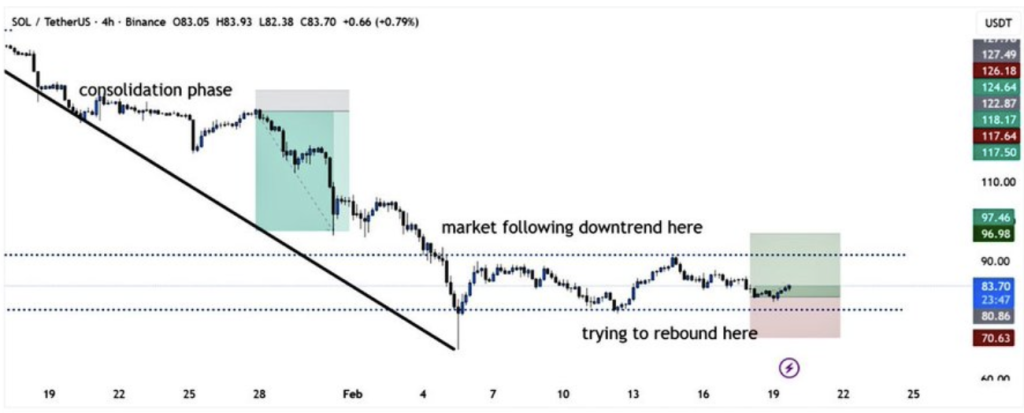

- Solana rebounded from the important thing $80 assist zone, however stays in a broader consolidation section.

- A decisive breakout above $90 is required to verify a short-term development reversal.

- Shedding the $80 degree may reintroduce robust bearish stress and prolong the correction.

Solana has lastly caught a small breath of air after weeks of regular promoting stress. The token bounced from the $80 zone, a degree that merchants have been watching nearly obsessively, and is now making an attempt to stabilize. On the time of writing, SOL trades close to $83.18, up 2.85% over the previous 24 hours, with roughly $5.74 billion in day by day quantity and a market cap hovering round $47 billion.

It’s a bounce, sure. However whether or not it’s a reversal… that’s nonetheless up for debate.

The $80 Zone Turns into a Battlefield

Over the previous few periods, SOL has been consolidating between $80 and $83, forming what some analysts describe as a possible accumulation pocket. In line with crypto analyst BitGuru, this vary has been defended a number of occasions, which will increase its technical significance. Repeated holds usually strengthen a assist zone — till they don’t.

There’s one thing refined taking place right here. Worth has ticked larger whereas quantity has remained comparatively steady, which might recommend consumers are steadily stepping again in. Not aggressively. Not euphorically. Simply… slowly.

Nonetheless, consolidation alone doesn’t affirm something. For bulls to realize actual management, SOL must clear $90 decisively. That degree now acts because the gatekeeper. A powerful breakout above it will invalidate the latest sample of decrease highs and doubtlessly shift short-term construction again in favor of consumers.

Till that occurs, that is merely range-bound value motion. Nothing extra.

Is This a Restoration — or Only a Pause?

Not everyone seems to be satisfied the rebound has legs. Analyst Extra Crypto On-line provided a extra cautious interpretation, suggesting the latest uptick may characterize a short lived reduction rally fairly than a full development reversal. In downtrends, sharp counter-moves are frequent. They will look convincing. They not often final until construction modifications.

That’s why $80 issues a lot.

If SOL loses that assist after this bounce, the market may interpret it as weak point, not resilience. And in thinner liquidity environments, draw back can speed up sooner than most anticipate. Momentum works each methods.

The Subsequent Transfer Will Be Decisive

Proper now, Solana sits at a technical crossroads. The $80–$83 band continues to behave as near-term demand, whereas $90 stands as clear overhead resistance. It’s clear. Nearly textbook.

A convincing day by day shut above $90 may invite renewed momentum, presumably triggering sidelined capital to rotate again in. On the flip facet, a breakdown beneath $80 would possible re-empower sellers and prolong the broader corrective construction.

In brief, SOL isn’t out of hazard. However it isn’t collapsing both. It’s compressing — and markets that compress are likely to broaden ultimately. The one actual query is route.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.