MicroStrategy Chairman Michael Saylor introduced right this moment that his agency bought one other 5,262 Bitcoin. This purchase price $561 million and continues his plan of regular BTC acquisition.

Nevertheless, because the agency was added to the NASDAQ-100, rumors are circulating that the corporate could pause these purchases in January.

Saylor Buys Even Extra Bitcoin

With the most recent acquisition, this marks MicroStrategy’s third Bitcoin buy in December alone. Simply final week, the agency bought $1.5 billion price of BTC at a mean value of $100,386. Below Saylor’s course, the agency has grow to be one of many world’s largest Bitcoin holders and hasn’t proven indicators of stopping.

“MicroStrategy has acquired 5,262 BTC for ~$561 million at ~$106,662 per bitcoin and has achieved BTC Yield of 47.4% QTD and 73.7% YTD. As of 12/22/2024, we maintain 444,262 BTC acquired for ~$27.7 billion at ~$62,257 per bitcoin,” Saylor claimed.

Because the generalized crypto bull run in November, Saylor has clearly signaled an intention to purchase big quantities of Bitcoin. To date, the asset’s value has been skyrocketing, producing excessive yields. Not too long ago, he additionally teased a big BTC purchase to mark MicroStrategy’s inclusion within the NASDAQ-100.

Nevertheless, rumors are circulating that MicroStrategy could enact a doable pause to those BTC purchases beginning in January. Since the corporate was added to the NASDAQ-100 and its quarterly earnings experiences are arising early subsequent 12 months, Saylor could implement a self-imposed blackout interval that may preclude any Bitcoin purchases.

The corporate’s latest actions have generated excessive yields, however they might current a double-edged sword for itself and the broader market. There are appreciable issues that Saylor materially contributed to “de-decentralization” within the Bitcoin economic system, and his agency has additionally outpaced Bitcoin’s intense progress charges.

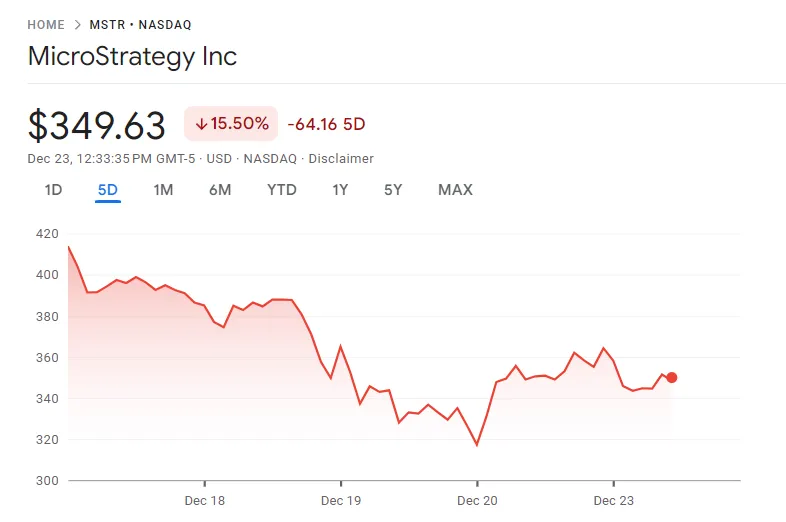

So, BTC’s volatility may have an outsized affect on MSTR’s inventory market efficiency. Previously week alone, Bitcoin has dropped almost 12%, and MSTR’s inventory value can also be down by over 15%.

For now, nevertheless, this sample of BTC shopping for seems secure. No matter whether or not or not Saylor will enact the rumored pause in January, additional high-profile buys within the final week of December are nonetheless believable.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.