Bitcoin’s 15% correction through the third week of December marked its largest weekly worth drop since August. Consultants attribute the decline to the impression of worldwide macroeconomic components, warning that Bitcoin might see additional draw back if these pressures intensify.

Nonetheless, Bitcoin additionally has inner components to counterbalance the detrimental impression of the macro.

International Liquidity Plunges Over the Previous Two Months

Based on The Kobeissi Letter, Bitcoin’s worth has traditionally proven a 10-week lagged correlation with International Cash Provide (International M2). Over the previous two months, International M2 has fallen by $4.1 trillion, signaling potential additional declines in Bitcoin costs if the pattern continues.

International M2 is a key financial metric that measures the whole provide of cash within the international economic system, together with money, demand deposits (M1), time period deposits, and different liquid belongings. Fluctuations in International M2 typically impression each inventory and cryptocurrency markets.

“As international cash provide hit a brand new document of $108.5 trillion in October, Bitcoin costs reached an all-time excessive of $108,000. During the last 2 months, nevertheless, cash provide has dropped by $4.1 trillion, to $104.4 trillion, the bottom since August. If the connection nonetheless holds, this means that Bitcoin costs might fall as a lot as $20,000 over the subsequent few weeks.” – The Kobeissi Letter predicted.

A month in the past, Joe Consorti, Head of Development at Bitcoin custody agency Theya, warned of a possible 20%-25% Bitcoin correction primarily based on related indicators. That forecast seems to be materializing.

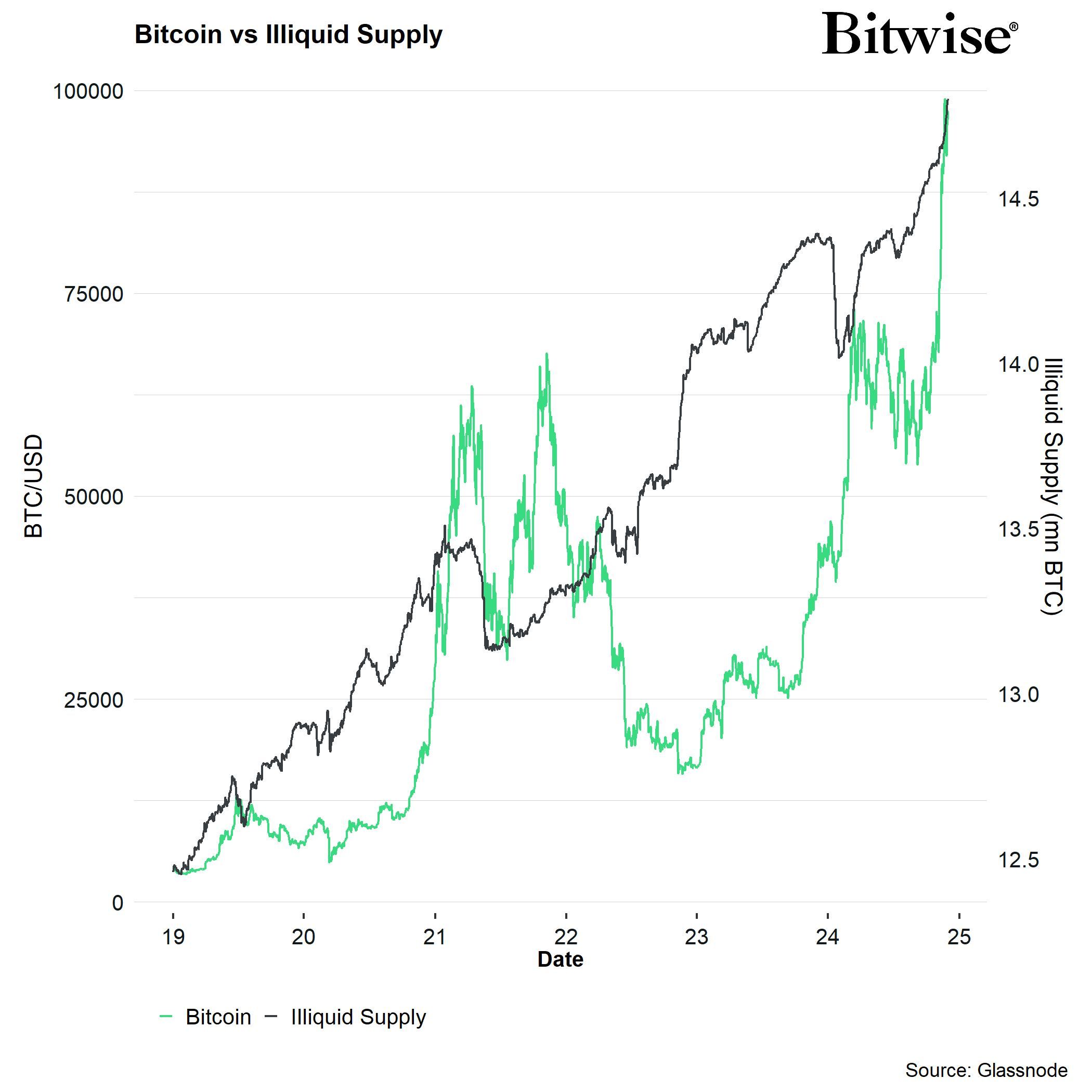

André Dragosch, Head of Analysis at Bitwise, shares the same outlook. He anticipates Bitcoin will stay below strain attributable to tightening liquidity in the US. Nonetheless, he highlights an inner Bitcoin issue that would counterbalance this liquidity squeeze: Bitcoin’s rising illiquid provide.

The next illiquid provide signifies elevated shortage of Bitcoin, doubtlessly supporting its worth below supply-demand dynamics.

“Bitcoin is at the moment balancing the prospects of a) growing macro headwinds stemming from the decline in US and international liquidity and b) ongoing on-chain tailwinds stemming from the robust BTC provide deficit. Finally bullish on-chain components will doubtless trump bearish macro components however this may doubtless create some volatility in early 2025 (and probably some engaging shopping for alternatives).” – André Dragosch commented.

At press time, Bitcoin is buying and selling round $94,000, with BeInCrypto information displaying it has dropped practically 6% over the weekend.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.