Realized losses surge as leverage resets, however institutional flows stay cautious.

Bitcoin’s newest correction has triggered one of many largest realized loss occasions ever recorded on-chain. Heavy promoting strain compelled many holders to exit at a loss. On the similar time, derivatives markets noticed a pointy contraction in positioning. In line with analyst Michaël van de Poppe, such circumstances typically seem close to main market turning factors.

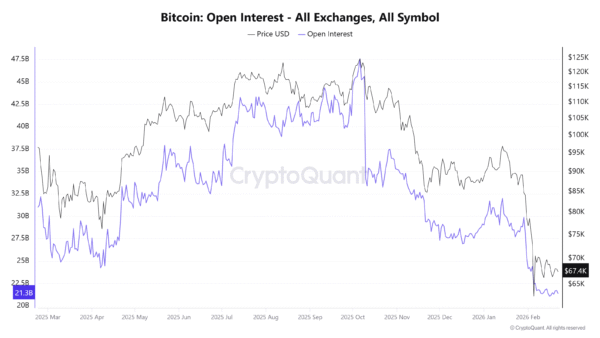

Bitcoin Open Curiosity Collapses 50% as Capitulation Alerts Mount

On-chain information exhibits a historic spike in Bitcoin’s Entity-Adjusted Realized Loss. That metric tracks losses when cash transfer at costs under their acquisition value. Present readings now rival capitulation phases seen throughout the 2018 bear market, the March 2020 COVID crash, and the 2022 Luna and FTX collapses.

This chart represents the whole USD worth of losses being realized by #Bitcoin holders after they promote their cash at a cheaper price than they purchased them.

The current correction has resulted in a large spike in realized losses taking place at the moment. The best it has ever been.… pic.twitter.com/2D82w1rjbr

— Michaël van de Poppe (@CryptoMichNL) February 21, 2026

Spikes of that scale usually happen when weak palms exit beneath strain. Pressured liquidations and panic promoting typically cluster round these moments. Van de Poppe argues that the dimensions and velocity of losses counsel broad capitulation relatively than routine profit-taking.

Bitcoin open curiosity throughout all exchanges has fallen from roughly $45 billion to close $21 billion. Greater than 50% of positions have been worn out in a brief interval. Typically, such contractions replicate lengthy liquidations and speedy deleveraging.

Picture Supply: CryptoQuant

Historic patterns present main open curiosity resets typically align with native bottoms. Extra hypothesis will get flushed from the system, leaving a cleaner construction. Mixed with realized loss spike, a drop in open curiosity factors to a liquidation-driven occasion.

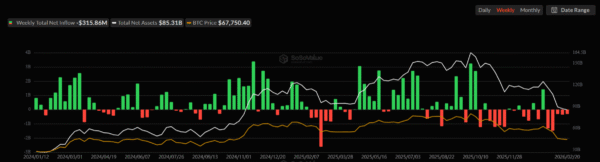

Spot Bitcoin ETF flows recorded roughly $315 million in weekly internet outflows. A number of current weeks confirmed constant redemptions. Whereas scale stays modest in comparison with prior influx waves, route indicators ongoing danger discount.

Picture Supply: SoSoValue

Retail merchants and overexposed longs seem like exiting. On the similar time, institutional consumers have but to step in aggressively. With out regular ETF inflows, affirmation of a sturdy backside stays incomplete.

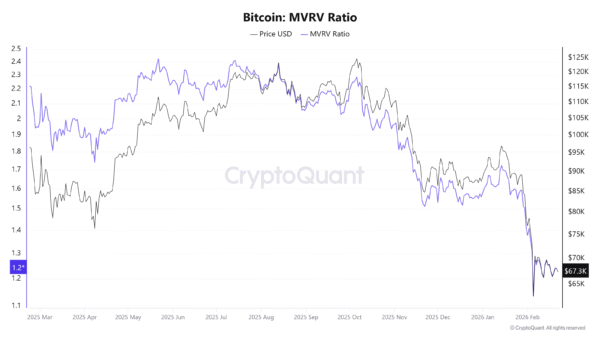

MVRV Compresses Whereas Realized Losses Surge in BTC Correction

Valuation metrics replicate a reset however not deep-cycle undervaluation. As an example, the MVRV ratio has compressed sharply throughout the correction. Revenue margins throughout the community have narrowed, and speculative extra has light. Earlier macro bottoms in 2018 and 2022 noticed MVRV fall to deeply discounted ranges. Present readings sit above these extremes.

Picture Supply: CryptoQuant

Van de Poppe defined that risk-adjusted returns have fallen to ranges final seen close to prior market bottoms. Such readings typically accompany intervals of extreme stress and compelled promoting.

Information now presents a combined however structurally essential image:

- Huge realized losses sign widespread capitulation.

- Open curiosity collapse confirms heavy deleveraging.

- ETF outflows present establishments stay cautious.

- MVRV compression factors to a valuation reset, not deep undervaluation.

Bitcoin at the moment trades about 50% under its all-time excessive. Prior bear markets noticed drawdowns between 70% and 85%. The dimensions of the present decline suggests a significant mid-cycle deleveraging relatively than a full structural collapse.

In line with Michaël van de Poppe, excessive realized losses typically coincide with bottoming phases as weak contributors exit. A affirmation of a macro backside will rely on stabilization in ETF flows and broader liquidity circumstances within the coming weeks.