability within the UAE. The mission was one of many largest disclosed industrial mining deployments within the area, reflecting the nation’s ambitions to turn out to be a hub for crypto infrastructure.

Arkham mentioned its newest estimate revises down an earlier projection from August 2025, when the agency attributed roughly $700 million in mined bitcoin to the UAE throughout a interval of upper costs. At the moment, Arkham estimated the nation had mined about 9,300 BTC and held roughly 6,300 BTC, rating it among the many prime sovereign entities with verified onchain holdings.

Below the up to date figures, the UAE’s holdings characterize about 0.03% of bitcoin’s whole provide, in keeping with Arkham.

Abu Dhabi’s Bitcoin ETF publicity

Abu Dhabi’s sovereign wealth funds are additionally getting in on the enjoyable. This week they disclosed a serious improve of their publicity to BlackRock’s iShares Bitcoin Belief (IBIT), reporting possession of 12.7 million shares value about $630.6 million as of Dec. 31. That marks a 46% soar from the 8.7 million shares beforehand reported on the finish of September.

Mubadala, which oversees a world portfolio throughout know-how, healthcare, infrastructure, non-public fairness, and public markets, manages greater than $330 billion in belongings. Its mandate is to generate long-term returns for the Abu Dhabi authorities whereas supporting financial diversification past oil.

One other Abu Dhabi-based agency, Al Warda Investments, additionally raised its IBIT place in This fall 2025 to eight.22 million shares, up from 7.96 million in Q3, persevering with a shift towards public bitcoin ETF publicity that started earlier within the yr.

Al Warda, a part of the Abu Dhabi Funding Council below Mubadala, has historically centered on non-public investments, making its rising allocation to IBIT notable for the area. Collectively, Abu Dhabi funding automobiles held greater than 20 million IBIT shares on the finish of final yr, with a mixed worth above $1.1 billion.

Arkham did be aware that the USA stays the biggest sovereign bitcoin holder, with roughly 328,000 BTC valued at $22 billion, largely derived from seizures tied to instances such because the Bitfinex hack and Silk Highway investigations.

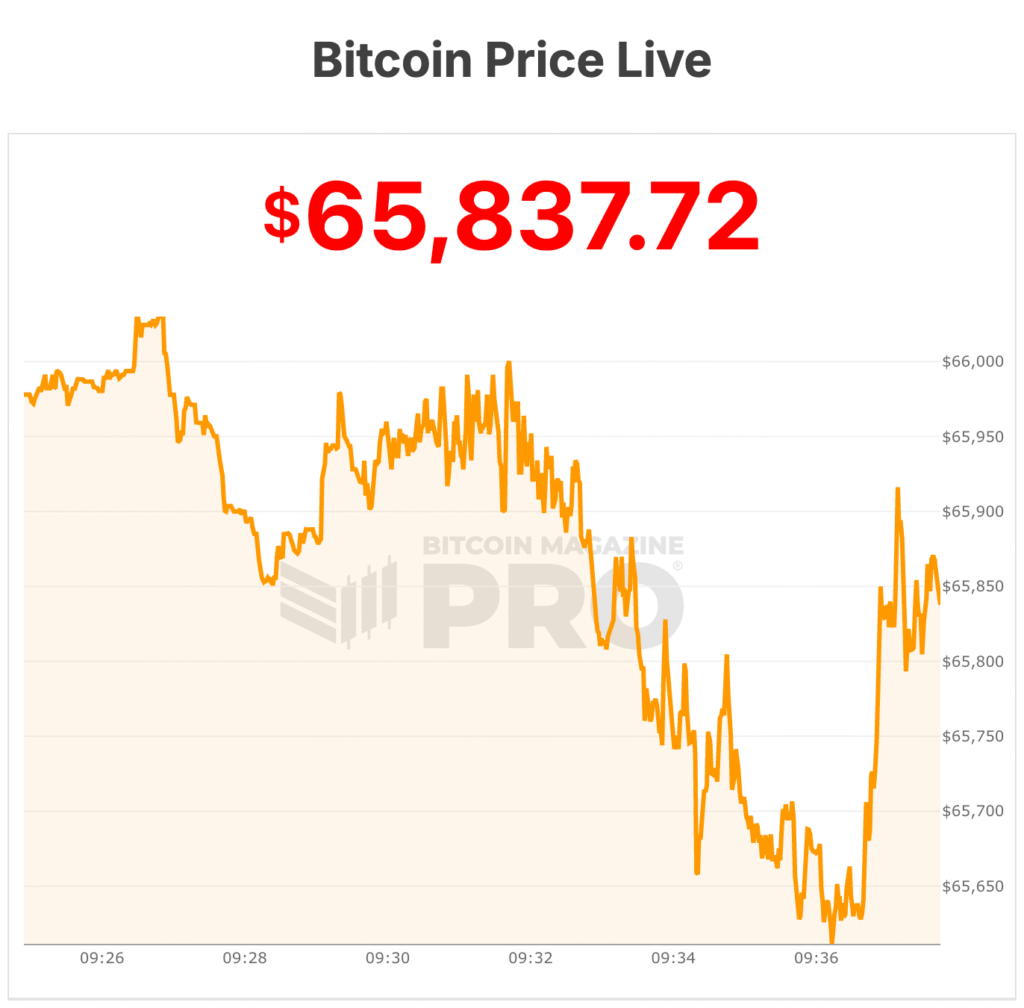

At time of writing, Bitcoin is buying and selling proper under $66,000.