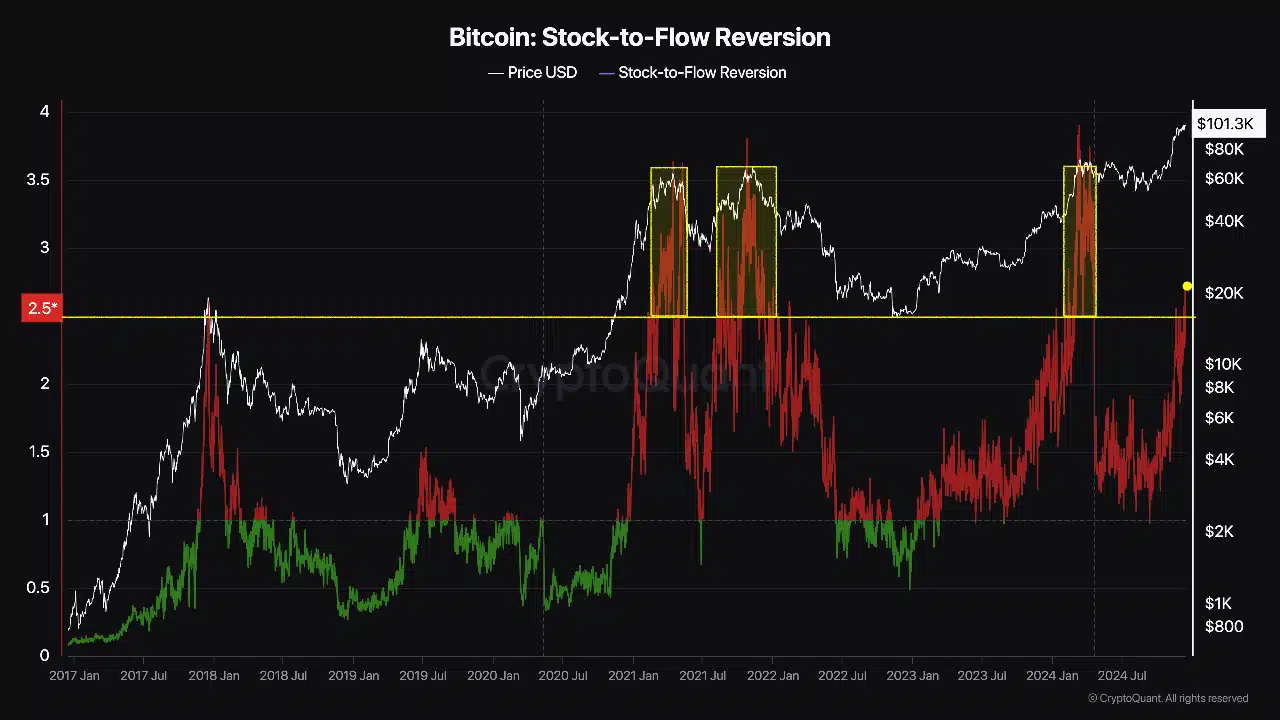

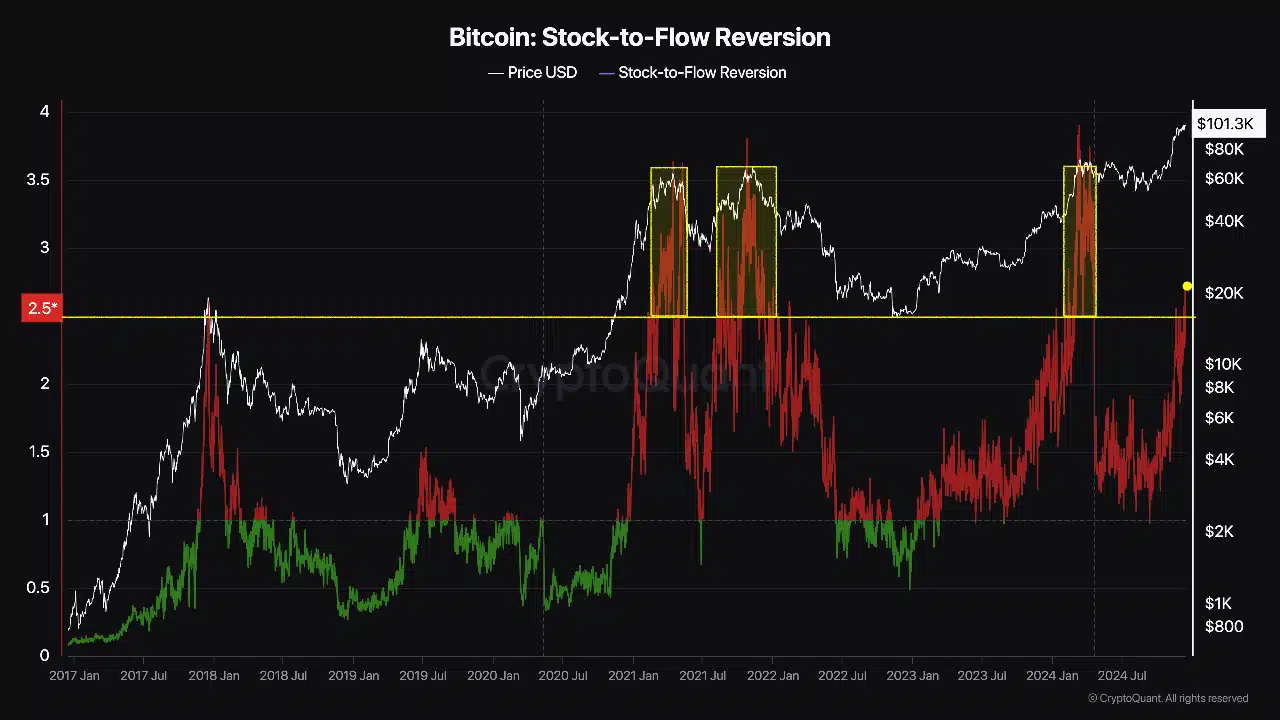

- S2F reversion mannequin gauges Bitcoin value deviations, providing insights for profit-taking alternatives.

- Thresholds like 2.5 and three.0 assist merchants stability danger and reward throughout market highs.

Bitcoin’s [BTC] latest surge to a brand new ATH has sparked renewed curiosity in key market metrics, particularly within the Inventory-to-Circulate (S2F) reversion mannequin.

The S2F reversion metric measures Bitcoin’s value deviations from its anticipated worth, providing helpful insights for traders trying to time market entries and exits.

Merchants are more and more counting on this mannequin to gauge market sentiment and pinpoint optimum profit-taking alternatives.

Understanding the S2F reversion mannequin

Bitcoin’s key metric, the Inventory-to-Circulate (S2F) reversion mannequin, evaluates Bitcoin’s value deviations from its anticipated worth primarily based on the extensively recognized Inventory-to-Circulate mannequin.

This mannequin considers Bitcoin’s shortage, linking its provide issuance price to its market worth. The S2F reversion metric quantifies how far the precise value diverges from the anticipated value, providing a data-driven perspective on market tendencies.

Understanding this metric is important, notably throughout pivotal market actions like Bitcoin’s latest ATH of $106,352.

By figuring out value overextensions or undervaluations, the S2F reversion metric equips traders with a scientific device for assessing market sentiment.

This helps merchants not solely to identify worthwhile entry factors, but additionally to attenuate dangers throughout unstable durations. Its structured method makes it an indispensable asset for timing market selections successfully.

Bitcoin’s key metric: The two.5 and three.0 thresholds in S2F

CryptoQuant analyst Darkfost highlights the significance of particular S2F reversion thresholds — 2.5 and three.0 — in optimizing Bitcoin profit-taking methods.

A price above 2.5 traditionally indicators average profit-taking alternatives, reflecting rising market enthusiasm with out extreme danger.

Conversely, a worth exceeding 3.0 usually signifies market overheating, suggesting it’s time for extra substantial profit-taking to keep away from potential downturns.

Supply: Cryptoquant

Darkfost recommends a two-step method: safe smaller positive factors at 2.5 and bigger earnings at 3. This technique permits merchants to stability danger and reward, leveraging historic knowledge to make knowledgeable selections.

For instance, as Bitcoin surged to $106,352, these thresholds present readability on when to behave amidst market euphoria. Using this mannequin ensures merchants don’t miss revenue alternatives whereas staying cautious throughout speculative highs.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025