In a market dominated by Bitcoin and stables, Ethereum worth is sitting at a reduction whereas sentiment stays locked in excessive concern throughout the crypto complicated.

Thesis: Ethereum Worth Is Low-cost for a Purpose — However the Market Is Near Oversold Exhaustion

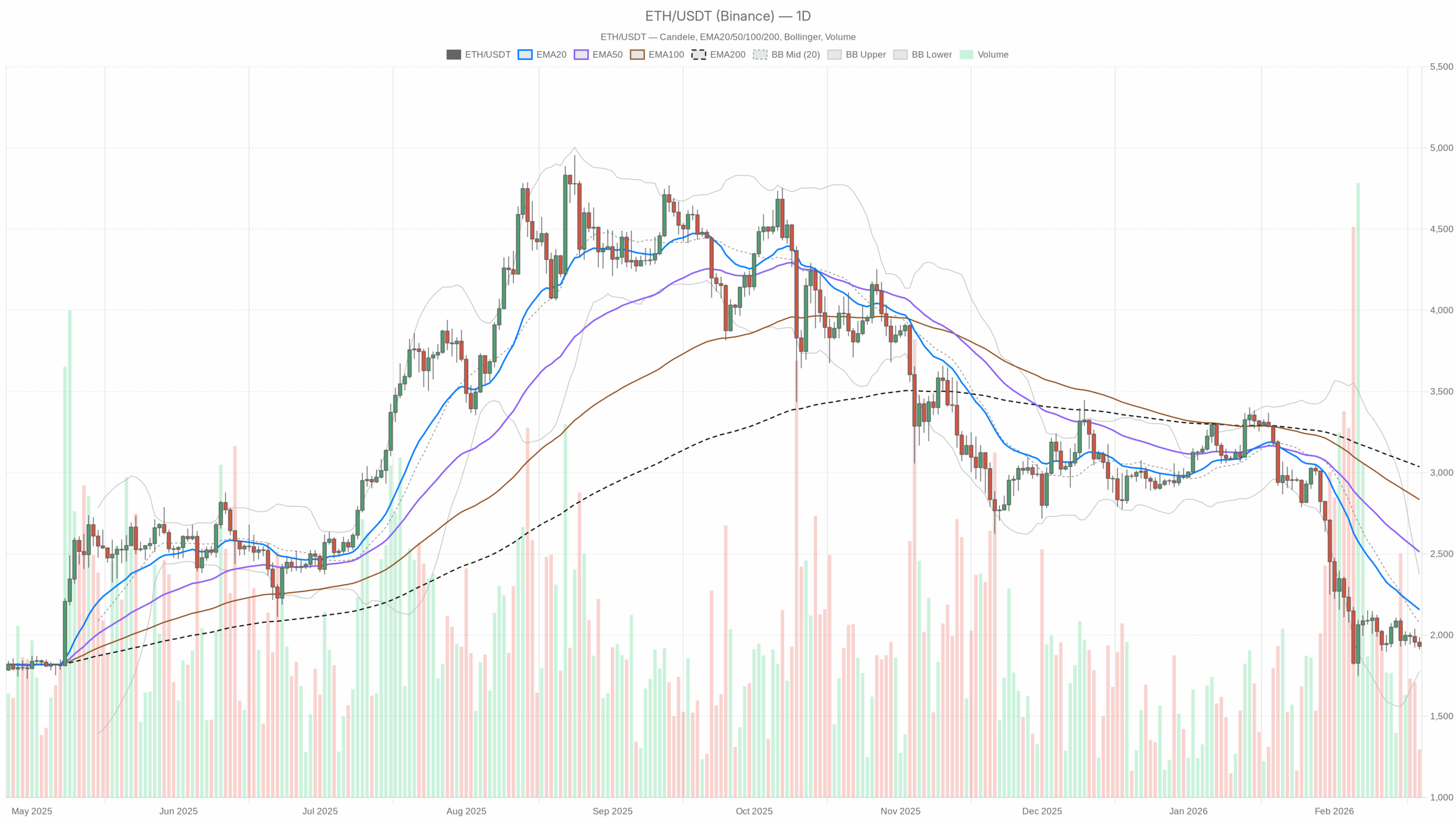

Ethereum (ETHUSDT) is buying and selling round $1,930, sitting effectively beneath all key day by day shifting averages in a market dominated by Bitcoin at ~56% dominance and a crypto-wide sentiment of Excessive Worry (index at 9). That mixture often means Ethereum worth appears optically low-cost, however patrons are nonetheless too scared to step in measurement.

The dominant power proper now’s risk-off positioning: capital is hiding in BTC and stables whereas development belongings like ETH commerce at a reduction. The query is just not “is ETH undervalued?” within the long-term sense, however moderately: is the present downtrend mature sufficient to justify taking the opposite facet? On the day by day chart, the construction remains to be bearish, however momentum and volatility counsel we could also be coming into the late section of the selloff moderately than the center.

Day by day Chart (D1): Macro Bias – Bearish, However Late within the Transfer

On the day by day timeframe, ETH/USDT is clearly in a bearing regime. Worth is beneath all main EMAs and trades within the decrease half of its Bollinger Band vary.

Pattern Construction: EMAs

Day by day shut: $1,930.61

EMA 20: $2,155.87

EMA 50: $2,512.20

EMA 200: $3,036.68

ETH is buying and selling roughly 10% beneath the 20-day, 23% beneath the 50-day, and an enormous 36% beneath the 200-day EMA. The short-, medium-, and long-term pattern traces are all stacked above worth and pointing down.

Interpretation: It is a textbook downtrend. Ethereum worth is reasonable versus the place it traded over the previous few months, however it’s low-cost inside a pattern, not in a vacuum. Any bounce again towards the 20-day EMA close to $2,150 presently appears extra like a rally into resistance than a full pattern reversal.

Momentum: RSI (14)

RSI (14): 32.56

RSI is hovering simply above the traditional oversold line with out really breaking beneath 30.

Interpretation: Sellers are clearly in management, however we aren’t at capitulation ranges but. That is the zone the place continued grind decrease remains to be potential, however it additionally doesn’t take a lot further promoting to set off real oversold situations and spark short-covering. Momentum is bearish, however it’s now not early; it’s within the late, heavy section of the transfer.

Momentum & Pattern Affirmation: MACD

MACD line: -209.59

Sign line: -231.10

Histogram: +21.50

The MACD is deeply unfavourable, confirming the energy and length of the downtrend. Nevertheless, the MACD line has crossed above the sign line, turning the histogram barely constructive.

Interpretation: The pattern remains to be down, however draw back momentum is slowing. That is usually what you see when a selloff is transitioning from acceleration to consolidation or a possible base. MACD is just not giving a clear purchase sign but, however it does say the worst of the momentum could also be behind us, even when worth has not discovered a agency flooring.

Volatility & Positioning: Bollinger Bands

BB mid (20 SMA proxy): $2,075.66

Higher band: $2,373.98

Decrease band: $1,777.35

Worth vs bands: $1,930 is beneath the midline, above the decrease band.

ETH is buying and selling within the decrease half of the band vary, nearer to the decrease band however not hugging it.

Interpretation: The market has already priced in a major quantity of draw back, however we aren’t in an outright panic the place worth rides the decrease band. That often means the transfer is extra of a managed de-risking than a liquidation spiral. A retest of the decrease band close to $1,780 stays on the desk if concern intensifies, however the present spot is extra weak, however not breaking than freefall.

Volatility & Threat: ATR (14)

ATR (14): $129.21

With ETH at about $1,930, a day by day ATR of roughly $129 implies typical day by day swings of about 6.5% of worth.

Interpretation: Volatility is elevated however not at disaster ranges. For merchants, it means danger per place is excessive: stops want extra room, and leverage needs to be dialed down. For longer-term traders watching perceived Ethereum worth, it means short-term noise is giant sufficient that entries will not often be good; you must be comfy with $100+ swings even in case you are directionally proper.

Close to-Time period Map: Day by day Pivot Ranges

Pivot (PP): $1,943.22

Resistance 1 (R1): $1,974.94

Assist 1 (S1): $1,898.88

Worth is buying and selling simply beneath the day by day pivot and simply above S1.

Interpretation: The intraday steadiness is barely unfavourable: the market is leaning beneath the pivot, however not convincingly breaking assist. A clear day by day shut again above $1,975 can be the primary signal that dip-buyers are lastly stepping in; a break and maintain beneath $1,900 ramps up the danger of a deeper slide towards the decrease Bollinger Band.

Hourly Chart (H1): Brief-Time period Strain, Managed Promoting

On the 1-hour chart, ETH can be in a bearish regime, however some indicators present compression moderately than acceleration.

Pattern on H1: EMAs

H1 shut: $1,931.95

EMA 20: $1,958.45

EMA 50: $1,970.43

EMA 200: $1,998.02

Worth is beneath all three hourly EMAs, however the distance to them is comparatively modest, at about 1–3%.

Interpretation: The short-term pattern remains to be down, however the transfer is just not prolonged on this timeframe. Bears are in management, but the market is just not closely stretched intraday. That always results in uneven, mean-reverting bounces into the EMAs, which then act as resistance.

Hourly RSI & MACD

RSI (14, H1): 35.82

MACD (H1): line -9.38, sign -5.86, histogram -3.52

Hourly RSI is beneath 40, confirming bearish momentum, whereas MACD is unfavourable with the histogram additionally unfavourable.

Interpretation: Not like the day by day MACD, the hourly MACD has not but turned. Brief-term momentum remains to be drifting decrease. This helps the concept intraday rallies are more likely to be offered till we see constructive divergence or a flip within the histogram.

Hourly Bollinger Bands, ATR & Pivots

BB mid: $1,956.97

BB higher: $1,989.27

BB decrease: $1,924.68

ATR (14, H1): $15.41

H1 Pivot (PP): $1,926.62

R1: $1,941.18

S1: $1,917.40

Worth is hovering simply above the decrease hourly band and simply above the hourly pivot.

Interpretation: Intraday, ETH is heavy close to the decrease bands however not breaking down. Volatility round $15 per hour is significant however manageable. So long as worth holds above $1,917–1,925, short-term sellers are urgent however not dominating; a break beneath that zone would probably invite a fast slide to check deeper helps.

15-Minute Chart (M15): Execution Context – Micro Downtrend, No Clear Reversal But

The 15-minute chart is solely for timing. It mirrors the upper timeframes with a smaller lens.

M15 shut: $1,932.26

EMA 20: $1,944.61

EMA 50: $1,956.40

EMA 200: $1,970.96

RSI (14, M15): 36.65

MACD (M15): line -11.13, sign -9.11, histogram -2.02

BB mid: $1,947.85

BB higher: $1,978.96

BB decrease: $1,916.74

ATR (14, M15): $10.56

Pivot (PP, M15): $1,926.73 (R1: $1,941.38, S1: $1,917.60)

Worth is sitting simply above the 15-minute pivot and the decrease band space; momentum is bearish however not collapsing.

Interpretation: The micro pattern factors down, however worth motion is in a zone the place scalpers might begin fading additional weak point, particularly if increased timeframes maintain their close by helps. Any aggressive bounce from $1,920–1,930 that reclaims $1,950–1,960 on M15 can be an early inform that short-term promoting is lastly tiring.

Market Context: Ethereum Worth vs. Macro Crypto Flows

The broader market cap has slipped about 1.8% in 24 hours, and sentiment is pinned at Excessive Worry. BTC dominance above 56% whereas Ethereum holds beneath 10% market share is a traditional risk-off alignment: the market is rewarding perceived security in BTC and stablecoins whereas systematically underweighting ETH and the remainder of the danger curve.

On the elemental facet, DeFi exercise is combined. Uniswap V3 charges spiked over 400% within the final day, although seven-day charges are down. That hints at episodic bursts of on-chain exercise, probably volatility or rotation trades, moderately than a gentle development pattern. For Ethereum worth, that could be a double-edged sword: the community is clearly nonetheless used, however the flows don’t but present a definitive, sustained return of danger urge for food.

A notable headline is Harvard reportedly rotating from Bitcoin into Ethereum. One establishment doesn’t outline worth, however it underscores a long-running theme: on longer horizons, giant gamers are keen to deal with ETH as a core asset moderately than a speculative token. Within the brief time period, nonetheless, that type of information is being drowned out by macro de-risking.

Principal State of affairs Based mostly on D1: Reasonably Bearish With a Late-Stage Really feel

Taking the day by day chart because the anchor, a number of parts align. The pattern based mostly on EMAs is firmly bearish. RSI is weak however not but washed out. MACD remains to be unfavourable however beginning to enhance. Worth is within the decrease half of the Bollinger vary, not pinned to the underside. Volatility is elevated however not excessive.

Put collectively, the base case is bearish, with a robust likelihood we’re nearer to the later innings of the downtrend than the start. The market remains to be pricing Ethereum worth defensively, however indicators of momentum fatigue are creeping in.

Eventualities for ETH/USDT

1. Bullish State of affairs: Oversold Rebound and Imply Reversion

Within the bullish path, the present space round $1,900–1,930 acts as a higher-timeframe assist pocket, and excessive concern lastly begins to draw contrarian patrons.

Key elements:

- Assist holds: Day by day worth defends the $1,900 zone (S1) and avoids a clear break of the decrease Bollinger band close to $1,780.

- Momentum flip: Day by day RSI stabilizes and curls again above 40, whereas MACD histogram continues to develop constructive, confirming that draw back momentum has actually peaked.

- Brief-term reclaim: On H1 and M15, ETH reclaims and holds above the 20 and 50 EMAs, roughly $1,960–1,980. These begin performing as assist moderately than resistance.

Targets on this bullish mean-reversion state of affairs:

- First, a transfer again to the day by day pivot/R1 cluster round $1,975–2,000.

- Then a check of the day by day mid-Bollinger and 20 EMA zone round $2,075–2,150.

If danger urge for food returns extra broadly and BTC dominance cools, a deeper retrace towards the 50-day EMA, presently about $2,500, turns into potential, however that could be a second-stage transfer, not the primary expectation.

What invalidates the bullish state of affairs?

- A decisive day by day shut beneath $1,900 adopted by continuation towards $1,800.

- Day by day RSI sliding into deep oversold, beneath 30, with worth hugging the decrease Bollinger band, which might sign we aren’t accomplished with the liquidation section.

2. Bearish State of affairs: Continuation Right into a Deeper Worth Reset

The bearish path says the present pause is only a relaxation cease in a bigger downtrend. Excessive concern doesn’t convert into shopping for; as a substitute, it displays actual compelled promoting or macro risk-off that also has legs.

Key elements:

- Pivot failure: ETH loses the $1,900–1,910 assist band on a day by day closing foundation.

- Momentum re-accelerates: Day by day MACD histogram stalls or turns again down, and RSI breaks beneath 30 with out a right away rebound.

- Band stroll: Worth begins buying and selling constantly close to or beneath the decrease Bollinger band, indicating sustained promoting strain.

In that case, the subsequent logical space is a full check of the decrease band area round $1,780. If that fails, markets will begin repricing Ethereum worth based mostly not on current buying and selling ranges however on earlier structural helps, which may very well be considerably decrease than present ranges.

What invalidates the bearish state of affairs?

- A robust push that closes the day above $2,000, takes out R1, and holds above the day by day pivot for a number of classes.

- H1 and D1 each flipping right into a sample the place worth rides above the 20 EMA as a substitute of beneath it, exhibiting a real change of management from sellers to patrons.

Positioning, Threat, and The way to Assume About Ethereum Worth Right here

It is a trend-down, late-phase setting with elevated volatility and excessive concern. That mixture tends to punish each extremes: dip patrons who ignore the prevailing pattern and scale in aggressively too early, and late shorts who chase breakdowns after volatility has already expanded.

For merchants, the secret’s acknowledging that the day by day pattern remains to be down. Any lengthy makes an attempt are, for now, counter-trend and want tight invalidation ranges across the close by helps, with $1,900 first, then the decrease band close to $1,780. Brief setups ought to respect the truth that momentum has already accomplished loads of work; this isn’t the time for blind, extremely leveraged continuation bets with out clear ranges.

For traders pondering when it comes to Ethereum worth moderately than simply worth ticks, the present zone is the beginning of the territory the place concern can create alternative, however the tape doesn’t but present a confirmed backside. Which means sizing and endurance matter greater than precision. The market remains to be keen to low cost ETH in favor of BTC and stables; till that modifications on the charts, each bounce is suspect.

The one certainty right here is uncertainty. Volatility is excessive, macro danger sentiment is fragile, and the tape remains to be trending down. Any plan, bullish or bearish, wants clear ranges the place you admit you’re incorrect and step apart, moderately than attempting to struggle a market that has already made up its thoughts for the day.