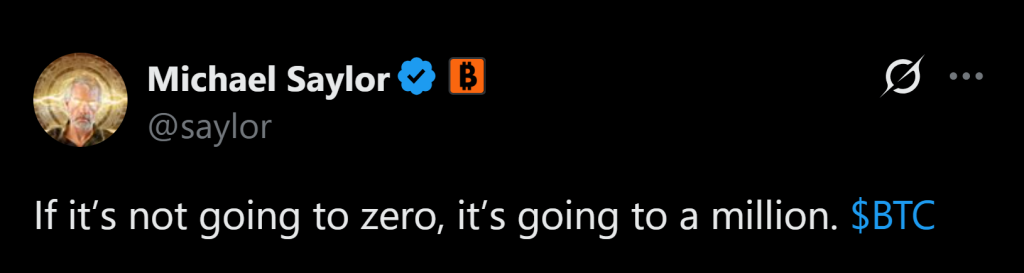

- Michael Saylor framed Bitcoin’s future as both zero or $1 million

- The assertion displays excessive volatility and break up market sentiment

- Binary narratives can amplify each concern and euphoria in crypto markets

Michael Saylor has by no means been refined about Bitcoin, however his newest framing could be his most polarizing but. He steered Bitcoin’s future is strictly binary: it both crashes to zero or ultimately reaches $1 million. That’s not a worth goal. It’s a philosophical stance wrapped in headline vitality.

On the floor, it sounds absurd. Markets hardly ever transfer in pure absolutes. Property don’t usually go from international adoption to literal zero with out a systemic collapse. However Saylor isn’t actually forecasting a particular path. He’s reinforcing a conviction narrative: Bitcoin both turns into foundational to the monetary system or it fails utterly.

Why the “Zero” Situation Isn’t Simply Fearbait

To be honest, the concept of Bitcoin going to zero isn’t invented out of skinny air. Search curiosity in “Bitcoin to zero” spikes each time costs slide arduous. Sentiment has deteriorated sharply in current downturns, particularly when Bitcoin pulled again from report highs and macro stress mounted.

Critics level to regulatory crackdowns, technological displacement, state-level bans, or catastrophic protocol failures as potential black swan dangers. Are these doubtless? That’s debatable. However they exist within the danger spectrum. Bitcoin remains to be a comparatively younger asset class, and younger asset lessons carry existential danger.

The $1 Million Case Has Structural Backers

On the opposite facet of the spectrum, the $1 million thesis will not be purely fantasy both. Institutional flows, ETF entry, sovereign accumulation, and Bitcoin’s mounted provide narrative all assist long-term upside arguments. Halving cycles traditionally tighten provide. Adoption curves proceed increasing. Capital markets infrastructure round BTC retains maturing.

The bullish case assumes Bitcoin evolves into digital gold at scale and even one thing bigger. Underneath that lens, $1 million will not be tomorrow’s goal, however a multi-cycle risk. The secret is timeframe. Excessive upside situations often depend on a long time, not months.

Binary Considering Fuels Volatility

Right here’s the place issues get messy. Framing Bitcoin as “zero or $1M” encourages emotional positioning. Buyers both go all-in with blind conviction or panic out solely. Markets don’t thrive on absolutes. They thrive on possibilities.

When high-profile figures promote binary narratives, they amplify irrational habits. Concern spikes more durable. Euphoria stretches additional. Leverage builds quicker. And corrections minimize deeper. That doesn’t imply Saylor is incorrect. It simply means his framing shapes psychology greater than valuation fashions.

The Actual Takeaway

Bitcoin doubtless gained’t transfer in a straight line to both final result. The extra practical path is messy, risky, and stuffed with cycles. However Saylor’s remark captures one thing true about crypto: conviction and skepticism coexist at excessive ranges.

Whether or not you imagine Bitcoin turns into a million-dollar asset or collapses below its personal weight, decreasing it to a coin flip oversimplifies a fancy system. Buyers could be clever to deal with danger administration, adoption information, and macro circumstances, not simply the loudest soundbite.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.