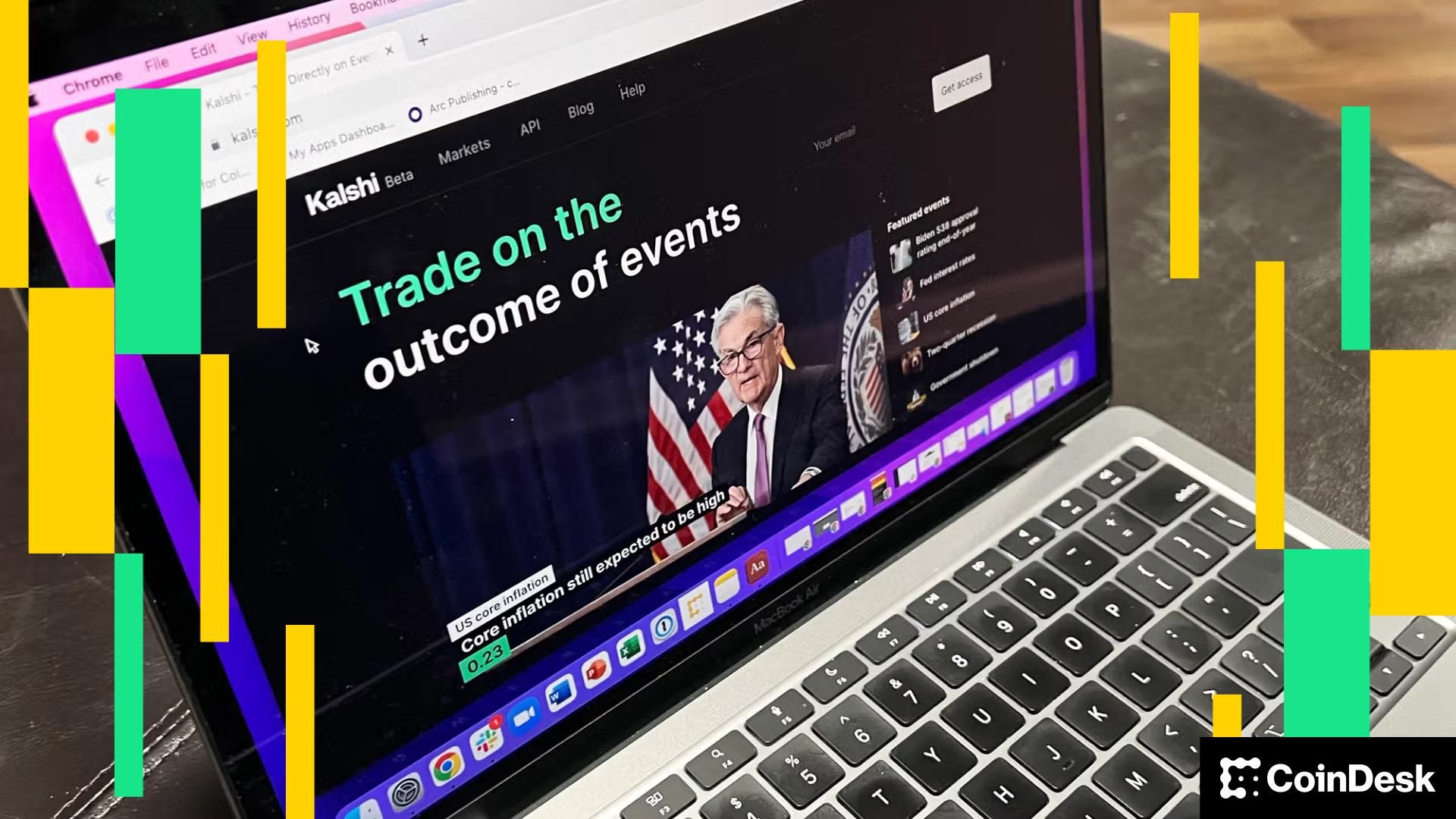

A analysis paper on the U.S. Federal Reserve praised the usefulness of prediction markets — particularly Kalshi — in getting a real-time deal with on financial coverage.

“Kalshi’s forecasts for the federal funds charge and [the U.S. Consumer Price Index] present statistically important enhancements over fed funds futures {and professional} forecasters, all whereas offering repeatedly up to date full distributions reasonably than rare level estimates,” based on the paper revealed on Thursday.

And the markets, through which retail traders can purchase contracts in just about any yes-no query in such various fields as economics, politics and sports activities, are subjects on a stay foundation that different sources of data do not.

Prediction markets “present distinctive insights — notably for variables like [gross domestic product] development, core inflation, unemployment and payrolls, for which no different market-based distributions presently exist.”

And on this research, Kalshi predictions “completely matched the realized federal funds charge by the day of every assembly since 2022, a feat not achieved by both surveys or futures.”

A part of the key sauce that units prediction markets aside as a useful gizmo stands out as the inclusion of retail individuals, which makes them “distinct from institutionally dominated markets,” the paper famous.