- Sharplink Gaming shares plunged over 67% in after-hours buying and selling following an S-3 SEC submitting that traders misinterpret as a significant inventory dump.

- The panic got here simply days after the corporate introduced plans to construct a $1 billion Ethereum treasury, which had beforehand despatched the inventory hovering.

- Executives insist no shares had been offered, however confusion across the submitting erased most of SBET’s current 1,900% rally features.

Sharplink Gaming (SBET) surprised the market Thursday night, with shares plunging greater than 67% in after-hours buying and selling after the corporate filed an S-3 registration assertion with the U.S. Securities and Trade Fee. What regarded, at first look, like a routine submitting rapidly spiraled into full-blown panic. Many traders assumed the transfer signaled a large inventory dump, simply days after Sharplink had boldly introduced plans to construct a $1 billion Ethereum treasury.

The Minneapolis-based betting platform had already closed common buying and selling at $32.53, down 12.25% for the day, which wasn’t precisely comforting. However the actual shock got here later. Inside hours, SBET cratered to as little as $8 earlier than clawing its approach again towards $10.55, nonetheless marking a brutal 67.6% collapse from the day’s shut. It was the sort of transfer that feels much less like a correction and extra like a trapdoor opening beneath the ground.

Ethereum Treasury Desires Flip Into Market Concern

The irony is that simply weeks in the past, Sharplink was being celebrated. On Could 30, the corporate revealed plans to boost as much as $1 billion by way of a personal funding in public fairness (PIPE) deal, with many of the proceeds earmarked for Ethereum purchases. Merchants liked the narrative. SBET rocketed from $6 on Could 23 to an eye-popping $124, as speculators rushed in, desperate to front-run what they believed can be a large ETH accumulation technique.

However hype can flip fragile quick. The brand new SEC submitting registered practically 58.7 million shares for potential resale, and that single phrase — potential resale — was sufficient to shake confidence. Traders interpreted it as insiders lining as much as money out, successfully flipping the script on the Ethereum pivot story. BTCS CEO Charles Allen summed it up bluntly, calling it a “prisoner’s dilemma,” the place everybody races to promote earlier than another person does. A basic rush for the exits, messy and emotional.

Executives Deny Any Precise Promoting

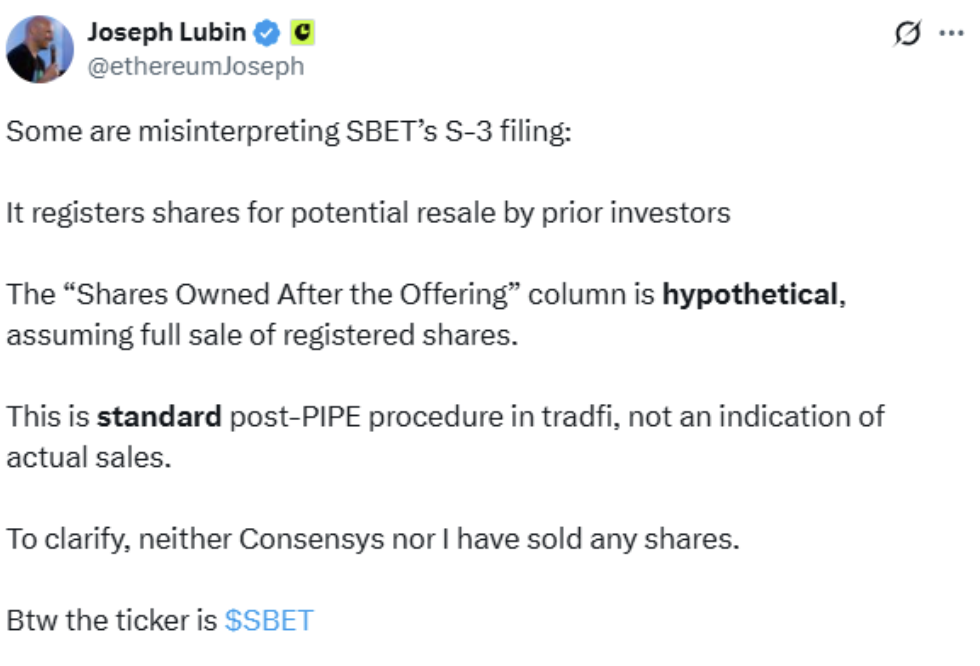

huu8Joseph Lubin, Chairman of Sharplink and CEO of Consensys, pushed again laborious towards the hypothesis. He clarified that the submitting was commonplace process after a PIPE deal and didn’t point out any precise share gross sales. In accordance with Lubin, some market individuals had been merely misreading the doc, complicated administrative formalities with insider dumping.

Consensys’ normal counsel, Matt Corva, echoed that clarification. The deal had closed weeks earlier, he famous, and the S-3 was simply formalizing the power for early traders to probably resell shares in the event that they select. A particular column within the submitting displaying “Shares Owned After the Providing” as zero triggered further confusion, however Lubin emphasised that the determine was hypothetical, assuming a full resale situation. Nonetheless, as soon as concern takes maintain, logic doesn’t all the time win.

From Crypto Momentum to Harsh Actuality

Sharplink’s Ethereum treasury technique had positioned it alongside a rising listing of public corporations experimenting with crypto-backed stability sheets, impressed by Michael Saylor’s Bitcoin-heavy Technique. With over 582,000 BTC on its books, Technique turned company treasury administration right into a sort of crypto wager. Sharplink’s $425 million preliminary PIPE increase to kickstart its ETH reserves was seen as one of many boldest Ethereum-focused performs but.

However markets will be ruthless when expectations get forward of readability. Ethereum itself was buying and selling close to $2,640 at publication, down 4% over 24 hours, which didn’t precisely assist sentiment. After hovering greater than 1,900% in per week at its peak, SBET’s 67% plunge worn out most of these features in a flash. Now the corporate’s restoration could hinge on one factor: delivering on that Ethereum buy rapidly, and speaking it clearly. As a result of on this surroundings, hesitation can value thousands and thousands, possibly extra.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.