XRP value has traded principally flat over the previous 24 hours and the previous week. This sideways transfer reveals clear market indecision. On the floor, institutional exercise appears supportive. XRP spot ETFs have now recorded three straight weeks of inflows. However beneath this constructive pattern, a hidden weak spot is quietly constructing.

A number of technical and on-chain alerts counsel XRP could also be nearer to a breakdown than it seems.

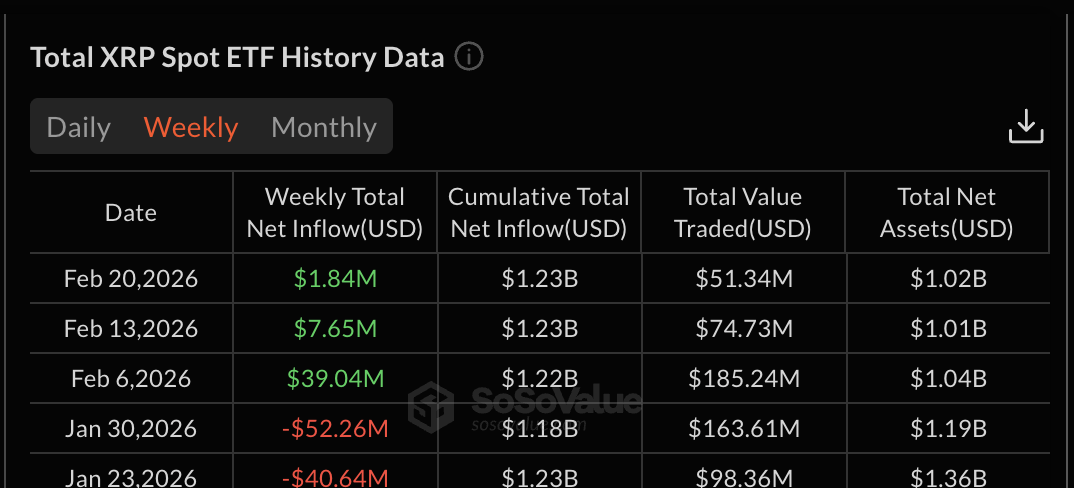

ETF Inflows Keep Optimistic, However Institutional Power Is Quickly Fading

XRP spot ETFs have recorded inflows for 3 straight weeks. The week ending February 6 noticed $36.04 million in inflows. By the week ending February 20, inflows had fallen additional to only $1.84 million.

This represents a drop of almost 95% in weekly inflows inside three weeks.

ETF inflows present how a lot institutional cash is coming into an asset. Rising inflows often sign rising confidence. However falling inflows, even when nonetheless constructive, present that institutional conviction is weakening rapidly.

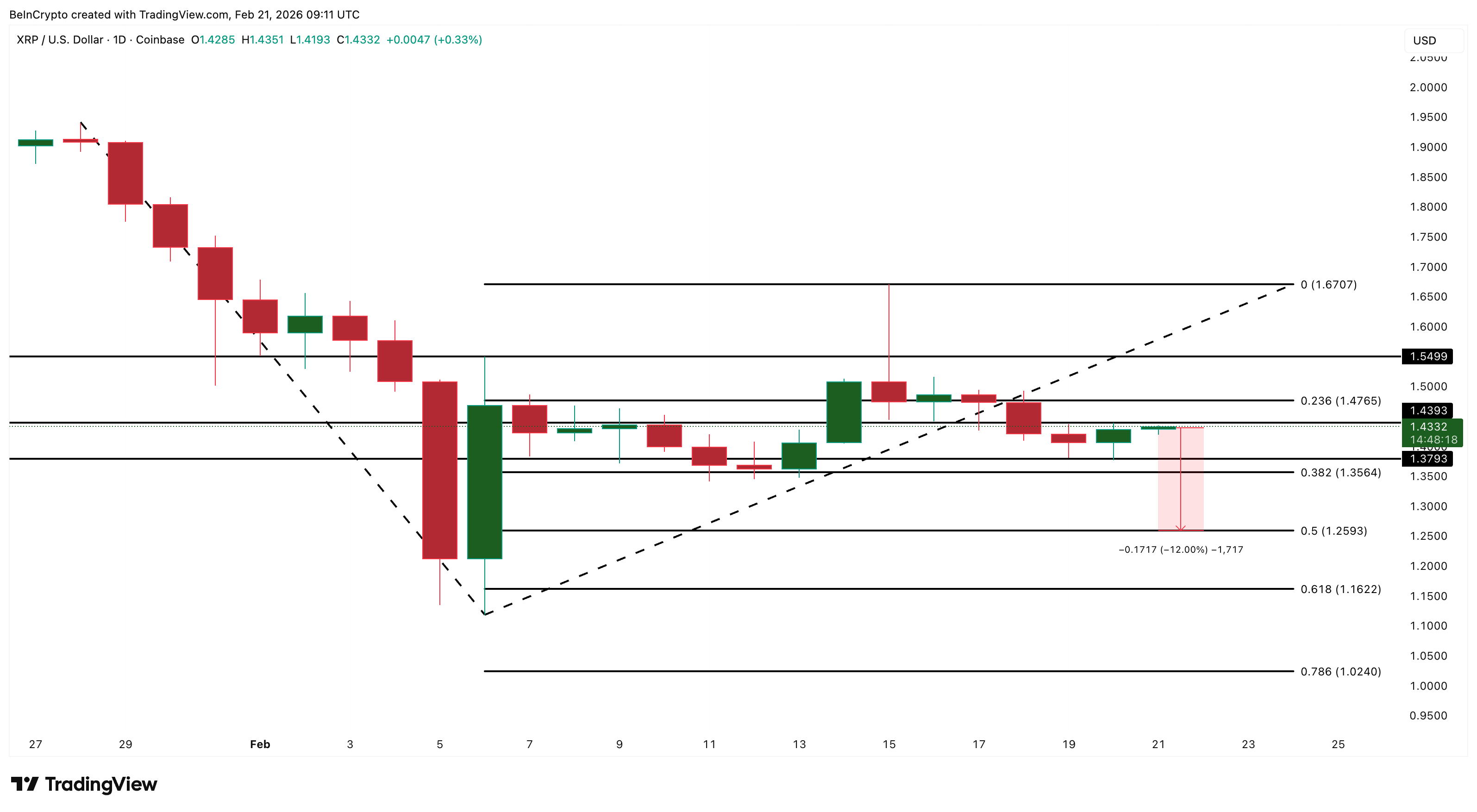

This institutional slowdown is already seen on the chart. XRP fell beneath its weekly Quantity Weighted Common Value, or VWAP, on February 18 and hasn’t reclaimed the road since.

VWAP represents the common value weighted by quantity. It’s broadly used as a proxy for institutional value foundation and is referred to by large cash as a benchmark.

When the worth falls beneath VWAP, it means establishments are holding positions at a loss on common. This typically reduces their willingness to purchase extra. The final time XRP broke its weekly VWAP, it fell almost 26%. The correction since February 18 can also be persevering with.

On the similar time, XRP is near forming a hidden bearish divergence between February 6 and February 20. Throughout this era, the XRP value appears to be printing a decrease excessive. However the Relative Power Index, or RSI, already fashioned a better excessive.

RSI measures momentum. When momentum rises, however value fails to observe, it alerts weakening restoration energy and a attainable downtrend extension for XRP if $1.379 breaks. A transparent price-specific affirmation would happen if the present XRP value fails to achieve or exceed $1.439.

Collectively, weakening ETF inflows, VWAP loss, and bearish divergence present that institutional energy is fading regardless of the constructive ETF streak.

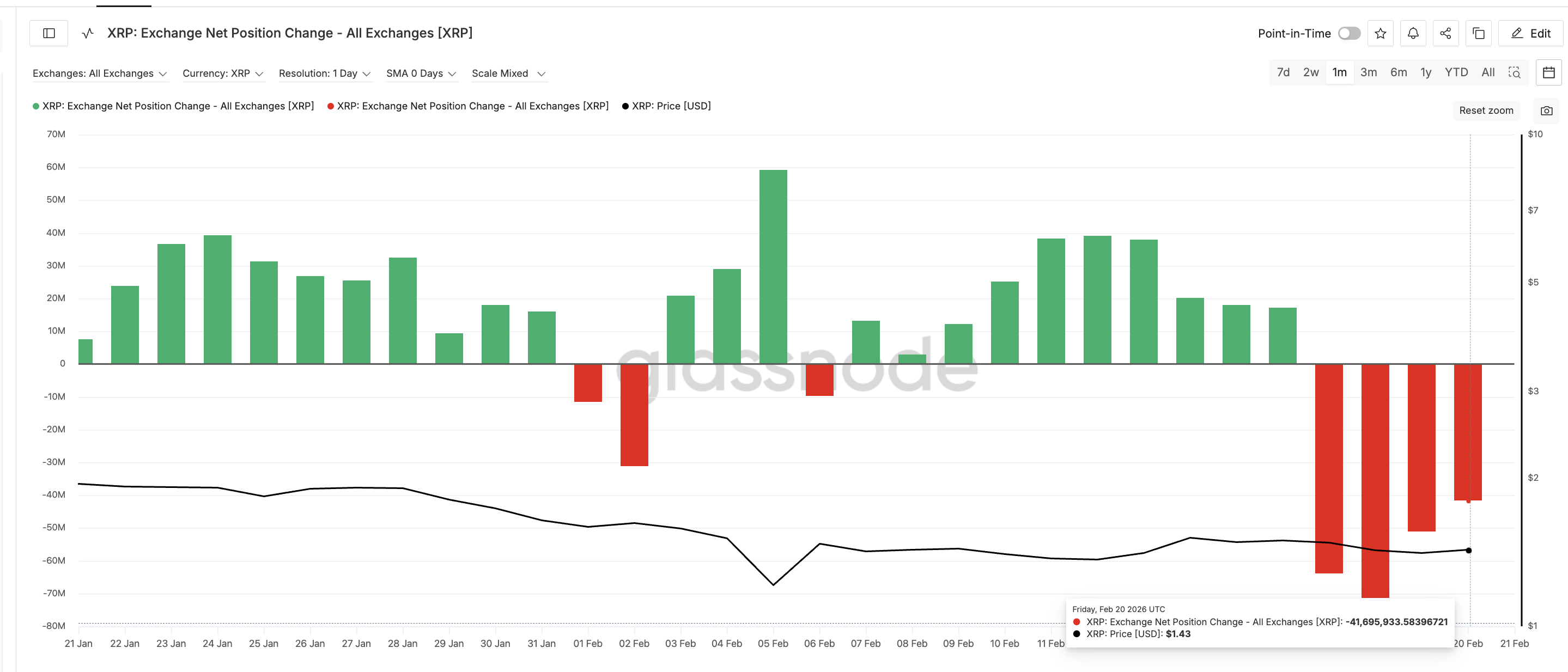

Alternate Flows and Dip Shopping for Clarify Why Value Has Not Collapsed But

Regardless of falling beneath the VWAP, XRP has not collapsed sharply, like earlier. On-chain information helps clarify why.

One key metric is Alternate Internet Place Change. This tracks whether or not cash are transferring into or out of exchanges. Outflows often sign shopping for, whereas falling outflows present weakening demand.

On February 18, alternate outflows peaked close to 71.32 million XRP. Just lately, outflows dropped to round 41.69 million XRP. This marks a decline of about 41%.

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

This reveals that purchasing stress has weakened considerably however nonetheless stays.

One other indicator reveals patrons are nonetheless energetic. The Cash Circulate Index, or MFI, tracks actual capital coming into an asset. Between February 6 and February 19, the XRP value trended decrease.

However MFI trended larger. This divergence reveals dip patrons are slowly accumulating whilst the worth weakens.

This dip shopping for helps clarify why XRP has remained comparatively steady after dropping its VWAP. Consumers are absorbing promoting stress. This has prevented a right away collapse to date. However this assist is proscribed. If dip shopping for weakens, draw back threat may improve rapidly.

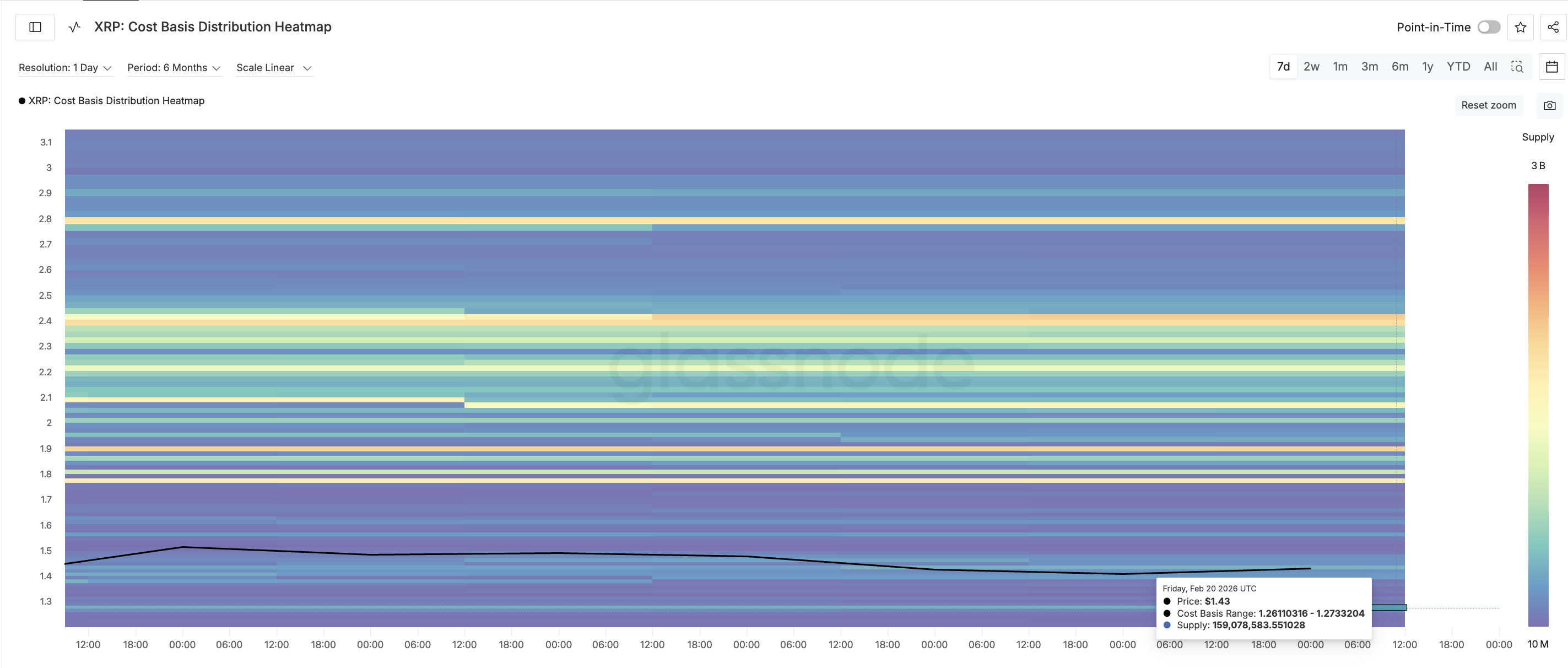

XRP Value Faces Vital $1.25 Take a look at as Value Foundation Cluster Turns into Remaining Assist

Value foundation information now reveals XRP approaching a important assist zone. Value foundation represents the costs at which buyers beforehand purchased XRP.

These ranges typically act as robust assist or resistance. A very powerful assist cluster at the moment sits close to $1.26, internet hosting over 159 million XRP.

That is the place a lot of holders purchased XRP. So long as this degree holds, the XRP value could keep away from a deeper crash past 12% even when the speedy assist zone at $1.35-$1.37 breaks.

Nonetheless, if XRP falls beneath $1.26 ($1.259 on the chart), promoting stress may speed up sharply. The following main draw back ranges would seem close to $1.162 and $1.024.

On the upside, XRP should first reclaim $1.439. A stronger restoration would require strikes above $1.476 and $1.549. Solely a breakout above $1.670 would totally minimize the bearish momentum.

For now, XRP stays caught between weakening institutional assist and regular dip shopping for. ETF inflows are nonetheless constructive, however falling quickly.

Technical and on-chain alerts present that $1.259 is now an important degree that might decide XRP’s subsequent main transfer, particularly if the bearish divergence and VWAP weak spot proceed to play out.