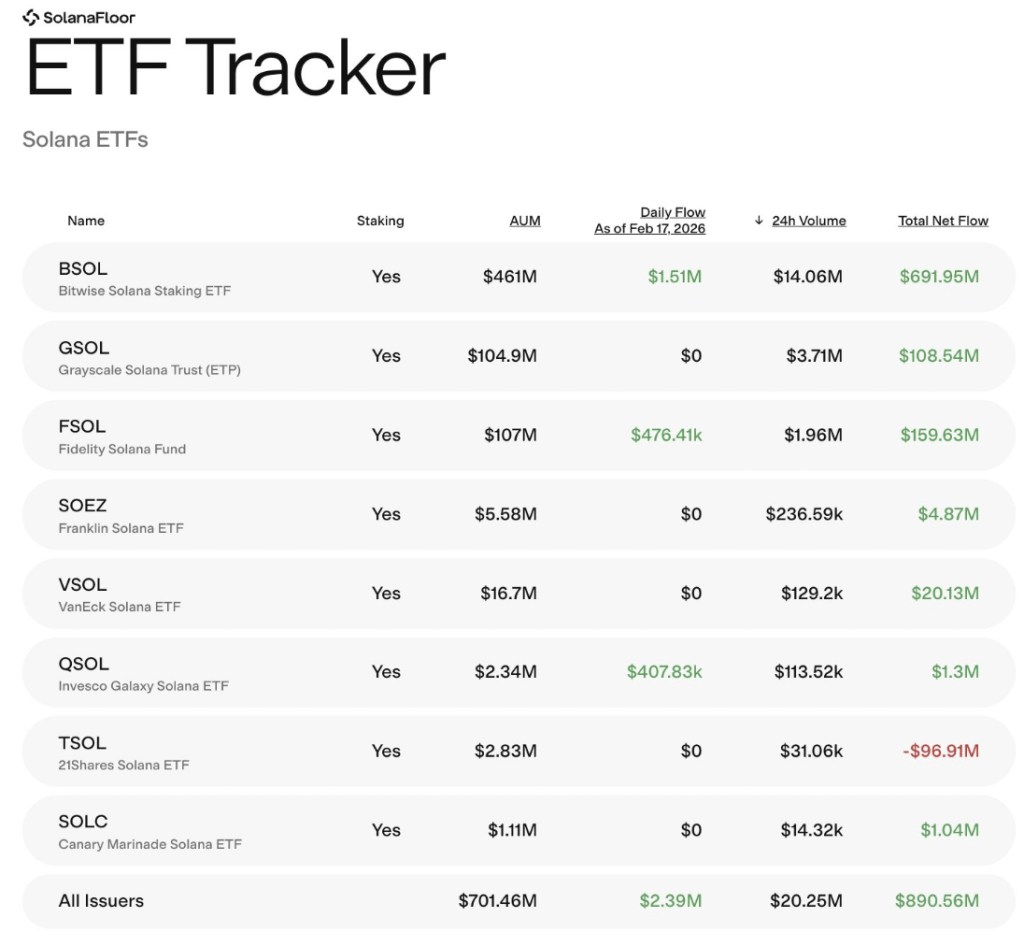

- Solana fell almost 30% over the previous month, but SOL ETFs recorded $2.39 million in web inflows, diverging from BTC and ETH outflows.

- Regardless of value weak point, Solana leads Layer 1 friends in 24-hour DApp income, signaling sturdy community utilization and developer exercise.

- A rising income seize ratio reveals bettering capital effectivity, reinforcing institutional confidence in SOL’s long-term outlook.

Institutional cash doesn’t normally chase weak point with out a cause. And but, that’s precisely what appears to be taking place with Solana. Whereas SOL has pulled again almost 30% over the previous month and reveals little technical proof of a clear bullish reversal, institutional flows are quietly leaning the opposite approach.

On the time of writing, Solana ETFs recorded $2.39 million in web inflows, extending a six-day streak. In the meantime, Bitcoin and Ethereum ETFs have continued to bleed capital. That divergence alone raises eyebrows.

Value Weak spot, However Capital Conviction

Technically, SOL nonetheless seems to be heavy. The chart hasn’t printed a convincing increased excessive. Momentum stays subdued. In most cycles, that sort of setup retains establishments cautious.

However fundamentals are telling a barely totally different story.

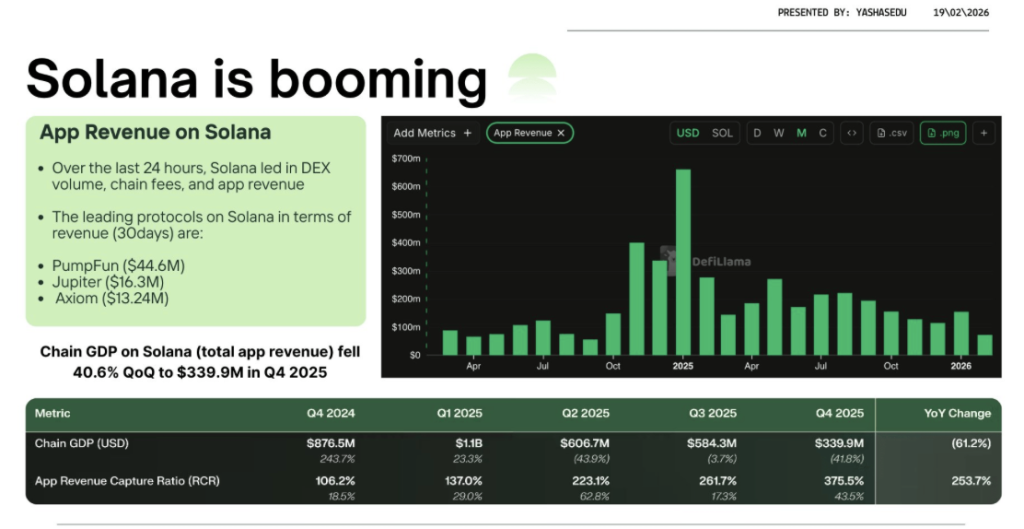

Amongst Layer 1 blockchains, Solana has been main in 24-hour DApp income, producing roughly $3.43 million at press time. That’s not a conceit metric. It indicators actual utilization — customers interacting, builders deploying, charges being paid. Even in a softer value atmosphere.

So that you get this uncommon break up: value drifting decrease, but institutional flows strengthening. It’s not typical habits. Good cash, at the very least on this case, seems extra centered on community effectivity than short-term charts.

The Income Story Beneath the Floor

In risk-off situations, most chains battle. Volatility cools exercise. Decrease exercise reduces transaction charges. Decrease charges compress income. It’s a reasonably predictable chain response.

Solana, although, appears to be bending that sample.

Its app income seize ratio — primarily how a lot DApps earn relative to community charges paid — jumped from 262% to 375% final quarter. Meaning for each $1 spent in charges, functions are producing about $3.75 in income. That’s a pointy enchancment in capital effectivity.

This issues greater than many understand.

Institutional traders usually prioritize effectivity metrics over uncooked exercise spikes. A community that may generate stronger returns per greenback of exercise turns into structurally extra enticing, particularly in unsure markets. Effectivity sustains ecosystems. Hype doesn’t.

Capital Effectivity as a Aggressive Edge

Although SOL stays one of many weaker large-cap property by way of latest value motion, its fundamentals aren’t deteriorating in the identical approach. In actual fact, they’re tightening up. Turning into leaner.

That effectivity shift sends a sign to builders as properly. It says: even in volatility, the community can ship yield on effort. Builders discover that. So do funds.

The result’s a delicate however necessary divergence. Whereas broader market concern and uncertainty dampen sentiment, Solana continues attracting institutional capital and sustaining top-tier DApp income. It’s not explosive. It’s not euphoric. Nevertheless it’s regular.

And typically, regular conviction throughout weak point says greater than value energy throughout hype.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.