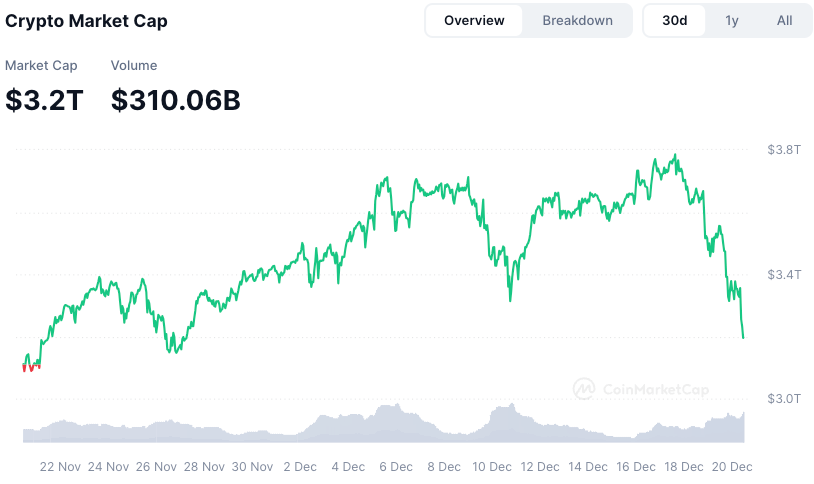

The cryptocurrency market is down by over $200 billion within the final 24-hour interval and by round $600 billion previously week amid a major downtrend that has been attributable to a number of elements, together with the Federal Reserve chopping rates of interest by 25 foundation factors and its Chair Jerome Powell suggesting fewer cuts are coming subsequent 12 months.

Powell’s feedback dampened investor sentiment and affected threat belongings throughout markets, with the S&P 500 dropping round 3.2% of its worth because the feedback had been made and the Nasdaq seeing an identical dip. The market sell-off prompted the Dow Jones Industrial Common to proceed its decline after experiencing 9 straight dropping classes, marking its longest sequence of day by day losses since 1974.

Within the cryptocurrency area, the sell-off noticed bitcoin’s worth plunge by greater than 9% to now commerce beneath $93,000, whereas Ethereum’s ether dropped 15.6% to $3,120 on the time of writing. Main altcoins together with Solana, DOGE, ADA, and BNB noticed losses between 11.6% and 27%.

The sell-off additionally noticed spot bitcoin exchange-traded funds see a file $671 million outflow, its largest single-day loss, placing an finish to a 15-day influx streak these funds had been seeing. The biggest outflow was seen on Constancy’s FBTC, which noticed $206.8 million pulled from the fund, whereas Grayscale’s Bitcoin Mini Belief skilled $188.6 million in outflows, and ARKB noticed $108.4 million in outflows.

The market can also be enduring a downturn over the anticipated launch of the November Private Consumption Expenditures (PCE) index, a key inflation measure anticipated to additional affect future rate of interest selections.

Featured picture through Pexels.