- XRP has actual utility, but it surely’s targeted on quick, low-cost cross-border funds and liquidity bridging

- Most XRP utilization as we speak comes from merchants, exchanges, and choose fee suppliers, not common financial institution adoption

- Banks typically use Ripple’s infrastructure with out straight utilizing XRP, making adoption extra restricted than many assume

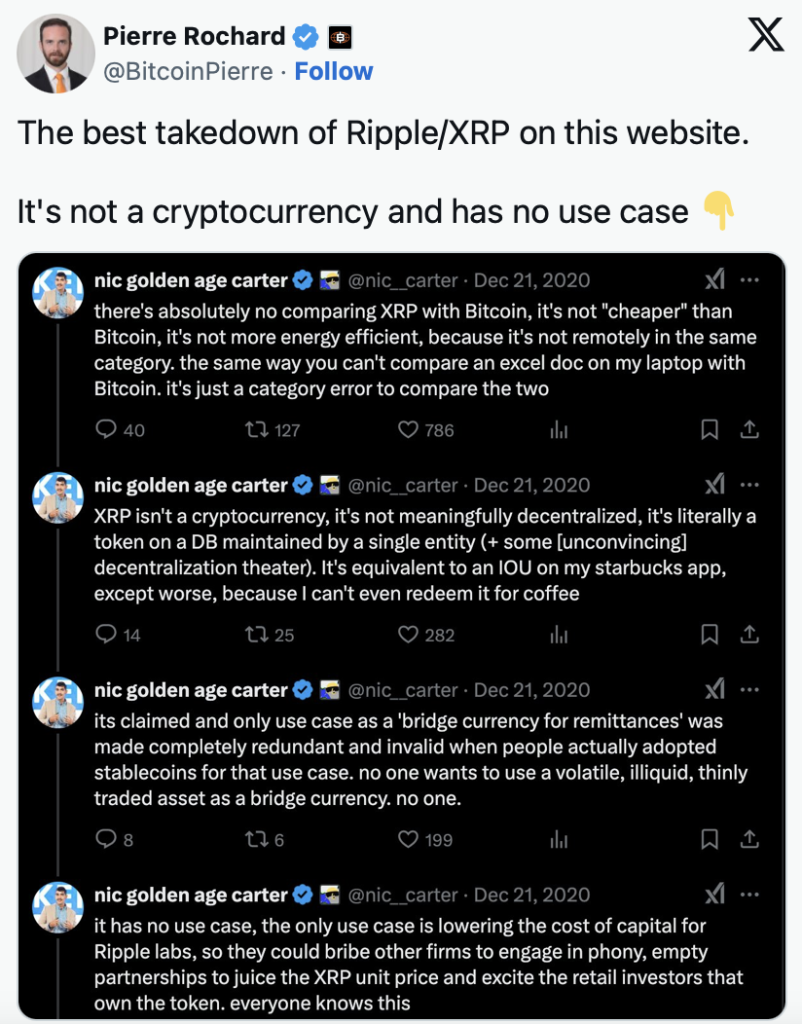

Few cryptocurrencies cut up opinion the way in which XRP does. On one facet, critics throughout crypto and DeFi like to say XRP has no actual utility, that it’s principally only a speculative token with a loud fanbase. On the opposite facet, you’ve obtained the XRP Military, one of the dedicated communities within the trade, satisfied XRP will finally sit on the heart of worldwide finance.

The fact is much less dramatic than both camp desires to confess. XRP does have utility, and it’s actual. However it’s additionally extra particular, narrower, and extra infrastructure-focused than individuals assume once they throw round phrases like “international takeover.”

XRP Was Constructed for One Job, and It’s Nonetheless Good at It

XRP is the native asset of the XRP Ledger, which launched in 2012 with a reasonably clear function: quick, low-cost cross-border funds. That’s the core design. In contrast to Bitcoin, which leans into decentralized worth storage, or Ethereum, which dominates programmable sensible contracts, XRP was constructed to maneuver cash between techniques rapidly and cheaply.

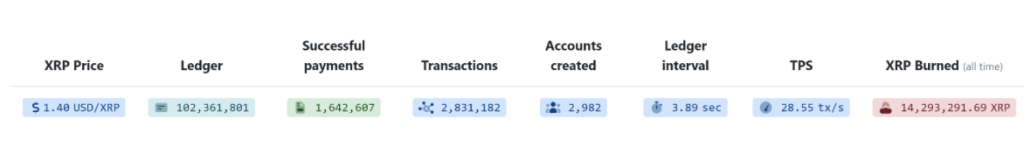

On the XRP Ledger, transactions settle in roughly three to 5 seconds and costs value a fraction of a cent. That pace and value construction makes XRP efficient as a bridge foreign money. In easy phrases, it might probably assist convert between two completely different fiat currencies with out requiring banks or fee corporations to maintain giant reserves sitting in overseas accounts. It’s not flashy, but it surely’s helpful.

Thousands and thousands Maintain XRP, However Actual Utilization Is Nonetheless Concentrated

Retail holders make up the most important group of XRP customers as we speak. As of early 2025, the XRP Ledger reportedly had round 6 to 7 million funded accounts, which means wallets that really maintain XRP. When you account for change custody and the truth that many customers maintain a number of wallets, analysts sometimes estimate that round 2 to three million people globally truly maintain XRP.

Crypto exchanges are one other main a part of the image. Platforms like Binance, Bitstamp, Kraken, and Uphold use XRP as a sensible software for transferring liquidity. XRP’s pace and low charges make it environment friendly for transfers between exchanges, inner treasury administration, and lowering friction when transferring funds round. This isn’t the sort of “utility” individuals brag about on social media, but it surely’s nonetheless real-world utilization.

Cost suppliers are the place XRP’s function turns into extra apparent. Corporations resembling SBI Remit in Japan and Tranglo in Southeast Asia have used XRP by way of Ripple’s On-Demand Liquidity system for cross-border remittances. In these setups, XRP acts as a brief bridge asset. It’s used for seconds or minutes, not held long-term, and it helps keep away from pre-funded overseas accounts. That’s principally the purpose.

Banks Use Ripple Tech, However Most Don’t Truly Use XRP

That is the place the story will get sophisticated, and the place either side normally begin arguing. Many main monetary establishments have labored with Ripple’s fee infrastructure, together with names like Santander, Normal Chartered, and Financial institution of America. However most of those relationships contain Ripple’s messaging and settlement software program, not direct XRP utilization.

In different phrases, Ripple expertise is used extra broadly than XRP itself. Solely choose companions — normally fee suppliers and remittance-focused corporations — use XRP straight for liquidity. That doesn’t imply XRP is ineffective, but it surely does imply the “each financial institution will use XRP” narrative is overstated. No less than for now.

XRP Nonetheless Has Utility Contained in the XRP Ledger Itself

Past funds, XRP additionally performs a technical function inside its personal community. Each XRP Ledger account should maintain a small quantity of XRP, and each transaction requires XRP to pay charges. XRP can also be used for decentralized buying and selling, token issuance, and asset transfers straight on the ledger.

So even outdoors the “financial institution adoption” debate, XRP continues to be the core gas that makes the community operate. It’s not optionally available. And that issues.

XRP Isn’t Ineffective, However It’s Not Common Both

XRP sits in a bizarre center floor. It isn’t a pointless token with zero use. However it additionally isn’t universally adopted by each financial institution on the planet. Its utility exists in particular infrastructure roles, particularly round liquidity provisioning and cross-border settlement, and that’s the place the strongest real-world case lives.

If you wish to perceive XRP correctly, you need to cease pondering in extremes. It’s neither a joke nor a assured international customary. It’s a software, and like most instruments, it really works finest when used for the job it was constructed for.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.