Almost $1.25 billion has been liquidated from the crypto market over the previous 24 hours, because the market’s practically down 10%.

Bitcoin dipped beneath $96,000, with meme cash seeing the very best loss on Thursday.

Inflation Forecast Triggers Huge Corrections within the Crypto Market

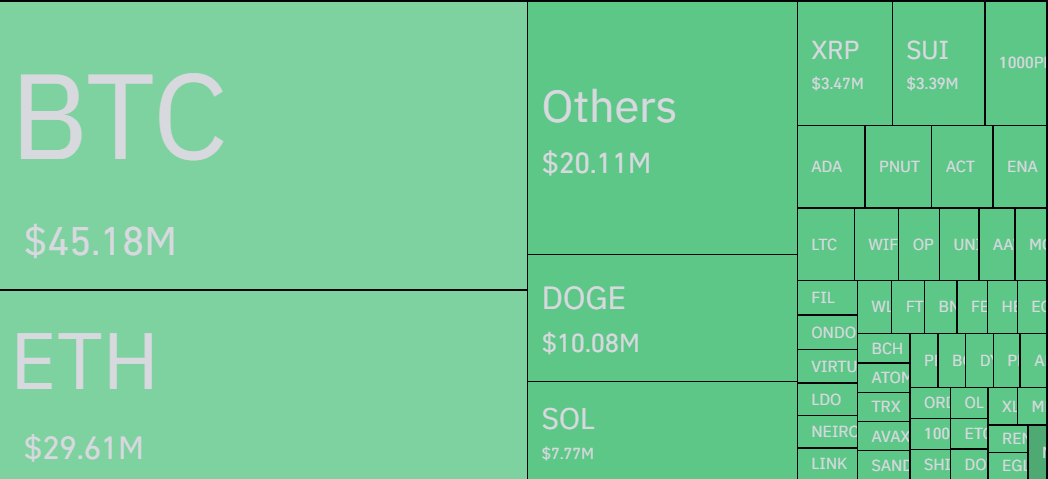

In accordance with Coinglass knowledge, Bitcoin noticed over $45 million in liquidation at the moment, whereas Ethereum noticed practically $30 million. This main correction occurred after the Federal Reserve reduce rates of interest by 25 foundation factors on Wednesday.

Often, an rate of interest reduce is bullish for crypto, as decrease charges sign a softer financial coverage. Nevertheless, what impacted the market was the Fed’s 2025 projections. Jerome Powell mentioned that the Federal Reserve is predicting larger inflation and solely two rate of interest cuts subsequent 12 months.

Whereas this degree of liquidation is critical, the influence on the inventory market is extra extreme. Almost $1.5 trillion was worn out from the US market. These heavy liquidations are driving issues for a possible bearish cycle.

“Hey guys, now that the bull market’s formally over I simply needed to increase a wholehearted thanks to everybody. I’ll be deleting all crypto associated socials and logging off,” one influencer posted on X (previously Twitter)

Nevertheless, the prevailing perspective of most analysts appears to point that at the moment’s liquidation is only a short-term flushout.

“Bitcoin Market Sentiment. It’s the identical story each time, and it by no means adjustments. Markets aren’t designed for almost all to win. Corrections are a pure a part of bull markets,” wrote fashionable analyst ‘Titan of Crypto’.

Different analysts, like Philakone, emphasised that these liquidations typically occur on the finish of a bullish 12 months when the market enters a cool-off interval. He additionally predicted that the bullish sentiment would return after December 17 and maintain till the primary week of January.

In the meantime, some analysts are forecasting an altcoin season. Rising liquidation for Bitcoin will influence its dominance within the coming months and create extra scope for main altcoins like Ethereum and Solana.

“When you suppose the altcoin season is over, it is advisable know this: The whole altcoin market cap (excluding BTC & ETH) is sitting at round $1.05 trillion. It’s tapping on the earlier altcoin market cap excessive from November 2021. The final time one thing related occurred was in Feb 2021, when this altcoin market cap examined the earlier excessive from Jan 2018,” wrote Lark Davis.

Whereas the Fed’s forecast had a notable influence in the marketplace at the moment, it’s vital to grasp that Bitcoin remains to be up by practically 130% this 12 months. Most significantly, a number of developments within the crypto business outweigh these macroeconomic components.

Michael Saylor’s MicroStrategy, which owns practically 2% of Bitcoin’s provide, has made consecutive purchases since November. The agency even purchased $3 billion price of BTC in December, whereas property hovered above $100,000.

Additionally, different public firms like MARA and Riot Plaforms have pursued related Bitcoin acquisition methods this month. There are additionally potential regulatory shifts to look ahead. International lawmakers throughout totally different international locations are advocating for a Bitcoin reserve.

So, whereas the macroeconomic components have raised momentary bearish alerts, the long-term outlook for 2025 nonetheless stays bullish.

Shrinking Provide Sign Potential Bitcoin Provide Shock

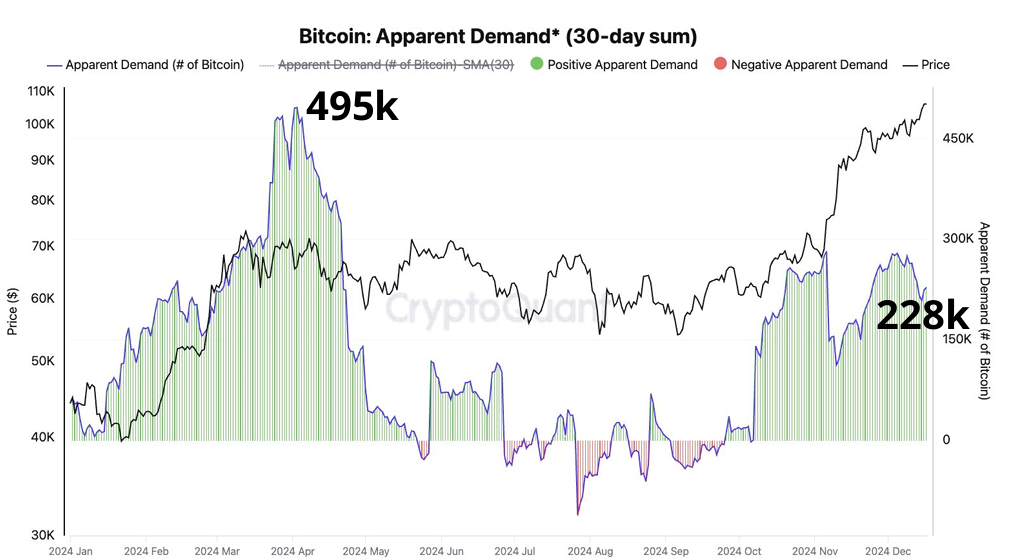

One more reason why we predict Bitcoin will proceed to stay bullish is its provide and demand ratio.

In accordance with knowledge from CryptoQuant, the Bitcoin market is displaying indicators of a possible provide shock as rising demand meets a shrinking provide of BTC accessible on the market. Bitcoin demand is rising, with accumulator addresses including 495,000 Bitcoin month-to-month.

In the meantime, the stablecoin market cap hit $200 billion, signaling recent liquidity. Optimism round pro-crypto insurance policies and potential US initiatives additional fuels demand.

Then again, sell-side liquidity has dropped to three.397 million Bitcoin, the bottom since 2020, together with exchanges, miners, and OTC desks. The stock ratio, which measures how lengthy present provide can meet demand, has plummeted to six.6 months from 41 months in October, highlighting the tightening market circumstances.

So, this provide shock, together with the macroeconomic components, could possibly be the important thing catalyst behind at the moment’s liquidations.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.