- Solana is struggling to reclaim $89 as damaging funding and lengthy liquidations hold strain on value

- Open curiosity collapsed roughly 75%, signaling a significant exit from leveraged bullish positioning

- Weekly Solana DApp income fell 25%, reinforcing weaker community demand and staking incentives

Solana simply can’t appear to get again above $89. Each try to reclaim that stage has been met with fading momentum and, extra importantly, fast closures of bullish by-product bets. That shift alone has elevated the chance of a breakdown beneath the $80 assist zone, which is now the road everyone seems to be watching.

Funding price information from Coinglass exhibits one thing attention-grabbing — and never in a great way for bulls. Quick sellers have been paying a premium for greater than per week, that means funding has stayed damaging. That tells us merchants are leaning closely bearish, they usually’re keen to pay to carry these positions. When that persists, it’s hardly ever random.

Open Curiosity Collapse Indicators Lengthy Exodus

The larger warning signal could be open curiosity. In response to CoinGlass, open curiosity has fallen from roughly $13.5 billion all the way down to about $3.4 billion. That’s a 75% drop. It’s not only a small shakeout — it’s a transparent exodus of leveraged longs leaving the desk.

When open curiosity drains that aggressively, it often displays pressured liquidations or merchants voluntarily closing threat. Both approach, it removes gasoline for upside strikes. With out recent lengthy positioning, rallies are likely to stall earlier than they actually start.

And this derivatives unwind isn’t taking place in isolation. It’s coinciding with weakening on-chain fundamentals, which provides one other layer of strain.

DApp Income Falls to Multi-Month Lows

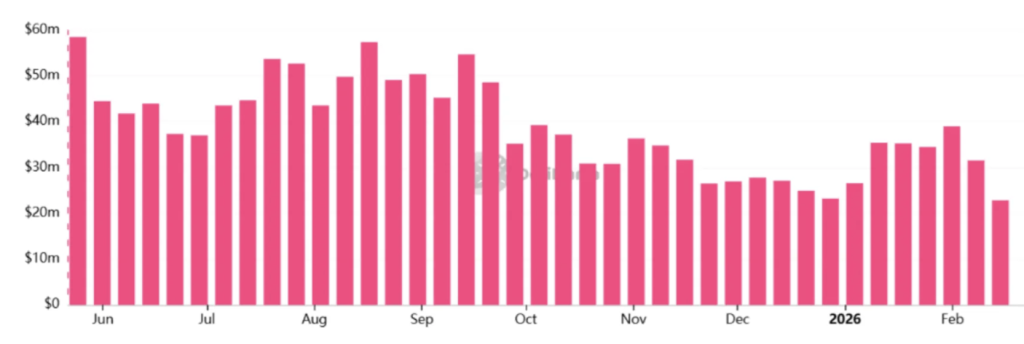

In response to DefiLlama, Solana DApps generated about $22.8 million in weekly income, down 25% from the earlier week’s $30.4 million. That places community income at its lowest stage since October 2024. It’s not catastrophic, however it’s a noticeable slowdown.

Decrease income instantly impacts validator incentives and staking yields. If community demand cools, staking rewards really feel it. And if staking turns into much less engaging, long-term holding incentives weaken. That dynamic doesn’t present up immediately in value, but it surely builds strain over time.

There’s additionally the uncomfortable actuality that a lot of Solana’s current income energy got here from memecoin launchpad exercise.

Memecoin Dependence Nonetheless Weighs on the Community

A big chunk of SOL’s DApp income has been tied to memecoin-driven buying and selling cycles. That sort of income can spike shortly, however it could actually fade simply as quick. It’s totally different from infrastructure-heavy income streams like lending protocols, block constructing, or sustained DeFi demand.

In comparison with Ethereum, Solana nonetheless generates much less income from deeper infrastructure protocols. That interprets to decrease institutional positioning and fewer Complete Worth Locked total. It doesn’t imply Solana lacks utility, but it surely does imply its income base can look extra retail-driven and cyclical.

When memecoin momentum cools, community income tends to observe. And proper now, that slowdown is seen.

ETF Hole Highlights Institutional Skepticism

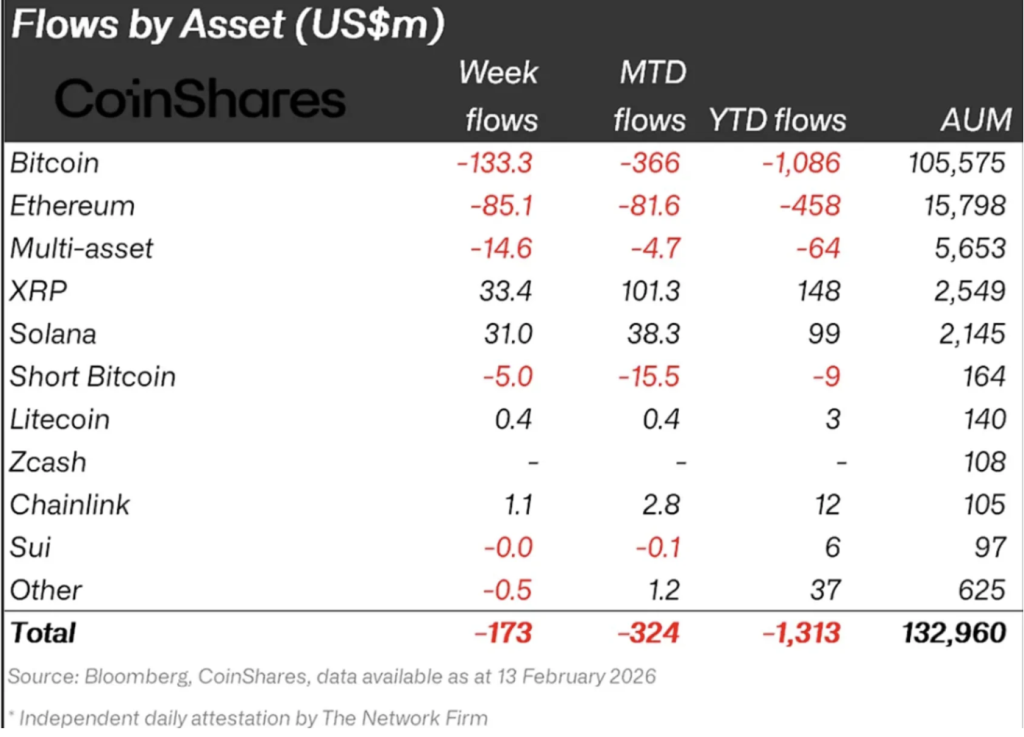

Institutional demand additionally tells a part of the story. CoinShares information exhibits Solana-based ETPs maintain round $2.1 billion in belongings underneath administration. In the meantime, Ethereum ETPs maintain over $16 billion. That hole is tough to disregard.

The distinction suggests establishments are nonetheless extra assured in Ethereum’s income sustainability and broader use case. Restricted ETF inflows imply SOL lacks the identical structural assist that helps soak up promoting strain throughout downturns. In bear phases, robust ETP inflows can cushion value drops. For Solana, that cushion appears to be like thinner.

Derivatives Construction Nonetheless Favors Draw back

Unfavorable funding mixed with falling open curiosity paints a transparent image: brief conviction is powerful, and new bullish positions are restricted. Solana has additionally underperformed the broader crypto market over the previous month, reinforcing the concept that sellers are nonetheless in management.

The important thing zone now sits between $78 and $80. If SOL can maintain that vary convincingly, it might stabilize and try a restoration. But when that assist cracks, it might set off one other wave of liquidations and prolong the present bearish construction.

Why This Issues

When community income declines and derivatives lean closely bearish on the identical time, demand weakens whereas strain builds. That mixture will increase the chances of a sustained transfer beneath $80, particularly if broader market situations stay fragile.

Solana isn’t damaged. However proper now, the information suggests it’s underneath strain — and till funding flips or income stabilizes, rallies might wrestle to stay.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.