Bitcoin retains steady institutional demand as Ethereum ETF flows stay skinny and risky.

Spot Bitcoin ETFs recorded strong inflows on Feb. 20, whereas Ethereum merchandise drew little new capital. Knowledge reveals most demand stays concentrated in a couple of main issuers. On the identical time, month-to-month tendencies point out momentum has slowed since mid-2025. Move patterns proceed to favor Bitcoin over Ethereum in each scale and stability.

IBIT Leads $88M Bitcoin ETF Influx Whereas Progress Momentum Slows

Bitcoin spot ETFs pulled in $88.04 million in web inflows on Friday, with capital as soon as once more clustered round two issuers. BlackRock’s IBIT absorbed $64.46 million, accounting for roughly 73% of day by day flows. Constancy Investments’s FBTC added $23.59 million. All different Bitcoin funds completed flat.

Picture Supply: SoSoValue

IBIT’s cumulative web inflows now stand at $61.30 billion, reinforcing its dominance inside the Bitcoin ETF market. No competing product approaches that scale.

Mid-last 12 months, BTC funding autos delivered a number of sturdy months with $5 billion to $8 billion in inflows. Nevertheless, the development flipped to a pointy multi-billion greenback outflow in November. And this development continued within the two months that adopted. Within the present month, these funds proceed to run properly under earlier enlargement phases.

Though cumulative belongings stay close to report ranges, on-chain knowledge reveals that development has cooled. Even so, current inflows counsel stabilization relatively than a recent wave of acceleration.

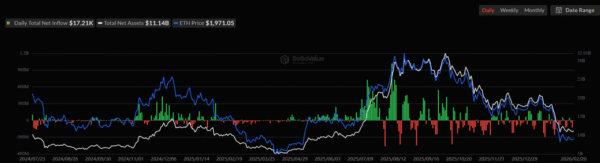

Ethereum ETFs Stall as Day by day Inflows Barely Attain $17K

Whereas its Bitcoin counterparts posted optimistic flows, Ethereum spot ETFs painted a weaker image. Whole web inflows on Feb. 20 got here in at simply $17,210, a fraction of Bitcoin’s $88 million haul.

BlackRock’s ETHA added $1.78 million, whereas Constancy Investments’s FETH noticed a $2.45 million outflow. 21Shares’s TETH gained $687,000, and different funds have been flat. ETHA’s cumulative web inflows now stand at $11.88 billion.

Picture Supply: SoSoValue

In distinction, Grayscale Investments’s ETHE nonetheless carries a historic web outflow of $5.19 billion, displaying continued capital rotation away from older constructions.

Day by day knowledge additionally factors to larger volatility in Ethereum flows. Jan. 30 recorded $252.9 million in outflows. Feb. 11 and Feb. 12 noticed $129.2 million and $113.1 million in redemptions, adopted by one other $130.2 million exit on Feb. 19. A number of rebound periods close to $50 million supplied aid, however swings stay sharp.

Cumulative Ethereum ETF inflows sit close to $11.52 billion, with complete web belongings round $11.14 billion. By comparability, IBIT alone exceeds $60 billion in cumulative inflows.

Bitcoin Consolidates Institutional Lead as ETH Flows Lack Depth

Bitcoin continues to carry a bigger and extra steady institutional base, whereas Ethereum flows stay extra reactive to short-term value strikes and macro headlines. Latest knowledge reveals momentum has cooled for each belongings, however volatility in Ethereum ETFs stays noticeably larger.

ETF flows act as a real-time sign of institutional threat urge for food. Friday’s inflows affirm capital continues to be coming into Bitcoin merchandise in significant dimension. Ethereum figures, against this, level to thinner demand and fewer constant allocation. With out regular multi-week accumulation in ETH funds, the hole in institutional adoption between Bitcoin and Ethereum may widen additional.