Solana’s transaction surge aligns with rising customers, sturdy DEX quantity, and deep stablecoin liquidity.

Recent on-chain information reveals Solana widening its lead over rival blockchains in 2025. Transaction counts have climbed to ranges no different main community presently matches. Curiously, exercise development extends past uncooked throughput and factors to deeper consumer and capital engagement. Latest metrics recommend dominance rests on structural demand quite than short-term spikes.

Solana Dominates Throughput Rankings as Consumer Exercise Rebounds

Based on a chart posted by Solana Sensei, each day transaction information reveals Solana persistently surpassing 100 million transactions. Late January peaks ranged from 150 million to 165 million per day.

Solana dominated all chains within the variety of transactions recorded in 2025. pic.twitter.com/xKkWopCx6g

— Solana Sensei (@SolanaSensei) February 22, 2026

In the meantime, fourth-quarter exercise ranged from 70 million to 100 million. January marked a transparent breakout section, adopted by cooling that also sits effectively above 2024 averages.

Notably, the community holds a big hole versus rivals throughout that interval. Amongst these chains, Ethereum, BNB Chain, Base, and Sui course of solely a fraction of Solana’s throughput. Solana’s lead is important, with transaction volumes working an order of magnitude increased than rivals throughout peak intervals.

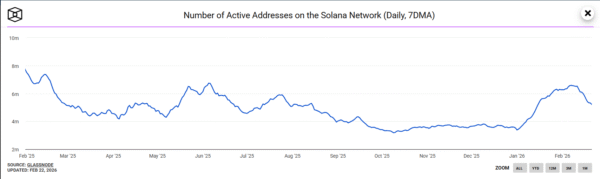

Consumer participation moved in tandem with transaction development. As per The Block information, each day lively addresses slid in the direction of the top of final yr. In reality, information reveals the determine bottomed close to 3.3 to three.5 million.

Picture Supply: The Block

Nonetheless, the development flipped sharply on the flip of the yr. Energetic addresses surged previous 6.5 million earlier than settling round 5 to five.5 million. Even so, present ranges stay effectively above fourth-quarter lows.

The parallel development in transactions and addresses reduces issues of bot-driven spikes. Extra so, broader participation suggests real engagement throughout January’s enlargement section.

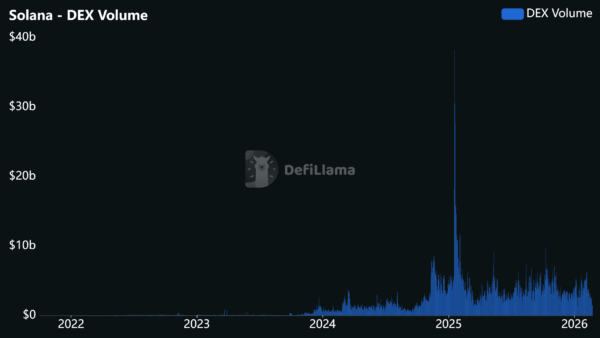

DEX Quantity Holds Above $1.4B Day by day as App Income Outpaces Base Charges

On-chain information from DefiLlama reveals regular DEX development from 2023 via 2024, adopted by a pointy surge early final yr. Exercise has remained elevated into 2026. Present figures present $1.456 billion in 24-hour quantity and $115.8 billion over 30 days. Weekly quantity is down 26%, however nonetheless effectively above ranges seen earlier than 2024.

Picture Supply: DefiLlama

Over the previous 24 hours, the blockchain collected about $637,000 in charges, with solely round $58,000 counted as community income. Compared, functions constructed on Solana generated about $5.86 million in charges and roughly $3.01 million in income.

Low base-layer charges maintain transactions low cost for customers. In the meantime, apps earn cash via buying and selling exercise, token launches, and DeFi companies. This setup permits heavy community utilization with out making transactions costly.

Solana Liquidity Metrics Sign Sustained Buying and selling and DeFi Demand

Sturdy liquidity helps Solana’s excessive exercise ranges, with stablecoins on the community whole about $15.18 billion in worth. Moreover, whole worth locked stands close to $6.57 billion, exhibiting funds dedicated to DeFi protocols.

Perpetual futures quantity reached $404.9 million in 24 hours, whereas bridged whole worth locked is round $39.75 billion.

Principally, massive stablecoin reserves assist energy buying and selling, derivatives, arbitrage, and quick token rotations. As a result of actual capital is lively on-chain, excessive transaction numbers mirror actual financial use, not empty transfers.