Injective (INJ) trades close to $3 after 76% yearly drop, testing key help as RSI indicators oversold circumstances.

Injective (INJ) is buying and selling close to $3.27 on the weekly chart, following an prolonged decline from its 2024 highs above $40.

Market information exhibits the asset stays below stress, whereas technical indicators recommend oversold circumstances.

Weekly Worth Construction Stays Bearish

The weekly INJ/USDT chart exhibits a transparent sample of decrease highs and decrease lows since early 2024.

A significant prime shaped above $40, and value has trended downward since then. The broader construction stays bearish.

Worth is now testing the $3.00 degree, which serves as a psychological and up to date response zone.

Beneath that, help ranges are seen close to $2.50 and $2.00. These areas beforehand acted as consolidation bases.

On the upside, resistance is seen close to $5.00, adopted by $8.00 to $10.00. A weekly shut above $5 would mark the primary structural enchancment. Till then, the pattern stays intact.

RSI and MACD Present Oversold Circumstances

The weekly Relative Power Index is close to 29 to 32. This locations INJ in oversold territory. Nonetheless, throughout robust downtrends, RSI can stay low for prolonged intervals.

A transfer above 40 on the weekly RSI would sign enhancing momentum. At current, no confirmed bullish divergence is seen. Worth continues to respect the broader downward construction.

The MACD indicator stays under the zero line. The histogram exhibits weakening bearish momentum, however no bullish crossover has shaped.

This implies draw back stress could also be slowing, although affirmation is absent.

Associated Studying: Bullish: New Injective Governance Vote Might Slash $INJ Provide By Half

Quantity, Efficiency Metrics and DeFi Context

Buying and selling quantity has declined in the course of the downtrend. There is no such thing as a seen accumulation spike on the weekly chart.

A sustained reversal would require a powerful inexperienced candle with increased quantity.

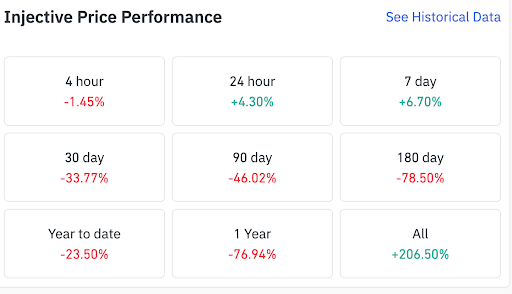

Efficiency information exhibits short-term good points however longer-term weak spot. INJ is up 4.30% over 24 hours and 6.70% over seven days.

Nonetheless, it stays down 33.77% over 30 days and 76.94% over one yr.

INJ exhibits combined timeframes with short-term good points however deep longer-term drawdowns — Supply: Coinglass information.

Complete Worth Locked throughout DeFi stands close to $94.3 billion, down 1.79% in 24 hours. This stays under the 2021 peak close to $180 billion, but above 2022 lows.

Whereas DeFi capital has stabilized, INJ value motion has not confirmed accumulation.

Injective now trades at a important degree close to $3.00. A sustained protection may result in vary formation between $3 and $5.

A breakdown under help might expose decrease historic zones close to $2.50 and $2.00.