Disclaimer: The opinions expressed by our writers are their very own and don’t characterize the views of U.Right now. The monetary and market info offered on U.Right now is meant for informational functions solely. U.Right now is just not chargeable for any monetary losses incurred whereas buying and selling cryptocurrencies. Conduct your individual analysis by contacting monetary specialists earlier than making any funding choices. We consider that every one content material is correct as of the date of publication, however sure affords talked about might now not be obtainable.

The worth of Dogecoin (DOGE) has been an actual curler coaster journey for all crypto market individuals over the previous 24 hours. Having misplaced greater than 11% within the second, DOGE’s value motion triggered greater than $35.1 million in liquidation in 24 hours, making the favored meme cryptocurrency one of many leaders on this “unlucky” indicator. Lengthy positions, by the way in which, had been liquidated considerably extra.

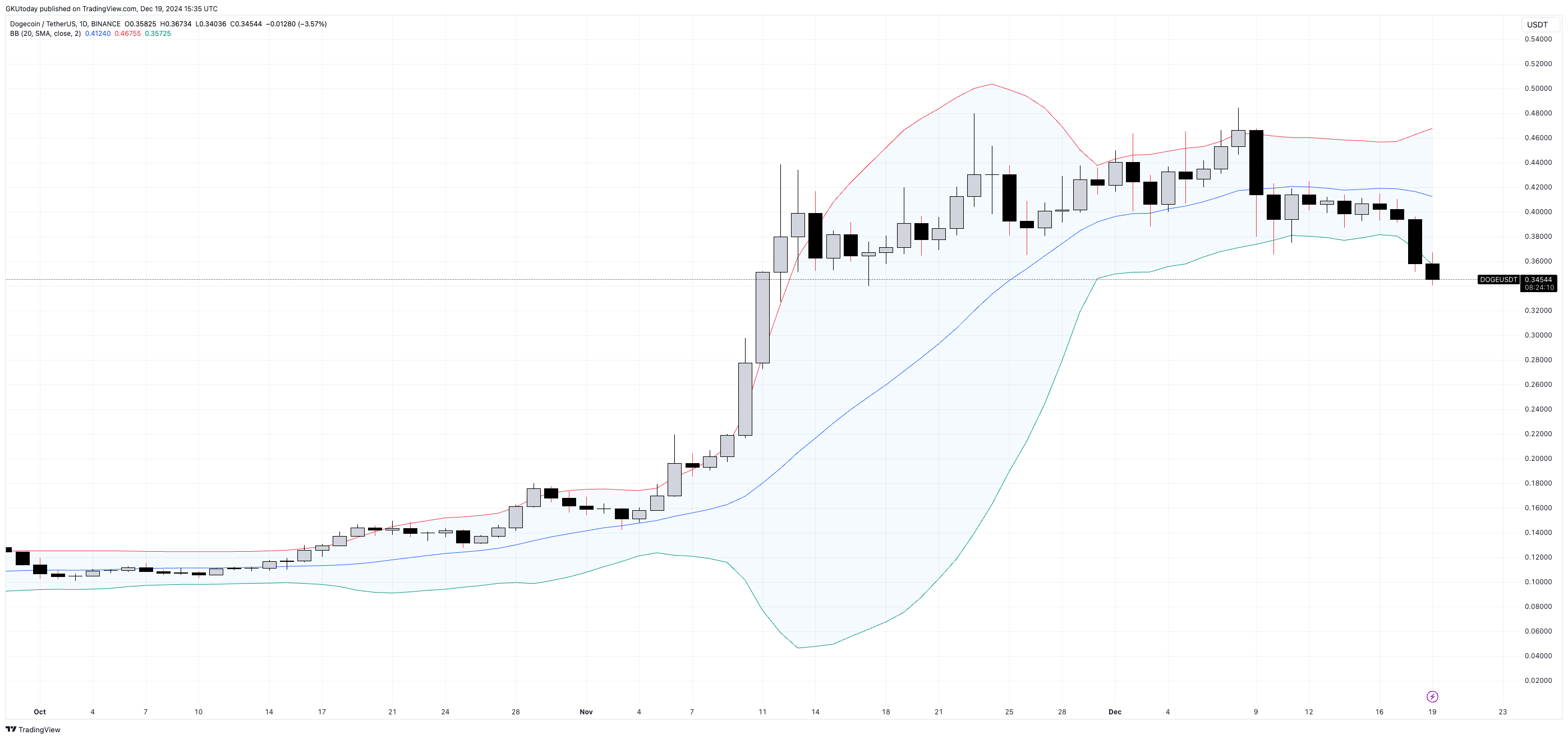

Nonetheless, regardless of all of the ugliness that Dogecoin might now current from an funding standpoint, one common indicator is definitely signaling that the principle meme crypto coin of the market is oversold. That is the Bollinger Bands, developed by skilled dealer John Bollinger many years in the past.

With out going into deep element, the Bollinger Bands characterize a 20-day shifting common and deviations from it in each instructions. Logically, the worth ought to fluctuate inside this vary. When there’s a transfer out of it, it could actually sign that the asset is oversold or overbought.

With DOGE, it’s precisely the primary scenario, when on all time frames, and extra importantly on the every day one, the worth of the meme cryptocurrency has gone past the decrease band, which is now at $0.3576 per DOGE, which is 3.5% larger than the present Dogecoin quotes.

Does this imply a rise within the value of DOGE proper right here and now? Not going. Nonetheless, Dogecoin’s return to the Bollinger Band vary is more likely to occur if the worth motion statistics are to be believed. The query of when stays open.