The crypto market will witness $2.62 billion in Bitcoin and Ethereum choices contracts expire as we speak. This huge expiration might have an effect on short-term value motion, particularly as each property have not too long ago declined.

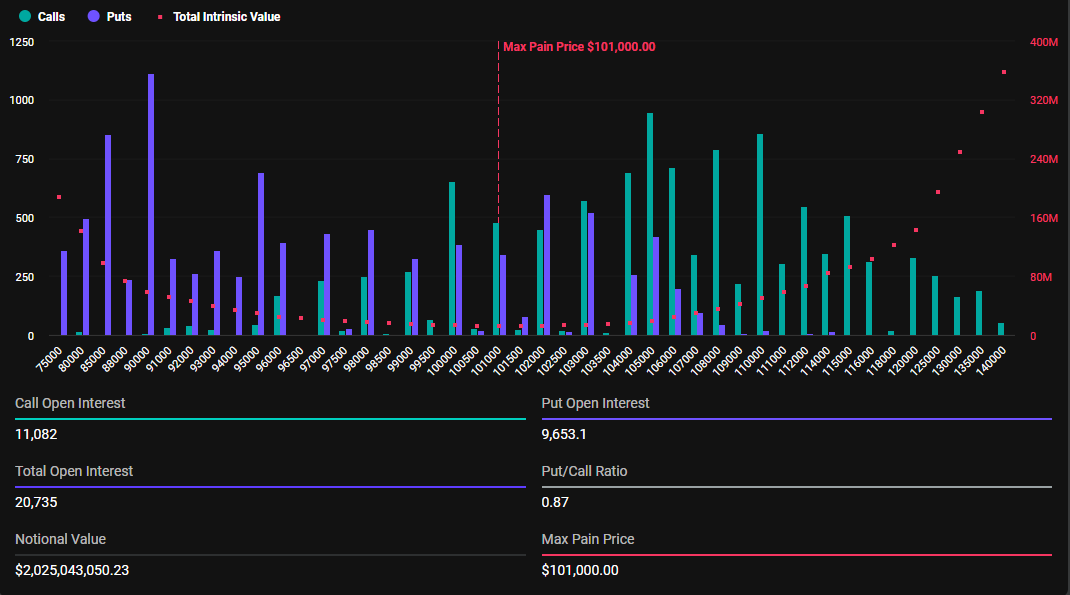

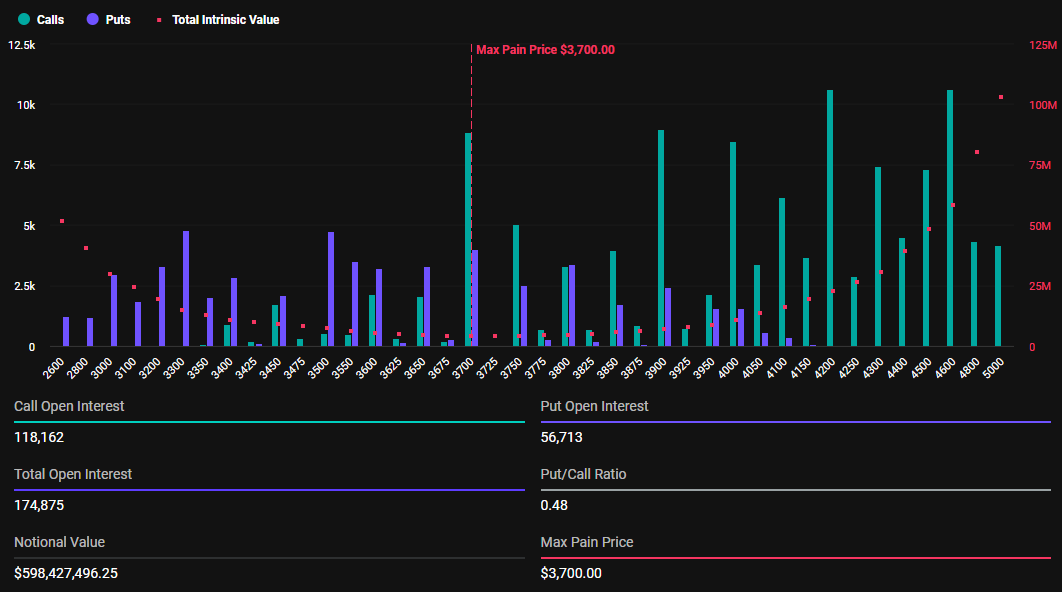

With Bitcoin (BTC) choices valued at $2.02 billion and Ethereum (ETH) at $598.99 million, merchants are bracing for potential volatility.

What Merchants Ought to Watch Amid Over $2.6 Billion Choices Expiry

Right now’s expiring choices mark a slight drop from final week. In response to Deribit knowledge, Bitcoin choices expiration includes 20,728 contracts, in comparison with 20,815 contracts final week. Equally, Ethereum’s expiring choices complete 174,863 contracts, up from 164,330 contracts the earlier week.

For Bitcoin, the expiring choices have a most ache value of $110,000 and a put-to-call ratio of 0.87. This means a usually bullish sentiment regardless of the asset’s current pullback.

As compared, their Ethereum counterparts have a most ache value of $3,700 and a put-to-call ratio of 0.48, reflecting an identical market outlook.

The utmost ache level is a vital metric that always guides market habits. It represents the worth stage at which most choices expire nugatory.

Moreover, the put-to-call ratios under 1 for each Bitcoin and Ethereum counsel optimism available in the market, with extra merchants betting on value will increase. Nonetheless, with that quantity of choices expiring, merchants and traders ought to brace for potential volatility.

“Choices expiry can result in elevated volatility as merchants regulate their positions. Look ahead to potential strikes in SPX and BTC as they might react to those market dynamics,” one consumer on X shared.

May Choices Expiry Catalyze Market Restoration?

Of notice is that these expiring choices come after Bitcoin retracted to $94,235. As of this writing, the pioneer crypto was buying and selling for $97,157, down nearly 4% because the Friday session opened.

With a most ache level of $101,000, Bitcoin stands properly under its strike value. However, Ethereum is buying and selling for $3,392, properly above its most ache value of $3,700. Based mostly on the Max Ache idea, BTC and ETH costs are prone to method their respective strike costs, therefore anticipated volatility.

This occurs as a result of the utmost ache idea in choices buying and selling operates on the belief that possibility writers are sometimes giant establishments or skilled merchants. Due to this fact, they’ve the assets and market affect to drive the closing value towards the utmost ache level on expiration day.

For Bitcoin, subsequently, this implies a doable restoration, doubtlessly reclaiming the $100,000 milestone.

“In a single day periods not wanting good. The saving grace could possibly be simply tons of choices expiring nugatory tomorrow,” one consumer on X quipped.

In the meantime, it’s unimaginable to disregard that whereas choices expirations usually trigger short-term value fluctuations, markets often stabilize quickly after as merchants adapt to the brand new value atmosphere. With as we speak’s high-volume expiration, merchants and traders can anticipate an identical end result, doubtlessly influencing future crypto market tendencies, particularly into the weekend.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.