Este artículo también está disponible en español.

Ethereum has confronted important volatility over the previous few days, with huge promoting strain rising after the cryptocurrency failed to interrupt above its yearly highs set earlier in December. This worth motion has left merchants and buyers questioning the subsequent course for ETH because it consolidates underneath important resistance.

Associated Studying

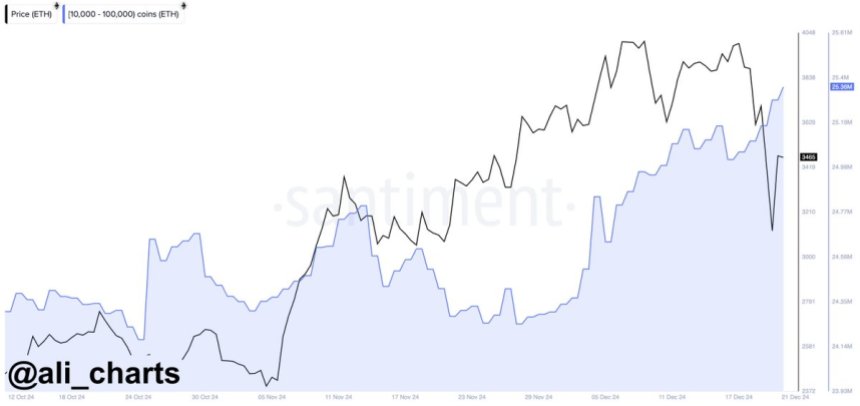

Regardless of the turbulence, on-chain information suggests a probably bullish outlook. Analyst Ali Martinez shared insightful metrics exhibiting that Ethereum whales have been accumulating closely throughout this era of uncertainty. Based on the information, whales bought 340,000 ETH—value over $1 billion—within the final 96 hours. This important accumulation signifies that main gamers see long-term worth in Ethereum, whilst short-term market sentiment stays blended.

The continuing whale exercise might sign an upcoming restoration for ETH, with giant holders positioning themselves for future features. Traditionally, such accumulation phases have typically preceded robust rallies, as elevated demand and decreased provide contribute to upward momentum.

Ethereum Whale Demand Retains Rising

Ethereum demand has proven important instability all year long, with persistent promoting strain pushing costs down from native highs. Every rally try has confronted resistance, highlighting the challenges ETH has encountered in sustaining upward momentum. Regardless of this, Ethereum continues to reveal resilience, significantly throughout corrective phases, as giant holders actively accumulate ETH.

Martinez lately shared compelling information on X, indicating a exceptional whale accumulation pattern. Previously 96 hours alone, whales have bought 340,000 Ethereum, valued at over $1 billion. This substantial shopping for exercise underscores the arrogance that main gamers have in Ethereum’s long-term potential. Such accumulation typically indicators the potential of a market shift, with whales strategically positioning themselves forward of a possible breakout.

Martinez and different analysts imagine this whale-driven demand hints at a major worth surge within the weeks to return. Moreover, the broader crypto neighborhood anticipates Ethereum enjoying a pivotal function within the anticipated altseason subsequent yr, solidifying its place as a market chief amongst altcoins.

Associated Studying

As Ethereum enters this important section, market members will carefully monitor its means to capitalize on the present accumulation. If whale exercise continues, it might pave the best way for Ethereum to reclaim native highs and probably set new milestones, reinforcing its dominance within the crypto area.

ETH Holding Key Help

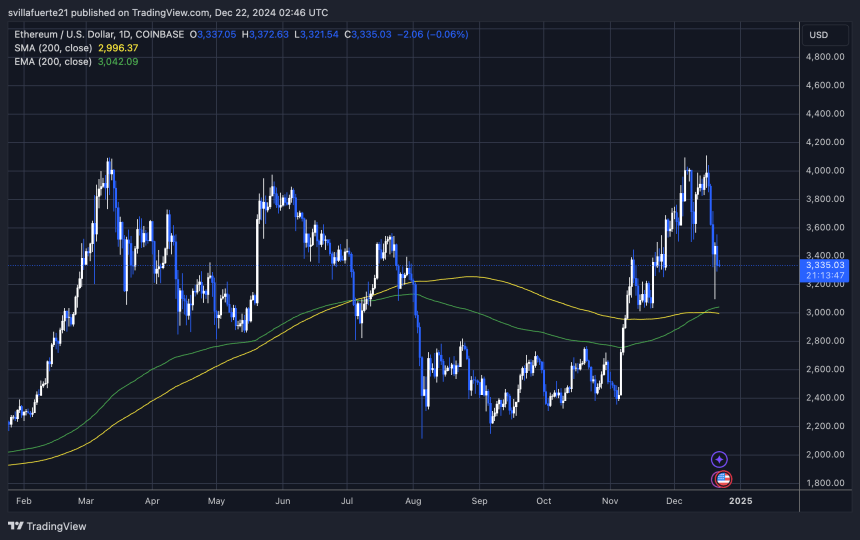

Ethereum is at the moment buying and selling at $3,320, exhibiting resilience after holding above the important 200-day transferring common (MA) at $3,000. This degree is extensively thought to be a key indicator of long-term market power. Holding above it means that Ethereum stays in a bullish construction regardless of latest volatility and promoting strain.

For Ethereum to regain momentum, bulls might want to push the value above the $3,550 resistance degree and keep it. Breaking this zone would sign a renewed upward pattern and enhance the chance of Ethereum testing greater ranges. Nevertheless, this will not occur instantly, because the market might enter a interval of sideways consolidation.

Associated Studying

Such consolidation is frequent after intervals of heightened volatility and permits the market to ascertain a extra steady base for the subsequent important transfer. A powerful consolidation section above $3,000 would additional affirm the 200-day MA as a stable help degree, boosting confidence amongst buyers.

Featured picture from Dall-E, chart from TradingView