Bitcoin’s worth has dropped by 7% over the previous week, reflecting a regarding lack of momentum available in the market.

Whereas the broader cryptocurrency panorama is beneath stress, a key issue behind Bitcoin’s decline is the noticeable inactivity of large-scale buyers, generally often known as whales, who’re crucial to sustaining value stability.

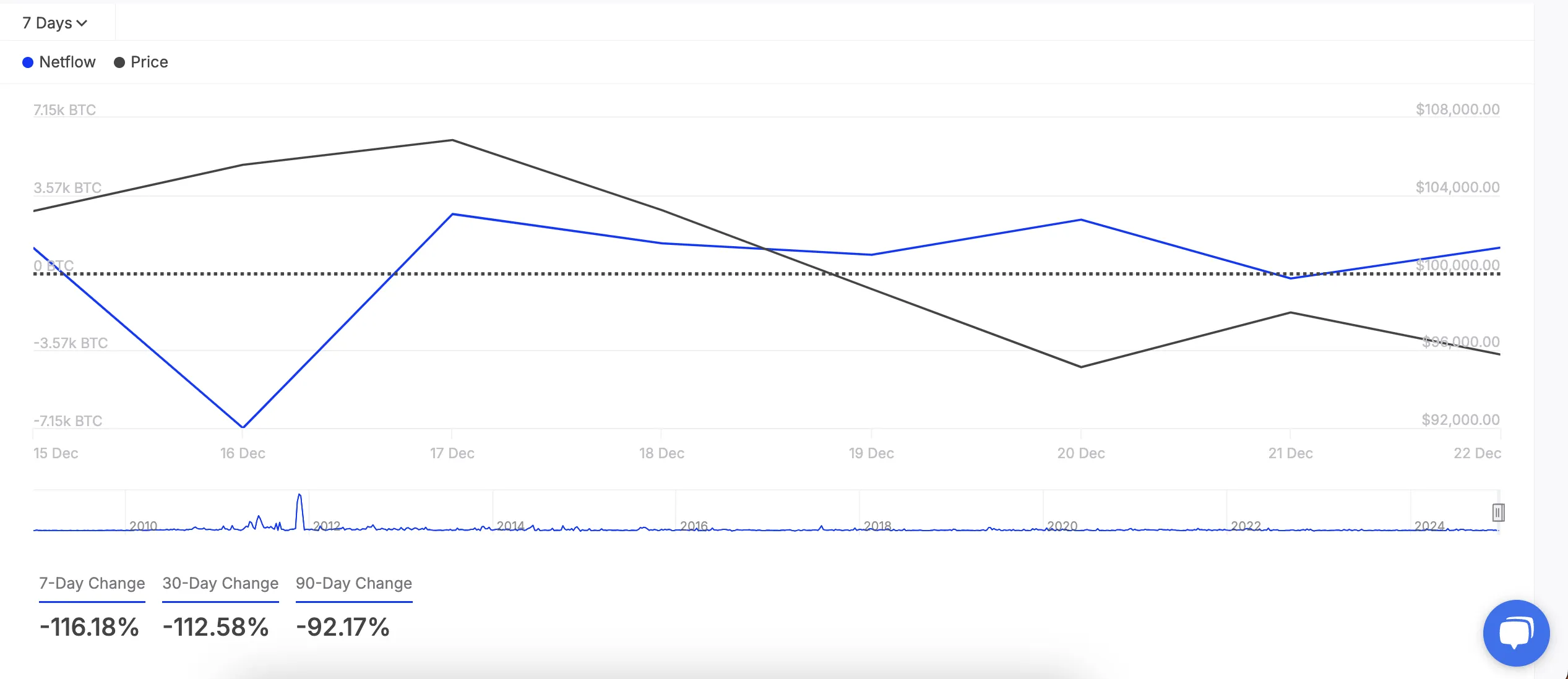

Latest knowledge reveals that main Bitcoin holders are considerably scaling again their exercise. Over the past seven days, web inflows to whale wallets have sharply decreased, signaling a desire for promoting quite than accumulating. This shift, as tracked by IntoTheBlock, suggests a rising reluctance amongst these buyers to wager on Bitcoin’s short-term efficiency.

Moreover, the frequency of enormous Bitcoin transactions has nosedived. Transfers valued between $100,000 and $1 million have seen a 48% discount, whereas transactions exceeding $1 million however under $10 million have dropped by 50%. Such a decline in high-value trades signifies weakened confidence from these influential market individuals, creating much less upward stress on Bitcoin’s value.

Bitcoin is presently buying and selling round $94,000. Nonetheless, if the present lack of whale exercise persists, this help might crumble. Analysts warning {that a} break under this level would possibly set off a speedy descent.

With main buyers seemingly hesitant to reengage, the outlook for Bitcoin seems precarious. The approaching days will possible decide whether or not the market can stabilize or if deeper losses are forward.