- Powell acknowledged that the regulation doesn’t permit the Fed to personal BTC.

- The group clarified that the US BTC reserve will probably be beneath the Treasury Secretary, not the Fed.

Fed chair Jerome Powell’s newest Bitcoin [BTC] reserve remark has made media buzz and confused some quarters of the crypto group.

Throughout his press convention on Wednesday, one of many journalists requested him if he sees any worth within the US having a BTC reserve.

In his response, Powell acknowledged,

“We’re not allowed to personal Bitcoin. However the Federal Reserve Act says what we are able to personal and we’re not searching for a regulation change.”

He added that some other regulation modifications have been inside the purview of Congress and never the Federal Reserve.

Will US have a BTC reserve?

A bit of the crypto group was dissatisfied by Powell’s remarks as some speculated that he may be a roadblock to the BTC reserve plans.

Nonetheless, others clarified that the BTC reserve plan was designed to be established by the US Treasury Secretary, not the Fed.

In line with the BTC reserve invoice launched by Senator Cynthia Lummis, the fourth part anchored the mandate with the Treasury Secretary and learn,

“The Secretary shall set up a decentralized community of safe Bitcoin storage services distributed throughout america, collectively to be referred to as the Strategic Bitcoin Reserve for the chilly storage of Authorities Bitcoin holdings”

That is most likely why the trade lobbyists pushed for a pro-crypto Treasury secretary and SEC chair within the upcoming Trump administration.

Scott Melker of the Wolf of All Streets additionally dismissed Powell’s remarks and reiterated that solely the Treasury may have an enormous say within the reserve. He stated,

“The Fed just isn’t allowed to personal Bitcoin. Good factor it will be the Treasury placing Bitcoin on the stability sheet if Bitcoin was made a reserve asset. This implies nothing.”

Regardless of Powell’s newest feedback, he had earlier praised the asset instead and competitor to bodily gold and never the US greenback.

Nonetheless, his current remarks have raised the query of whether or not the reserve will develop into a actuality.

Final week, Strike’s Jack Mallers acknowledged that the president-elect might use The Greenback Stabilization Act to concern a day-1 govt order to determine a BTC reserve to guard the US greenback. In that case, the US might create the reserve subsequent month after the inauguration.

Nonetheless, some market pundits imagine that the BTC reserve received’t defend the US greenback however destroy it.

So which path is the market leaning in?

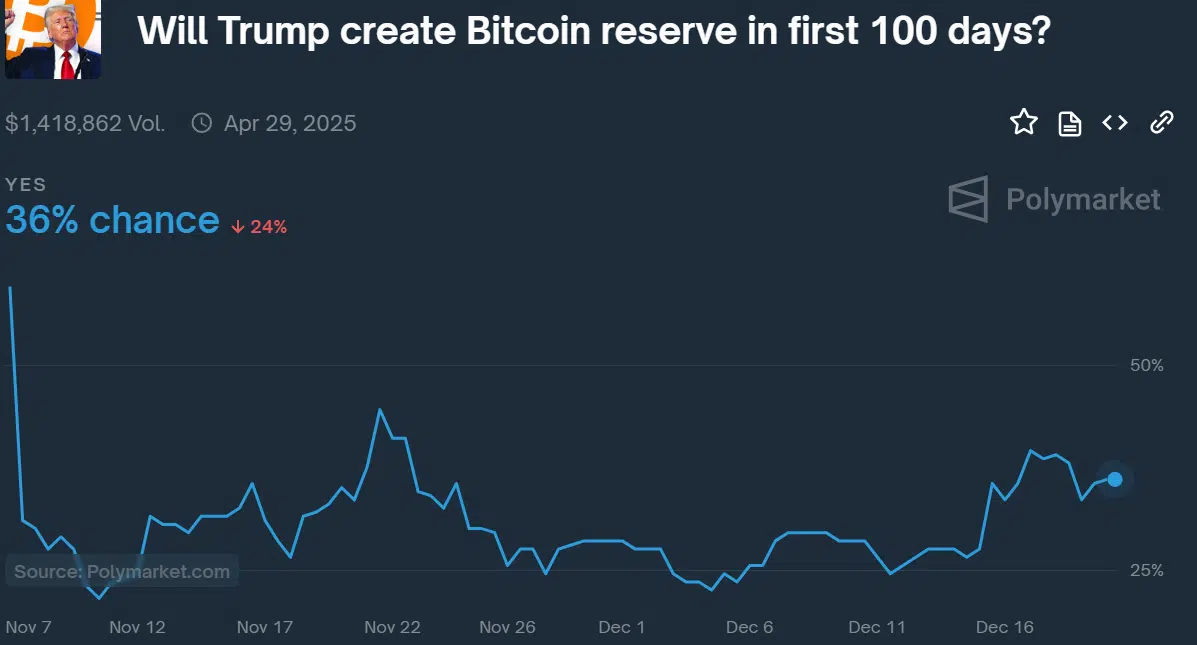

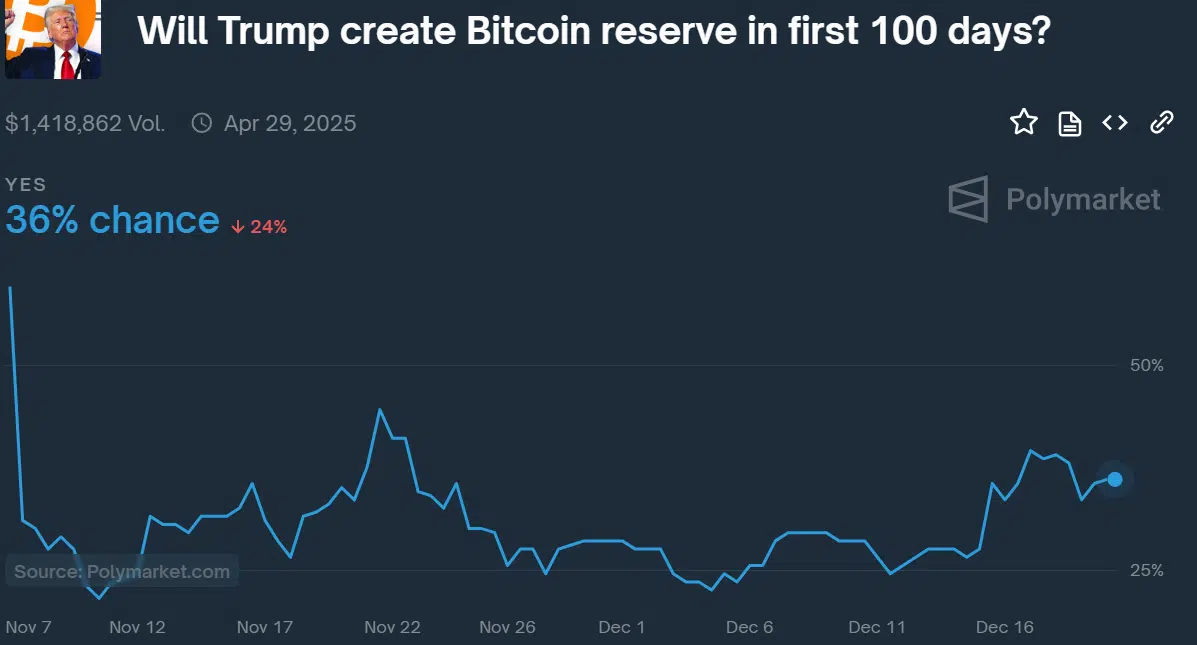

In line with prediction website Polymarket, the chances of forming a US BTC reserve jumped to 40% earlier within the week. The surge additionally noticed BTC topped $108K.

Supply: Polymarket

However the probabilities of the reserve slipped 4 factors to 34% following Powell’s remarks. BTC additionally briefly plunged beneath $100K over the identical interval.

Nonetheless, the chances have been barely up at 36% as of this writing, suggesting that the market was nonetheless optimistic in regards to the reserve.