US spot Bitcoin exchange-traded funds (ETFs) are dealing with their most sustained interval of institutional friction this 12 months.

This 12 months, the funds have logged six weeks of outflows amid macroeconomic uncertainty that’s driving capital towards conventional protected havens.

BlackRock, Constancy Lead Bitcoin ETF Exodus Amid Macro Jitters

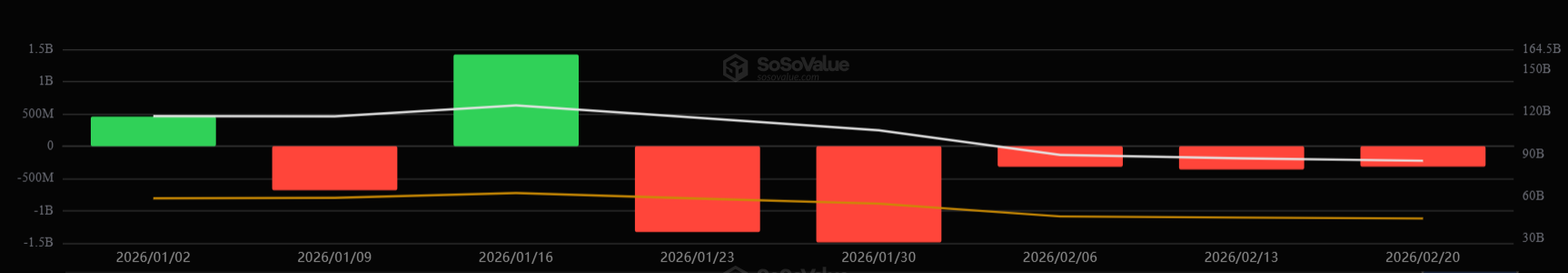

For the reason that begin of 2026, the funds have bled almost $4.5 billion, offset by simply $1.8 billion of inflows throughout the first and third weeks of the 12 months, in accordance with knowledge from SosoValue.

The majority of the injury occurred throughout the previous five-week stretch starting in late January. That run alone erased roughly $4 billion from the ETF advanced, triggered by Bitcoin’s latest value struggles.

The bleeding has been most pronounced among the many class’s heavyweights. BlackRock’s iShares Bitcoin Belief (IBIT) has shed over $2.1 billion up to now 5 weeks, whereas Constancy’s Sensible Origin Bitcoin Fund (FBTC) noticed greater than $954 million stroll out the door.

CryptoQuant analyst J.A. Maartun stated Bitcoin ETF outflows are at $8.3 billion, down from their October all-time excessive, marking the weakest 12 months for the reason that funds launched.

In the meantime, the present regular stream of withdrawals highlights a transparent shift in institutional urge for food from the aggressive momentum that outlined the asset class in its first two years.

Over the previous 12 months, the US’s macro insurance policies have prompted a broader de-risking amongst Wall Road allocators.

This has sparked a rotation out of digital belongings and into treasured metals like gold and silver. For context, gold and gold-themed ETFs have seen $16 billion in inflows throughout the previous three months.

Nonetheless, market observers have identified that Bitcoin ETFs’ structural footprint stays largely intact.

Bloomberg senior ETF analyst Eric Balchunas famous that the bigger image stays traditionally bullish for the nascent asset class.

He famous that, regardless of latest outflows, the funds have considerably outperformed early market expectations, which had projected first-year inflows of simply $5 billion to $15 billion.