Dogecoin’s first spot ETF merchandise have been reside since Nov. 24, 2025 within the U.S., however judging by the numbers by SoSoValue, it’s honest to say that DOGE has but to reside as much as the hype surrounding the ETF.

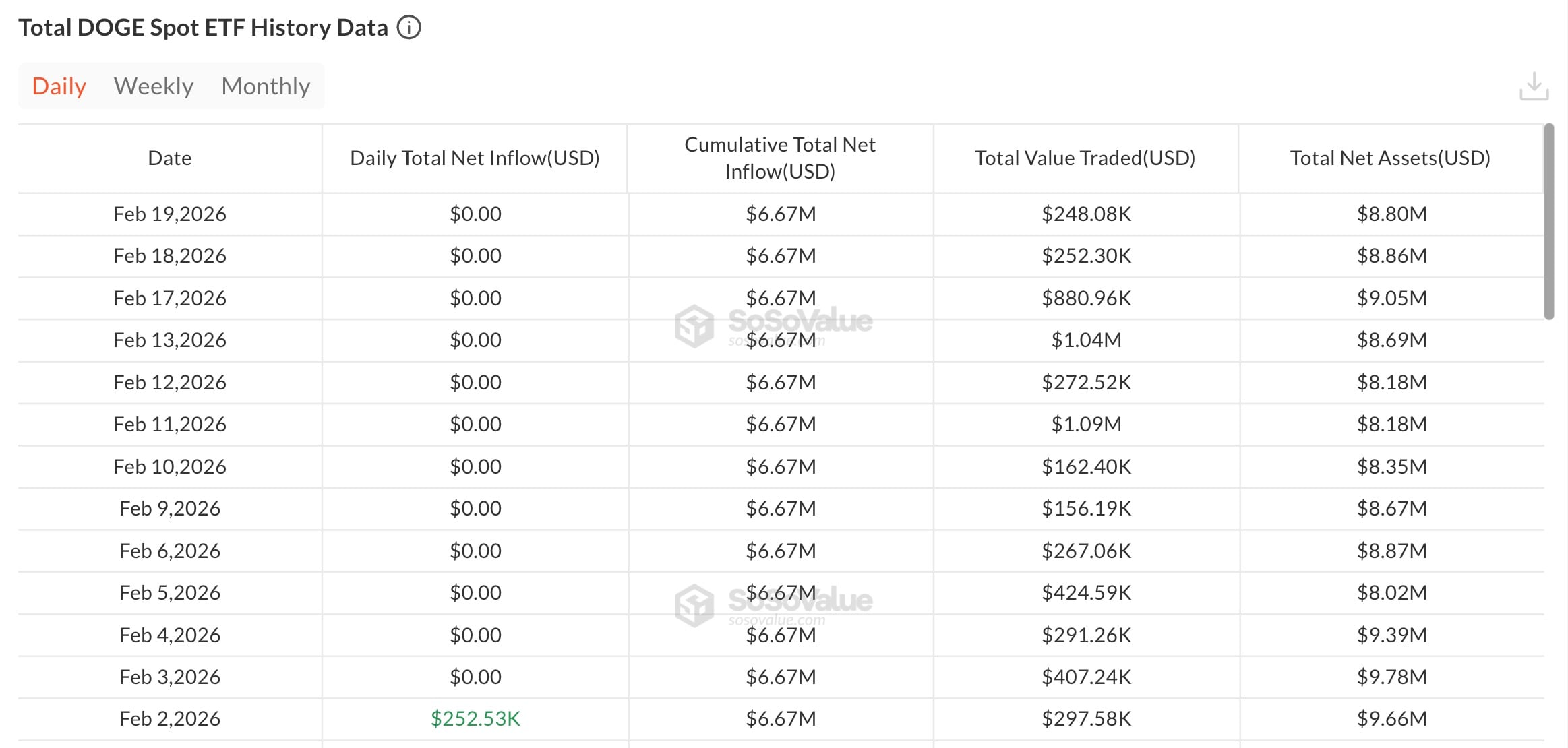

As of Feb. 19, the cumulative internet inflows throughout the U.S. DOGE spot ETFs had been $6.67 million, with a 18-day streak of $0 in internet inflows and whole internet belongings of roughly $8.8 million.

Beneath 1% of market cap: Is institutional demand for DOGE simply lagging?

The overall worth traded in the latest session was almost $247,000. For context, main Bitcoin and Ethereum ETFs moved billions of their opening weeks, setting a benchmark that any new crypto fund inevitably faces. This raises the query of whether or not the demand for this asset born from a meme was overestimated.

Crypto Market Evaluation: Shiba Inu Value Momentum Returns In New Uptrend, Is Ethereum (ETH) Caught within the Mud? Bitcoin Is not Giving Up on $70,000

Ripple Secures Main Partnership With Deutsche Financial institution, XRP Value Breaks Key Assist, Binance’s CZ Reveals His Function In UAE’s Bitcoin Mining Milestone — Crypto Information Digest

Three issuers at present dominate the DOGE ETF desk: Grayscale’s GDOG, which has roughly $6.38 million in internet belongings; 21Shares’s TDOG, which has almost $1.77 million; and Bitwise’s BWOW, which has round $641,000. The entire phase itself is so small, it represents lower than 1% of Dogecoin’s total market capitalization value $16.25 billion, as per CoinMarketCap.

DOGE is quoted at round $0.096 on the time of writing, down by over 1.5% for the day and properly under the $0.15 resistance degree seen earlier this 12 months. The long-term chart exhibits a constant downward development since September 2025, with current makes an attempt to achieve larger ranges failing miserably.

Calling the ETF a failure at this stage could also be untimely. Nonetheless, expectations for the institutionalization of meme belongings had been clearly larger than present move information for Dogecoin displays.

A extra related query is whether or not DOGE can generate sustained inflows past early adopters. If belongings beneath administration stay under $10 million and buying and selling exercise stays low, issuers may face business stress.