Silver worth has had a brutal but fascinating begin to 2026. After surging to an all-time excessive close to $121 on January 29, the metallic crashed practically 47% by February 6. However since then, silver has staged a relentless 32% restoration to commerce close to $84 on February 20.

With markets closed on the twenty first and twenty second, the query heading into March is obvious: is that this restoration the true deal, or does extra ache lie forward? The technicals and positioning information paint a nuanced image. A consolidation is probably going earlier than the following decisive transfer, however the weight of proof leans bullish.

Cup Formation, Hidden Bearish Divergence, And Indicators Of Consolidation

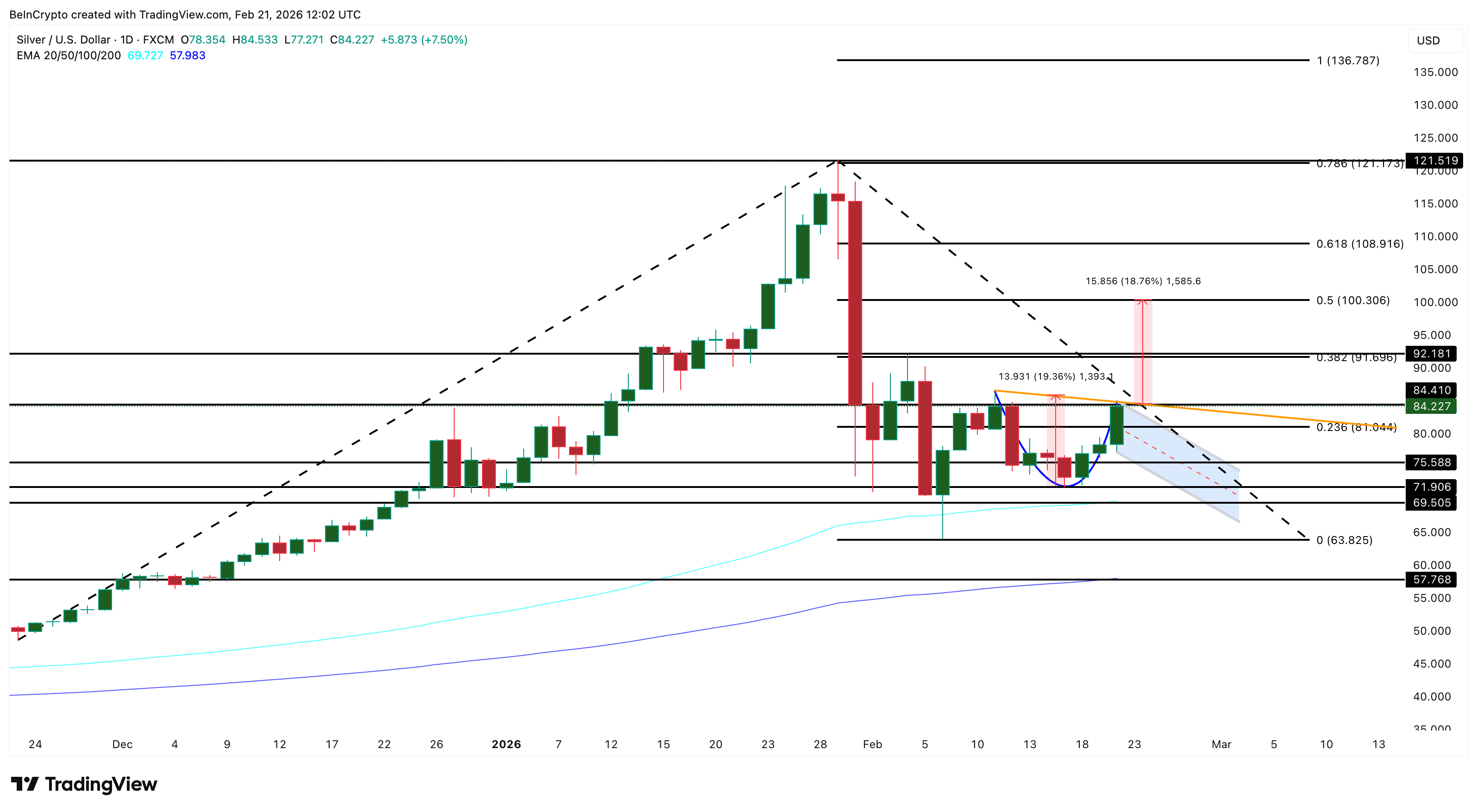

The XAG/USD each day chart reveals a growing cup sample, with the impulse wave originating from November 21, 2025, peaking at $121 on January 29, and pulling again to $63.85 on February 6. The current restoration towards $84 is now approaching the neckline of this formation.

Between February 4 and February 20, silver is printing a decrease excessive setup. However the relative energy index (RSI), a momentum indicator, throughout the identical interval is forming a better excessive: a hidden bearish RSI divergence.

This alerts that, regardless of obvious RSI energy, the value pattern favors consolidation earlier than a decisive transfer. This sample holds so long as the following candle stays beneath $92 (the earlier excessive) and the RSI continues to climb.

Sensible cash betting is betting on consolidation as effectively.

If the present consolidation develops right into a deal with, it should nonetheless maintain above $75 to maintain the bullish construction intact.

The cup-and-handle sample beneficial properties validity on a clear each day shut above $84. Nonetheless, some consolidation is anticipated first — and the supporting indicators clarify why a pause right here is wholesome relatively than regarding.

Miners Lead, Silver Futures Lag: The Bodily-Paper Divergence

The International X Silver Miners ETF (SIL), buying and selling above $107, provides early validation to the bullish case. SIL peaked at $119 on January 26 — three days earlier than silver spot topped on January 29. Miners main on the way in which up and holding comparatively agency on the restoration is a basic bullish main indicator.

Mining corporations have direct visibility into industrial order books and manufacturing demand, and their resilience suggests the basic image stays intact regardless of the January liquidation. When miners maintain whereas the metallic consolidates, it usually alerts that the following transfer is larger, not decrease.

The disconnect between this bodily market’s energy and the futures market’s hesitancy defines the present silver panorama.

COMEX silver futures (SI1!) are buying and selling round $82 — beneath the spot worth of $84. This backwardation (futures beneath spot) is uncommon and vital. It means patrons are prepared to pay a premium for bodily silver now relatively than anticipate future supply.

The market is pricing urgency into spot, signaling bodily tightness within the provide chain.

Nonetheless, open curiosity on SI1! has been steadily declining since February 6, even because the Silver worth rose from $63 to $82. A rising worth amid falling open curiosity is the signature of a short-covering rally — merchants who had been brief after the crash are shopping for again their positions, pushing the value larger.

This isn’t contemporary cash coming into but. It’s the aftermath of the January wipeout clearing out. Quick protecting rallies have a pure ceiling, and as soon as protecting is exhausted, the value wants new patrons to maintain momentum.

That is the place the transition to consolidation turns into essentially the most possible near-term path — the short-covering gasoline is working low, however the subsequent wave of shopping for hasn’t arrived but, as defined later.

Greenback Divergence, Gold Ratio Dangers, And Hedge Funds On The Sidelines

The macro and positioning layers clarify why consolidation is wholesome relatively than harmful.

The US Greenback Index (DXY) sits above 97, having risen steadily since February 11. However since February 17, silver decoupled and began rising alongside the greenback. This is among the strongest alerts within the present setup. When silver rises regardless of greenback headwinds, it means underlying demand. Patrons need silver now, no matter what the greenback is doing.

The Gold-Silver Ratio (XAUXAG) provides a layer of warning. At the moment at 60, the ratio has been declining since February 17, that means silver has been outperforming gold.

Nonetheless, the ratio is consolidating inside a bullish flag sample. A breakout above the higher trendline might push it towards 70 or larger.

If that occurs, gold would reclaim dominance over silver — the market rotating again from silver’s risk-on attraction towards gold’s safe-haven purity.

This may cap silver’s upside momentum or set off a pullback. So long as the flag holds with out breaking upward, silver’s outperformance can proceed, however this can be a threat to observe in March.

The tiebreaker comes from the COT (Dedication of Merchants) report dated February 17. Managed Cash — hedge funds and Commodity Buying and selling Advisors — holds a internet lengthy place of simply 5,472 contracts. Through the rally to $121, hedge funds had been positioned at multiples of this degree.

A studying this low means the speculative heavyweights are nonetheless on the sidelines, ready for a confirmed base earlier than committing capital.

That is concurrently essentially the most bullish medium-term sign and the clearest clarification for near-term consolidation. There’s large room for contemporary institutional shopping for when hedge funds re-enter. However they should see a secure base and a transparent breakout — seemingly above $92 — earlier than stepping in.

March 2026 Outlook: Silver Worth Ranges To Watch

4 of seven key indicators lean bullish. These embody Miners main by way of SIL energy, backwardation confirming bodily demand urgency, dollar-silver divergence displaying real underlying shopping for strain, and hedge funds barely positioned with large room to re-enter.

Plus, three indicators urge warning. These embody declining COMEX open curiosity, hidden bearish divergence, and the gold-silver ratio’s bullish flag threatening to rotate momentum again towards gold.

Probably the most possible path for March: silver consolidates between $75 and $92 because the market builds a base that offers Managed Cash the boldness to re-enter.

A each day shut above $84 confirms the cup-and-handle neckline. A push above $91–$92 validates the total breakout and opens the door to $100 — a psychologically vital degree seemingly achievable by mid-March.

Prolonged targets of $121 (a retest of the all-time excessive) and $136 (the total Fibonacci extension) turn into reasonable if the rally sustains by way of March with rising open curiosity confirming contemporary institutional participation.

On the draw back, $75 is the road within the sand. A each day shut beneath $75 cracks the cup construction and invitations a retest of $71. Shedding $71 invalidates the cup formation totally, exposing the 100-day transferring common at $69.

Beneath that, the 200-day transferring common at $57 represents one of many strongest structural help ranges on the chart.

The bearish state of affairs beneficial properties traction if DXY surges above 100. Or the gold-silver ratio decisively breaks out of its bullish flag. Or if upcoming US financial information reinforces a higher-for-longer Fed stance, crushing rate-cut expectations.