- Bitcoin rose 1.52% after the Supreme Courtroom dominated Trump’s tariffs unlawful, however failed to interrupt the important thing $70K resistance degree.

- Hotter-than-expected PCE inflation knowledge and weak 1.4% GDP development rapidly shifted sentiment, limiting bullish momentum.

- A $335M Bitcoin whale switch simply earlier than the GDP launch suggests rising warning and potential market stress.

Macro occasions and crypto have all the time had this unusual relationship. It’s hardly ever in regards to the occasion alone, it’s about when it lands and the way the market is positioned when it does. Brief-term reactions are usually sharp and emotional, cash rushes in or spills out virtually immediately. The broader influence, although, normally takes form extra slowly, after merchants have had time to suppose, reassess, perhaps second guess themselves.

February 20 Delivers a Double Shock

That’s just about how this present cycle is unfolding. February 20 delivered a heavy macro jolt, with two main developments colliding on the identical day and forcing traders to react in actual time. Bitcoin closed up 1.52%, a clear short-term bounce that signaled bullish intent. And but, regardless of that power, it nonetheless couldn’t crack the cussed $70k resistance degree, which continues to behave like a ceiling nobody can fairly punch by.

Tariff Aid Meets Inflation Actuality

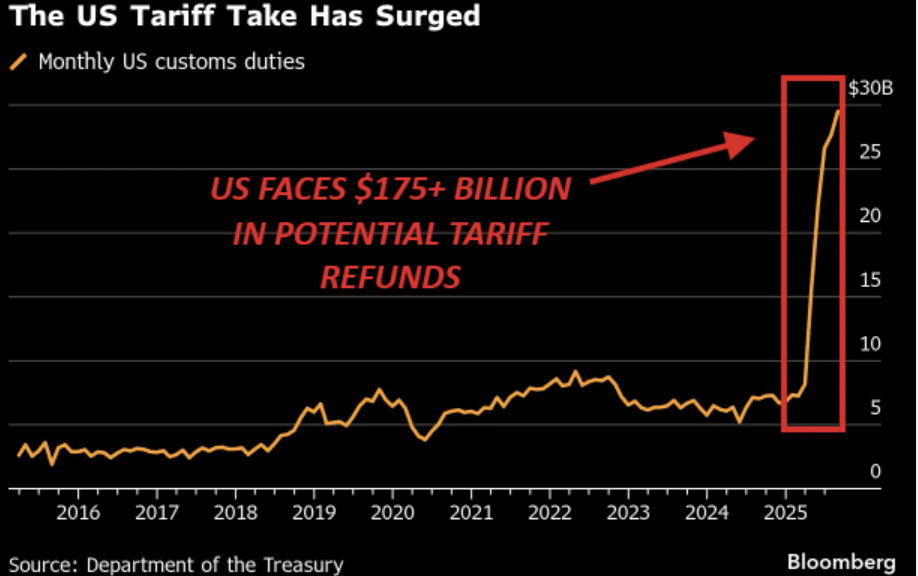

The primary catalyst was the U.S. Supreme Courtroom ruling that President Donald Trump’s tariffs have been unlawful. Nearly concurrently, the PCE inflation report got here in hotter than anticipated, reminding everybody that inflation isn’t quietly fading into the background. Bitcoin’s preliminary surge made sense. Aid over tariff uncertainty sparked shopping for, however that optimism light as merchants absorbed the inflation knowledge and recalibrated expectations.

Whale Timing Raises Eyebrows

Nonetheless, one growth ended up stealing the highlight and reinforcing the concept that timing is all the pieces on this macro-driven setting. Simply earlier than the U.S. This autumn GDP knowledge was launched, an insider whale pockets moved $335 million value of Bitcoin, roughly ten minutes forward of the announcement. GDP got here in at 1.4%, the weakest quarterly studying since Q1 2025, including to an already uneasy temper. Layer on prime the potential $175 billion in tariff refunds and speak of a “backup plan” from President Trump, and the stress available in the market felt virtually thick.

Fragile Assist, Lingering Warning

Put all of it collectively, and that whale switch doesn’t look random. Even with bullish information across the court docket ruling, Bitcoin couldn’t break $70k, which hints at deeper warning beneath the floor. Inflation dangers and the fiscal uncertainty tied to tariff refunds probably performed into the choice to maneuver such a big place. If something, the timing could function an early sign of stress constructing underneath the hood, particularly with Bitcoin’s assist ranges as soon as once more beginning to look fragile, perhaps even a bit shaky.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.