Solana’s complete worth locked (TVL) has plummeted to its lowest level this month, reflecting a decline in exercise on the Layer-1 community. Because the starting of the month, over $1 billion has been withdrawn from Solana’s DeFi ecosystem.

The sharp fall in TVL may be attributed to a drop in every day energetic addresses on the community. This means a dwindling consumer base and decreased on-chain exercise.

Solana’s TVL Plummets Amid Low Exercise

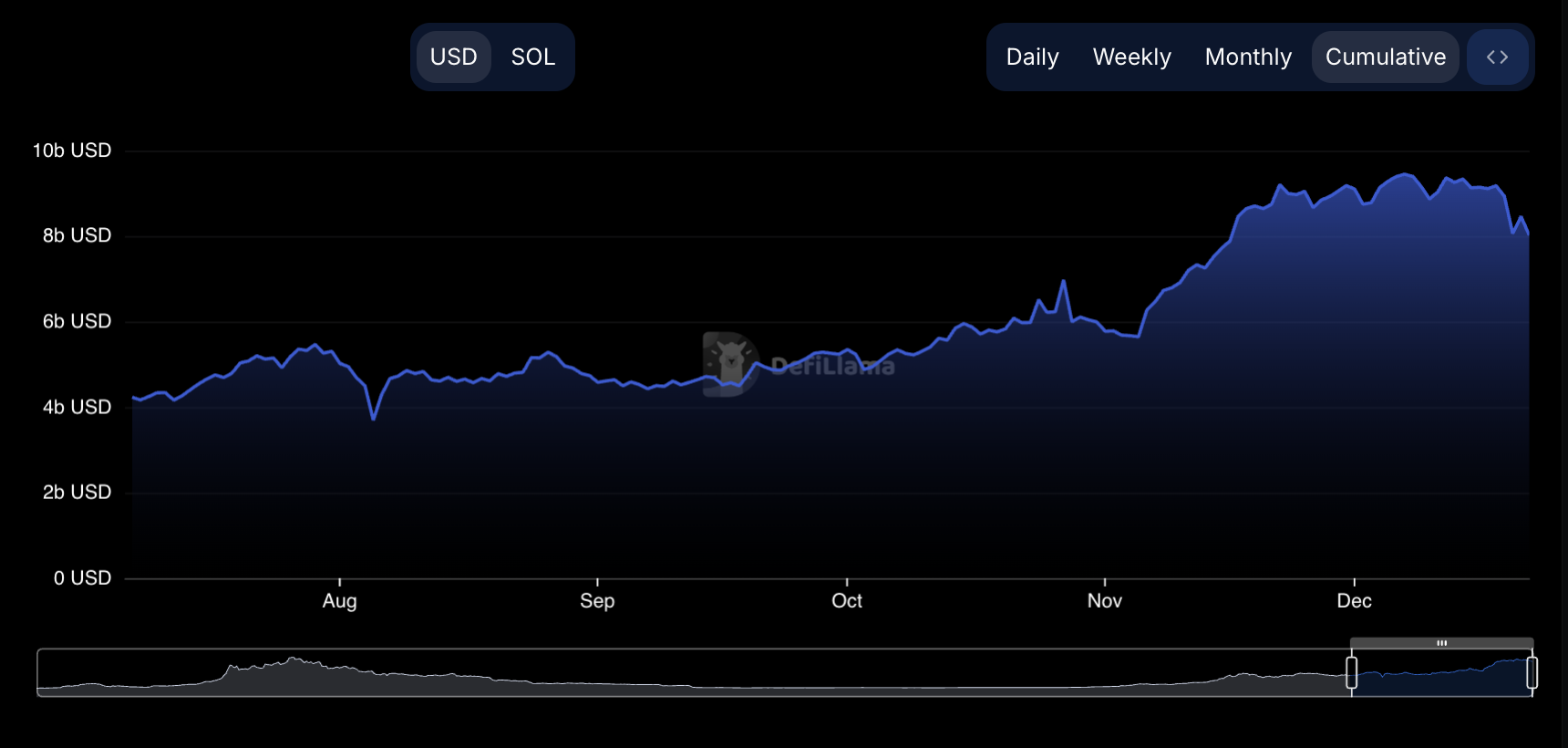

In response to DeFiLlama, Solana’s Whole Worth Locked (TVL) at the moment sits at $8.01 billion, representing a 12% decline since December 1, equating to $1.1 billion exiting the ecosystem. The community’s main DeFi protocol, Jito, has been hit notably onerous, recording a 28% drop in TVL over the previous month. On the time of writing, Jito’s TVL is $2.66 billion.

Solana’s TVL decline mirrors the broader drop in utilization throughout the interval underneath overview. In response to Artemis, consumer exercise on Solana has been on a downward development for the reason that begin of the month. Over the previous 21 days, 5.37 million distinctive addresses have accomplished a minimum of one transaction on the L1, marking a 7% decline in exercise on the chain.

Furthermore, resulting from Solana’s low utilization, its community income has additionally decreased. This decline has been additional worsened by SOL’s efficiency, with its worth dropping by 28% over the previous 30 days. In response to Artemis’ knowledge, the community’s income has plunged by 24% since December started.

SOL Worth Prediction: A Shift In Market Sentiment Might Reverse Bearish Development

An evaluation of the SOL/USD one-day chart has revealed the coin’s adverse Chaikin Cash Stream (CMF), which confirms its low demand. As of this writing, this indicator is at -0.04.

An asset’s CMF measures its accumulation or distribution over a specified interval, combining worth and quantity knowledge. When the CMF worth is adverse, it signifies extra market distribution (promoting strain) than accumulation (shopping for strain), hinting at a sustained worth decline. If SOL selloffs persist, its worth could fall to $168.83.

Nevertheless, this bearish projection will likely be invalidated if market sentiment shifts from adverse to constructive and shopping for exercise recommences. In that state of affairs, SOL’s worth will break above resistance at $187 and try and surge previous $200.

Disclaimer

Consistent with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.