Singapore-based Bitcoin miner Bitdeer has liquidated its whole BTC treasury, abandoning the trade’s normal holding technique.

This drastic transfer comes as plunging mining profitability forces the corporate to restructure its debt and speed up its AI pivot.

Why did this Bitcoin Miner dump its Holdings?

On February 20, the crypto mining firm disclosed it held zero Bitcoin, utterly draining its reserves. Notably, this excludes its buyer deposits.

The agency confirmed that it had offered its whole current output of 189.8 Bitcoin, and posted an enormous web discount of 943.1 Bitcoin.

Certainly, this aggressive sell-off highlights a deepening disaster for operators caught in a extreme margin squeeze.

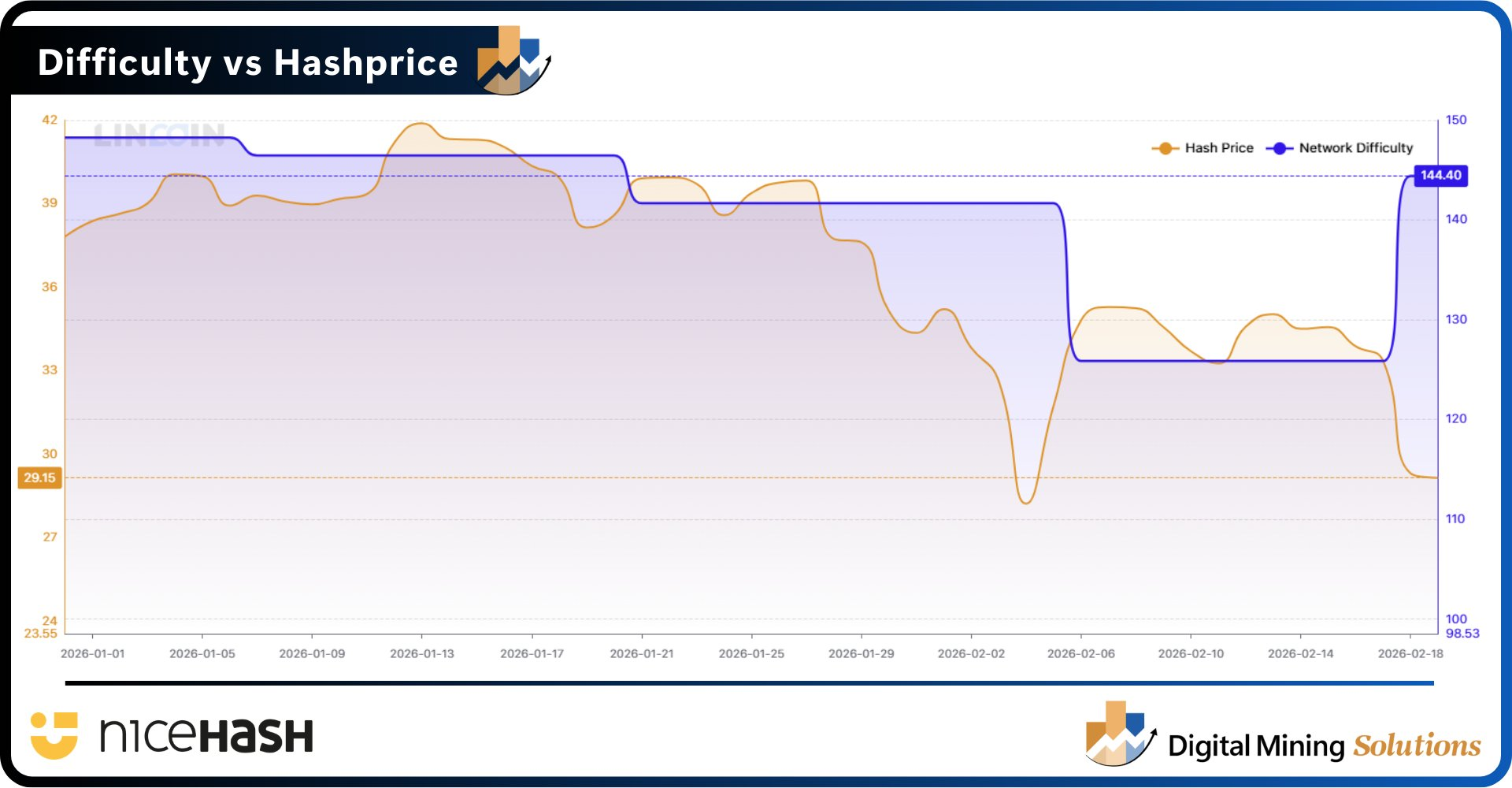

Following a short lived reprieve attributable to US winter storms that knocked home mining fleets offline, the Bitcoin community skilled a fast V-shaped restoration.

This week, community problem surged 14.7%. That is the most important upward adjustment since Might 2021 and erases the operational aid miners skilled earlier within the yr.

Consequently, mining profitability, measured by hashprice, plummeted to below $30 per petahash per day. The essential metric now sits inches above its all-time low, pushing manufacturing prices greater.

Bitdeer Seeks Funding for AI Pivot

To navigate the crunch, Bitdeer is popping closely to Wall Road to fund its pivot into synthetic intelligence.

On February 20, the corporate introduced an upsized $325 million personal sale of convertible senior notes.

The sale, anticipated to shut on February 24, consists of an choice for the preliminary purchasers to buy an extra $50 million in notes.

The monetary maneuvering is extremely defensive. Bitdeer will allocate $138.2 million to repurchase its present 5.25% convertible senior notes due in 2029. This successfully extends the miner’s runway by restructuring its debt.

One other $29.2 million will fund capped name transactions, an insurance coverage coverage that protects present shareholders from dilution if the inventory worth rises.

The remaining proceeds sign a transparent strategic departure from pure-play crypto mining.

Bitdeer said it’s going to use the contemporary capital to develop its high-performance computing and AI cloud companies, develop proprietary ASIC mining rigs, and fund knowledge heart growth.

In the meantime, the treasury liquidation and strategic pivot happen alongside a paradoxical trade milestone: Bitdeer is now the most important publicly traded self-miner on the earth.

Current reviews have revealed that Bitdeer’s self-managed hash charge reached 63.2 exahashes per second, surpassing competitor Marathon Digital’s 60.4 EH/s. This makes the Singapore-based agency the most important publicly traded firm with the best self-managed Bitcoin hashrate.