- BTC stays below the True Market Imply close to $79,000

- Ongoing ETF outflows are draining a key demand supply

- Liquidity stays tight, protecting rallies fragile

Bitcoin slipping under its onchain “line within the sand” isn’t only a technical element merchants can ignore. In response to Glassnode knowledge, the True Market Imply round $79,000 has traditionally separated growth phases from slower, grinding consolidation. Proper now, BTC is sitting between that higher boundary and the Realized Value close to $54,900.

That center zone tends to be uncomfortable. It typically produces sideways motion, short-lived rallies, and bursts of optimism that fade rapidly. It’s not panic territory, but it surely’s not energy both. It’s compression.

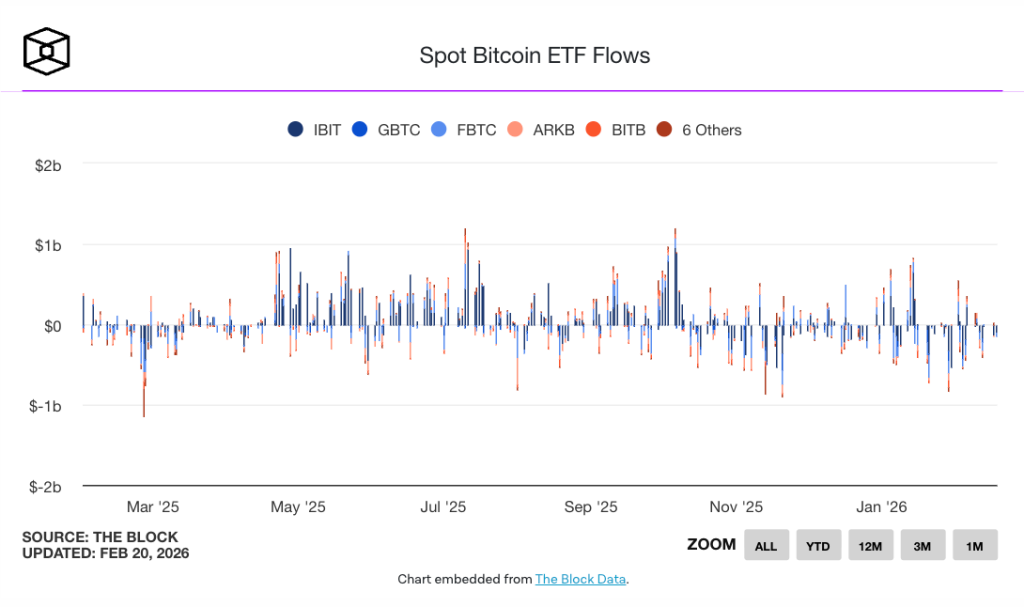

ETF Outflows Modified the Market Construction

For a lot of the earlier cycle, U.S. spot Bitcoin ETFs acted as a quiet however regular bid. That structural demand supplied stability throughout dips. Now, that stream has flipped. Persistent web outflows are changing accumulation, and the absence of that institutional demand is noticeable.

This isn’t a fear-driven liquidation cascade. It’s thinner participation. With out ETF inflows absorbing provide, value motion turns into extra reactive and fragile. Markets don’t simply fall due to sellers. They fall as a result of patrons disappear.

Calm Derivatives Don’t Equal Bullish Conviction

Choices markets present implied volatility easing, which could seem like stability. However diminished volatility doesn’t mechanically imply bullish positioning. Merchants seem much less concerned about panic hedges, but they’re not aggressively positioning for upside both.

Bottoms often require liquidity to increase, not simply sentiment to reset. Proper now, liquidity nonetheless feels constrained. That’s why even modest rallies battle to maintain momentum.

Macro Stress Is Nonetheless the Backdrop

The Federal Reserve’s hawkish tone continues to affect broader threat urge for food. Bitcoin has not decoupled from macro situations. It reacts to fee expectations, greenback energy, and broader liquidity alerts similar to equities do.

So long as macro stays restrictive, Bitcoin is unlikely to stage a clear breakout. Structural demand wants area to breathe, and tight financial situations restrict that respiratory room.

Endurance Over Predictions

Bitcoin isn’t collapsing, but it surely isn’t constructing sturdy upside construction both. It’s caught in a holding sample outlined by skinny liquidity and cautious positioning.

Till ETF flows stabilize and macro situations soften, rallies are more likely to stay susceptible. On this atmosphere, endurance issues greater than daring forecasts. The subsequent growth part will probably start with bettering liquidity, not with louder optimism.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.