- The Mar-a-Lago summit signaled political gravity, not grassroots crypto adoption

- USD1 is being positioned as regulator-adjacent finance, not only a funds device

- Stablecoins are more and more changing into affect devices, not impartial infrastructure

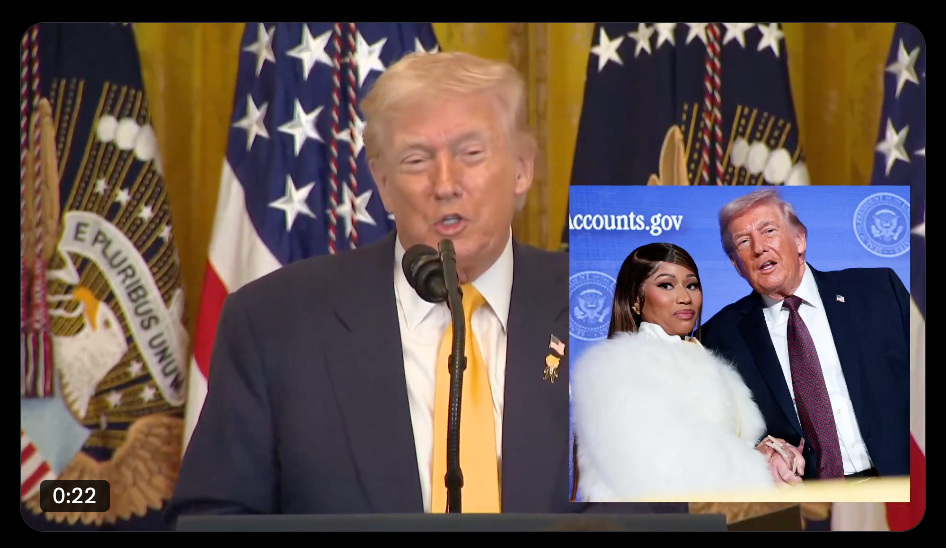

The Mar-a-Lago summit didn’t seem like a standard crypto occasion. It wasn’t attempting to steer skeptics or win over builders. It was signaling to insiders. When alternate CEOs, regulators, senators, and billionaires collect beneath chandeliers to bless a stablecoin, the message is fairly blunt: this isn’t about innovation anymore. It’s about who will get protected passage as crypto hardens into coverage.

That’s why the optics matter greater than the slides. This wasn’t a hackathon vibe. It was political gravity on show. And in markets, gravity shapes outcomes lengthy earlier than merchandise show themselves.

USD1 Isn’t Competing on Tech, It’s Competing on Proximity

World Liberty’s pitch is dressed up as a “sooner greenback,” however the true worth proposition is entry. USD1 isn’t attempting to win as a result of it has the perfect UX or the bottom charges. It’s attempting to win as a result of it’s relationship-powered. Treasury-backed reserves matter, positive. However being regulator-adjacent issues extra, particularly if the following stablecoin framework finally ends up favoring “trusted” issuers.

That’s how stablecoins transfer from wallets into company steadiness sheets. Not by memes or group. By way of perceived security, political cowl, and distribution that doesn’t get throttled.

The Line Between Enterprise and Governance Is Getting Uncomfortably Skinny

That is the half the market doesn’t need to say out loud. When CFTC commissioners, senators pushing market construction payments, and main alternate heads share a stage with a non-public issuer, crypto stops pretending it’s impartial. Regulation turns into one thing you assist write whereas launching merchandise that profit from it.

That could be authorized. It’s actually strategic. Nevertheless it isn’t clear, and it isn’t what most individuals thought “open finance” was alleged to seem like. The outdated separation between policymaking and product launch is fading quick, and stablecoins are the place that shift is most seen.

DeFi Language, TradFi Actuality

Even when the branding makes use of crypto language, nothing about this feels decentralized. It seems to be like conventional finance with new rails and louder advertising and marketing. Stablecoins are being framed as devices of greenback dominance and coverage affect, not as instruments for monetary freedom.

That framing appeals to establishments and policymakers as a result of it’s acquainted. It additionally quietly pushes the unique crypto viewers to the sidelines. The tradition is shifting from permissionless experimentation to permissioned legitimacy, and USD1 is mainly carrying that shift as a badge.

Stablecoins Are No Longer Plumbing, They’re Leverage

The market needs to be trustworthy about what’s taking place. Stablecoins are now not simply infrastructure. They’re leverage. They’re distribution. They’re political alignment. And in a world the place regulation is tightening, these issues could matter greater than code.

USD1’s success gained’t hinge on know-how alone. It should hinge on whether or not political capital can convert into lasting belief as soon as the highlight fades. If it could possibly, this turns into a blueprint. If it could possibly’t, it turns into a really costly spectacle.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.