- ADA stays over 90% beneath its 2021 all-time excessive of $3.10

- A $2,800 place at this time would require a transfer to $1 by 2030 to exceed $10,000

- Lengthy-term upside depends upon improvement execution, adoption development, and macro circumstances

Market sentiment throughout crypto stays cautious, perhaps even drained. Most main property are nonetheless buying and selling nicely beneath their 2020–2021 cycle highs, and Cardano isn’t any exception. Again in September 2021, ADA reached $3.10. Since then, it has misplaced greater than 90% of that peak worth, drifting by way of an extended and infrequently irritating downturn.

For a lot of long-term holders, that slide hasn’t simply been about numbers on a chart. It’s been about endurance being examined. Even throughout short-lived rebounds throughout the broader market, ADA has struggled to construct sustained momentum. That sample has left some traders questioning whether or not the restoration narrative is actual or simply wishful considering.

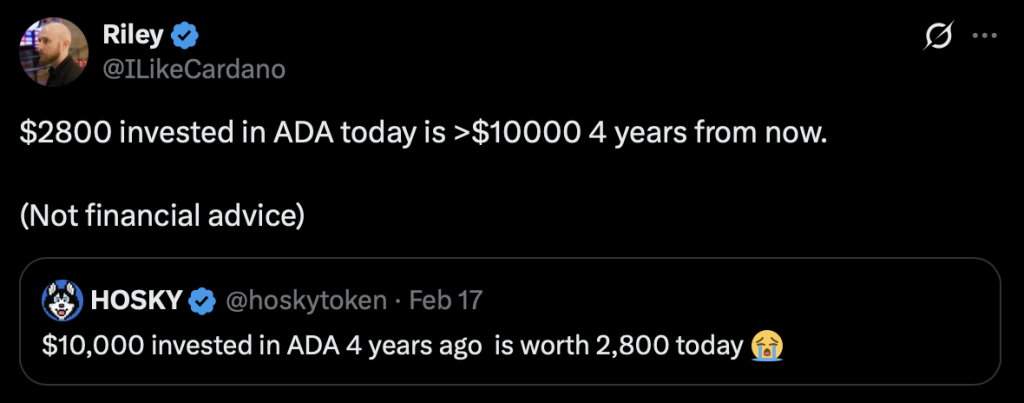

The $10,000 That Turned Into $2,800

The controversy resurfaced just lately after commentary from the staff behind Hosky Token identified simply how steep ADA’s drawdown has been. Based on their framing, a $10,000 funding in ADA made a number of years in the past would now be price roughly $2,800. That determine hit onerous, as a result of it’s not summary — it’s relatable.

Critics used the instance to argue that Cardano has underperformed relative to expectations. And so they’re not fully incorrect on a historic foundation. The final 4 years haven’t rewarded passive optimism.

However the dialog didn’t finish there.

A Completely different Angle From Contained in the Ecosystem

Riley, a senior engineer at Enter Output International, provided a counterpoint that reframed the identical numbers. As an alternative of specializing in what was misplaced, he targeted on what $2,800 at this time may develop into. In his view, that quantity might doubtlessly develop again above $10,000 by the top of the last decade if Cardano’s roadmap continues to progress.

That projection implies greater than a threefold return over roughly 4 years. It’s not a moonshot situation requiring a 10x rally in a single day. It’s a gentle appreciation thesis, anchored round improvement milestones and gradual adoption.

In fact, that’s a forward-looking opinion. Not a promise.

What Would ADA Have to Attain $1 Once more?

For the $2,800-to-$10,000 situation to work, ADA would want to commerce at or above $1 by 2030. Which will sound formidable when value is sitting far beneath that degree at this time. However traditionally, it’s not unprecedented.

ADA has traded nicely above $1 in prior cycles and got here near reclaiming that mark as just lately as 2025. From a purely numerical standpoint, a transfer to $1 would signify a average appreciation relative to previous expansions, not an excessive outlier. It’s not the identical as calling for a return to $3.10, or past.

Impartial forecasts add context. Analysts at Changelly have modeled ADA buying and selling above $1.50 by early 2030. Telegaon researchers have outlined way more aggressive projections, even double-digit territory later within the decade. These estimates fluctuate broadly, however importantly, the $1 threshold isn’t thought of fringe.

Improvement Roadmap Nonetheless Transferring Ahead

Past value forecasts, Cardano’s improvement roadmap stays energetic. Scalability upgrades like Leios goal to extend throughput and effectivity. Interoperability initiatives are working to hyperlink Cardano with networks like Bitcoin and the XRP Ledger. DeFi capabilities proceed increasing.

The argument from supporters is easy: if the infrastructure improves and real-world use instances develop, valuation ought to ultimately observe. That’s the speculation. Execution, in fact, is the place it will get sophisticated.

Markets don’t reward roadmaps mechanically. They reward delivered outcomes, sustained demand, and favorable macro circumstances.

Uneven Upside, However Not With out Threat

Riley’s perspective highlights a broader investing precept: uneven upside usually seems when sentiment is low and value is depressed. Shopping for close to peaks hardly ever gives that dynamic. Shopping for throughout extended stagnation generally does.

Nonetheless, uncertainty stays. Regulatory modifications, macroeconomic cycles, aggressive networks, and execution dangers all affect outcomes. A return to $1 is believable, however it’s not assured. Lengthy-term projections require endurance, and endurance isn’t at all times simple when value drifts sideways for years.

For traders contemplating ADA at present ranges, the chance could lie in measured expectations fairly than excessive predictions. The query isn’t simply whether or not Cardano can get well. It’s whether or not the event roadmap, adoption curve, and broader market surroundings align strongly sufficient to make that restoration sustainable.

And that, as at all times in crypto, takes time.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.