A serious participant within the cryptocurrency market discovered itself on an uncommon facet of historical past after experiencing its largest outflows in months.

The main asset supervisor BlackRock ended the influx streak of its Bitcoin exchange-traded fund after recording a $72.7 million value of outflow on December 20.

Largest Outflow On Document

Knowledge confirmed that BlackRock Bitcoin ETF (IBIT) witnessed the biggest outflow because it was launched in January this yr.

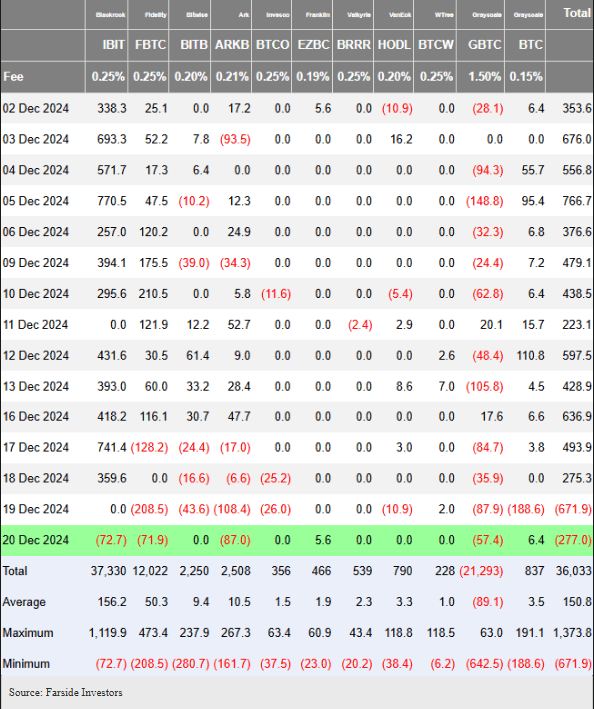

Based on Farside Traders, the worldwide asset supervisor’s Bitcoin ETF posted an outflow of 72.7 million in December, the best on document for IBIT. They added that this got here a day after IBIT registered zero flows, making traders anxious concerning the exchange-traded fund.

Supply: Farside Traders

IBIT will not be alone as fellow ETF issuer Constancy Sensible Origin Bitcoin Fund (FBTC) additionally hit an all-time excessive outflow of $208.5 million on December 19, a day earlier than IBIT hit the identical ordeal.

Analysts stated that the next day, December 20, FBTC recorded one other outflow of about $71.9 million, making the EFT endure a two-day outflow streak.

IBIT and FBTC are among the many prime performing exchange-traded funds in the US. The ETF issuers had been ranked 1 and a couple of among the many prime 25 ETFs when it comes to property after one month available in the market.

Market observers stated that the US Spot Bicoin ETF market’s record-high two consecutive day outflow was fueled by the all-time excessive outflows skilled by BlackRock and Constancy.

Knowledge confirmed that the ETF market misplaced $671.9 million on December 19 and one other $277 million in outflows the subsequent day, December 20.

Some Traders Are Involved

The huge outflows skilled by the 2 of the most important ETF issuers within the US sparked issues from crypto traders on what may very well be the outlook for the ETFs within the upcoming months.

Nonetheless, analysts believed that the ordeal confronted by BlackRock and Constancy mustn’t shock merchants since each worldwide asset administration companies have largely accounted for the big inflows.

Some traders are involved that current improvement in ETFs would possibly grow to be a turning level that might result in substantive lower within the institutional traders’ urge for food for Bitcoin publicity.

Market observers argued that outflows won’t linger, including that after Bitcoin plummeted to $92,710 earlier, the alpha crypto has been bouncing again and shifting up once more.

Bitcoin’s Quantity Down

Buying and selling analysts stated that Bitcoin’s market quantity dipped to $59.50 billion, a 52% decline in its complete quantity, contradicting the bullish run loved by the crypto after Donald Trump received the US election final month.

Through the crypto bull run, Bitcoin reached its all-time excessive of $108,000 per coin in November.

In the identical month, the US spot Bitcoin ETF additionally benefited from the crypto bull market after hitting a record-high of $6.2 billion in web inflows.

As of press time, Bitcoin is traded at $95,359 per coin, down by 1.3% within the final 24 hours, with a complete market capitalization of $1.9 trillion.

Featured picture from CNN, chart from TradingView

Supply: Farside Traders

Supply: Farside Traders