Este artículo también está disponible en español.

Bitcoin confronted a pointy retrace yesterday, dropping 8% from its all-time excessive of $108,300 after the Federal Reserve introduced a 25 foundation level charge reduce alongside a revised coverage signaling fewer cuts in 2025. Regardless of the drop, Bitcoin managed to carry above $98,000, a essential liquidity stage that analysts are carefully monitoring.

Associated Studying

This latest value motion raises a pivotal query: is that this the beginning of a extra important correction or merely a shakeout to gasoline the following leg of Bitcoin’s rally? CryptoQuant analyst Axel Adler supplied key insights, noting that no substantial panic promoting is clear available in the market—a sign that investor confidence stays intact for now.

Bitcoin’s resilience at present ranges suggests the market is recalibrating following the Fed’s newest strikes. As merchants and buyers digest these developments, all eyes are on whether or not Bitcoin can get better momentum and push again towards its earlier highs or if deeper retracements are on the horizon. With market sentiment hanging within the steadiness, the approaching days can be essential in figuring out Bitcoin’s subsequent route.

Bitcoin Stays Robust

Regardless of the latest dip and a noticeable shift in market sentiment, Bitcoin stays resilient above key liquidity ranges, sustaining its long-term bullish construction. The worth drop, sparked by broader market reactions to the Federal Reserve’s coverage announcement, has raised issues, however Bitcoin’s means to carry essential help underscores its underlying energy.

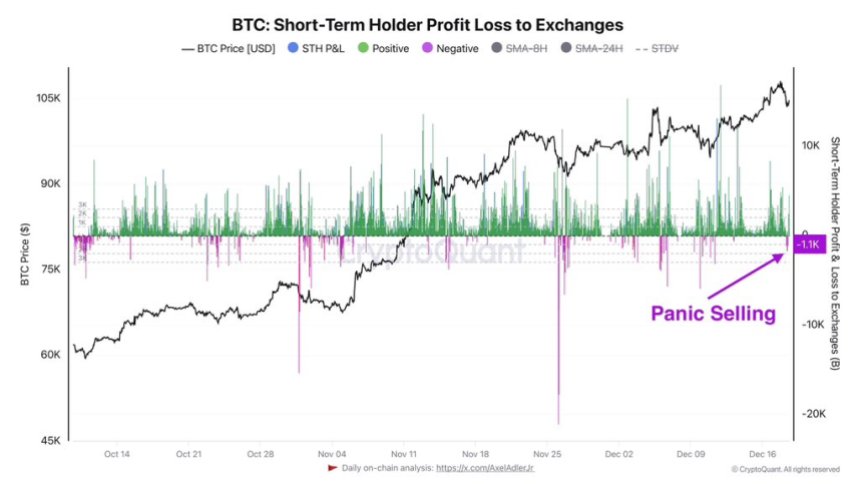

High CryptoQuant analyst Axel Adler not too long ago shared information on X, shedding mild in the marketplace’s present dynamics. Based on Adler, no important panic promoting is clear, even after Bitcoin’s sharp decline.

He highlighted a chart monitoring the BTC short-term holder profit-loss to exchanges, revealing that this metric is at the moment at a better stage than seen throughout early December promoting occasions. This means that the latest sell-off could have been much less pushed by worry and extra of a strategic shakeout.

This shakeout might serve to generate liquidity and supply the mandatory momentum for Bitcoin’s ongoing rally. Nevertheless, he additionally cautions that this might mark the start of a broader correction which may take time to completely develop.

Associated Studying

The approaching weeks can be pivotal for Bitcoin. Because the market stabilizes, merchants and buyers are watching whether or not Bitcoin can reclaim increased ranges or if additional draw back consolidation is on the playing cards.

Worth Motion: Technical Ranges To Maintain

Bitcoin is at the moment buying and selling at $101,800, following a profitable take a look at of native demand at $98,695 earlier right this moment. The worth construction stays intact, with Bitcoin forming a transparent sample of upper highs and better lows, signaling sustained bullish momentum. Regardless of the latest volatility, the market sentiment continues to lean optimistic as BTC holds above essential help ranges.

For Bitcoin to take care of its upward trajectory, a decisive push above $103,600 is important. This stage served as a big pivot final week, marking a key zone for each patrons and sellers. Breaking by means of this resistance would probably sign renewed momentum, setting the stage for additional positive factors as Bitcoin eyes new highs.

Nevertheless, failure to interrupt above $103,600 might result in a shift in sentiment. If BTC additionally loses the $100,000 psychological stage, it could probably affirm the beginning of a broader correction. Such a situation might drive the value towards decrease help zones because the market recalibrates.

Associated Studying

The following few days can be essential in figuring out Bitcoin’s near-term route. Merchants are carefully watching the $103,600 resistance and $100,000 help ranges, as these thresholds will dictate whether or not BTC continues its rally or enters a corrective section.

Featured picture from Dall-E, chart from TradingView