PEPE’s value has dropped almost 8% up to now 24 hours, days after reaching its all-time excessive on December 9. Momentum indicators, together with the RSI at 33.3, present that PEPE is nearing oversold territory however has not but hit the crucial threshold of 30, leaving room for additional correction.

Moreover, the 7D MVRV Ratio at -9.3% factors to important short-term holder losses, with historic information indicating a possible draw back towards -12% to -15% earlier than a rebound. Whether or not PEPE holds its key assist at $0.0000188 or breaks decrease will possible outline its subsequent main value motion.

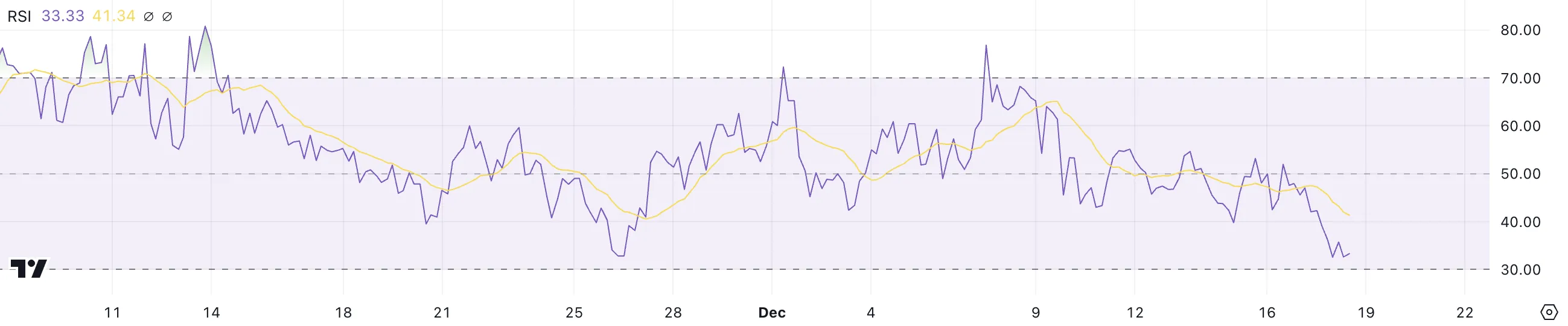

PEPE RSI Isn’t In The Oversold Zone But

PEPE RSI is at the moment at 33.3, reflecting a pointy decline since December 16. This means that the meme coin is approaching oversold territory, as its RSI nears the crucial threshold of 30.

The heavy drop in RSI, mixed with the continuing 8% correction within the final 24 hours, suggests elevated promoting strain and bearish sentiment within the brief time period.

The RSI (Relative Energy Index) measures the pace and magnitude of value modifications to guage whether or not an asset is overbought or oversold. RSI values above 70 point out overbought situations, usually signaling a possible pullback, whereas values under 30 counsel oversold situations, which might precede a rebound.

With PEPE RSI at 33.3 and nearing oversold ranges, the worth might proceed to face downward strain, however a possible bounce might happen if patrons step in at these decrease ranges.

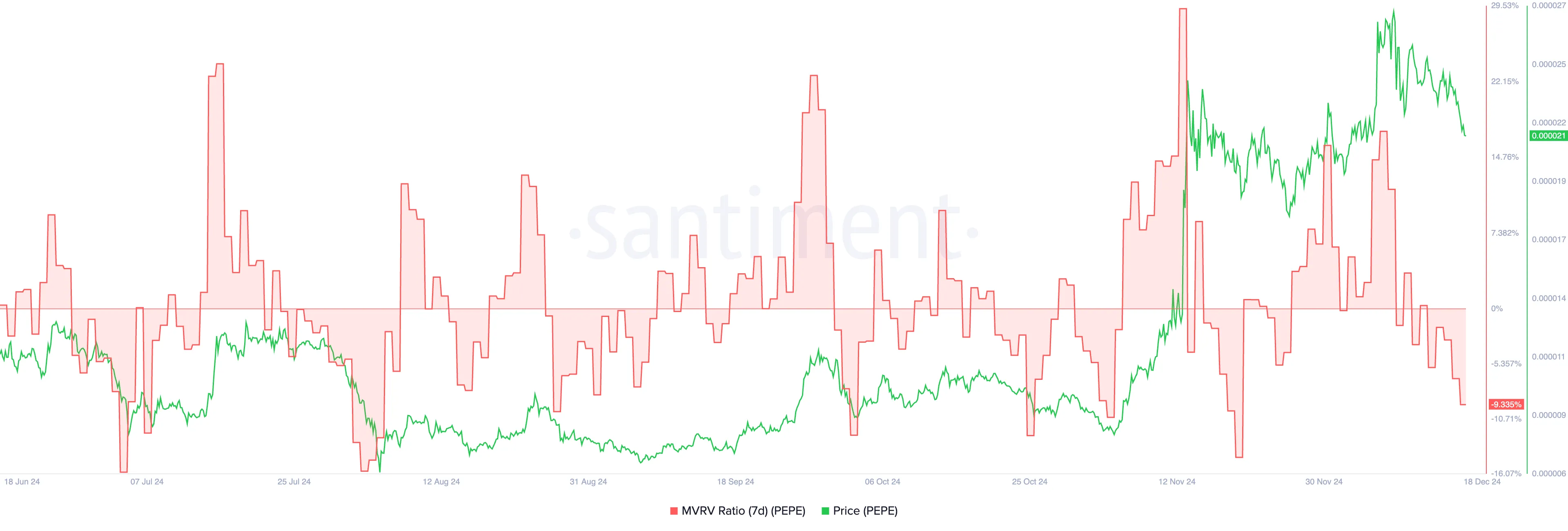

MVRV Ratio Reveals The Correction May Proceed

PEPE 7D MVRV Ratio is at the moment at -9.3%, a pointy decline from 17% on December 8 when its value hit a brand new all-time excessive. This unfavorable MVRV signifies that, on common, short-term holders at the moment are at an unrealized loss. The latest drop displays elevated promoting strain, suggesting that the present correction might persist within the brief time period.

The 7D MVRV Ratio measures the common revenue or lack of tokens moved within the final seven days relative to their present market worth. Historic information exhibits that PEPE’s 7D MVRV usually reaches ranges round -12% to -15% earlier than value recoveries happen.

If this development continues, the present -9.3% means that additional draw back is feasible earlier than PEPE finds a backside and begins to rebound.

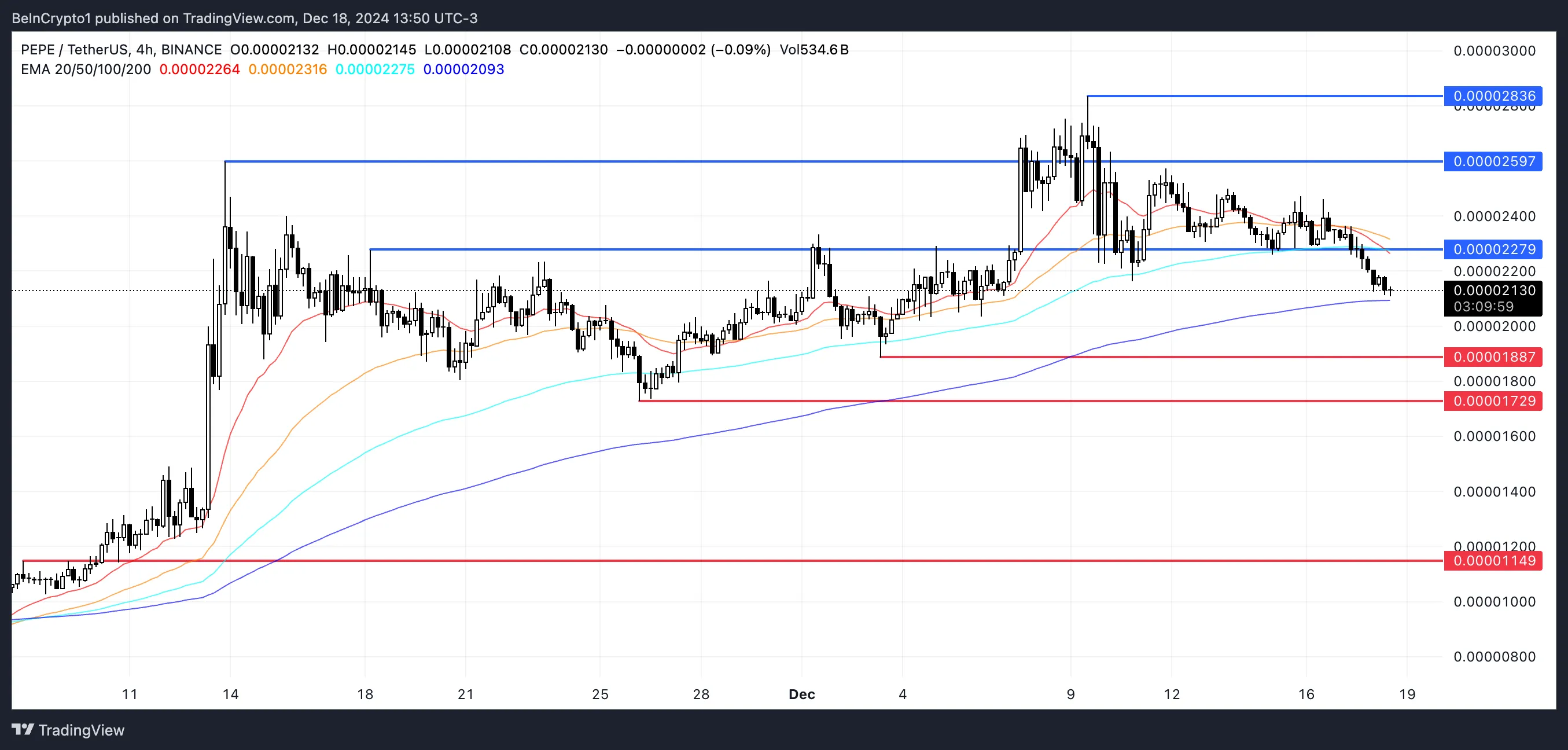

PEPE Value Prediction: A Potential 47% Correction Quickly?

The assist at $0.0000188 is a crucial stage for PEPE value, as a breakdown under it might result in additional declines. If this assist fails, PEPE might take a look at $0.000017, with the potential to drop as little as $0.000011, representing a 47% correction from present ranges.

This bearish outlook is bolstered by its EMA traces, which have fashioned a demise cross as short-term EMAs cross under long-term EMAs, signaling continued draw back momentum.

Alternatively, if PEPE value can regain constructive momentum, it might problem the resistance at $0.0000227.

A breakout above this stage might open the door to additional positive factors, with targets at $0.0000259 and probably $0.000028 if the uptrend strengthens.

Disclaimer

In step with the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.