Este artículo también está disponible en español.

Bitcoin skilled a extremely risky buying and selling session yesterday, with costs swinging between $92,300 and $96,420 all through the day. The cryptocurrency now hovers close to the $93,000 mark, struggling to determine a transparent path within the quick time period. As market individuals await decisive motion, uncertainty looms over whether or not Bitcoin will maintain its bullish construction or face a deeper correction.

Associated Studying

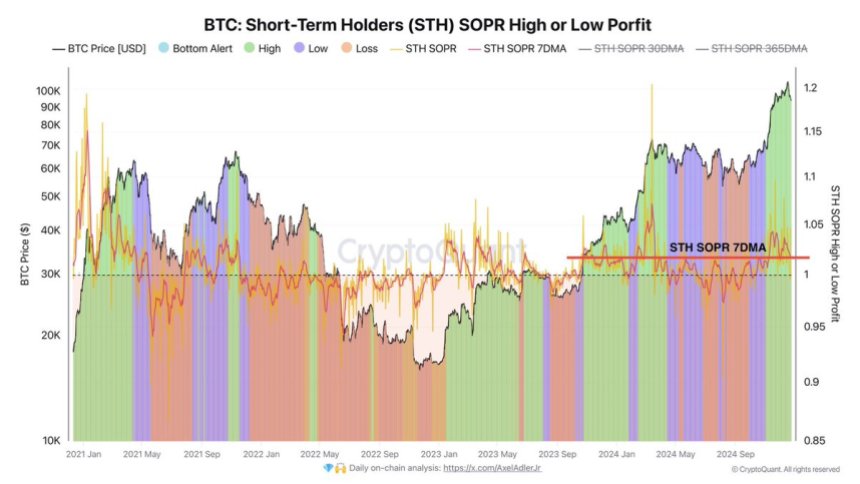

CryptoQuant analyst Axel Adler lately shared priceless insights, highlighting a big pattern amongst short-term holders (STH). In line with Adler, these traders proceed to promote their cash at high-profit margins, capitalizing on Bitcoin’s latest upward momentum. Whereas profit-taking is a pure a part of market cycles, the shortage of constant demand to soak up this promoting stress might problem Bitcoin’s worth stability.

If demand fails to match the tempo of lively profit-taking, a neighborhood correction might happen, doubtlessly resulting in a decline in Bitcoin’s worth. This delicate stability between profit-taking and market demand makes the approaching days important for figuring out Bitcoin’s subsequent transfer. Will consumers step in to help the value, or will promoting stress result in a deeper retrace? Traders and analysts are watching carefully as Bitcoin navigates this pivotal second.

Bitcoin Demand Ranges Responding

Bitcoin has confronted days of intense volatility because it struggles to interrupt above the $100,000 psychological barrier whereas holding agency above the $92,000 help. The market stays in a state of flux, with traders and analysts carefully monitoring Bitcoin’s subsequent transfer. Regardless of the uncertainty, Bitcoin’s resilience at these key ranges highlights the continuing tug-of-war between bullish and bearish forces.

Prime analyst Axel Adler lately shared an insightful evaluation on X, shedding mild on the habits of short-term holders (STHs). In line with Adler, STHs are actively promoting their cash at excessive revenue margins, profiting from the latest worth surges. Whereas profit-taking is a traditional a part of market cycles, a scarcity of constant demand to counter this promoting stress might result in a neighborhood correction and a possible worth decline.

Nonetheless, within the occasion of a worth drop, STHs are unlikely to proceed promoting their holdings, as promoting at a loss in a bull market is usually thought of an unwise transfer. This dynamic might present Bitcoin with the respiration room wanted to stabilize at its key help ranges, presently across the $90,000 mark.

Associated Studying

If Bitcoin efficiently holds above $90,000, a interval of consolidation round this stage might create the inspiration for the following rally, doubtlessly propelling BTC to new all-time highs. The approaching days will probably be important in figuring out whether or not Bitcoin continues its ascent or faces a short lived setback.

BTC Holding Above $90K

Bitcoin is buying and selling at $93,800 after enduring days of promoting stress and market uncertainty. Regardless of holding above key help at $92,000, the lack of each the 4-hour 200 transferring common (MA) and exponential transferring common (EMA) is a short-term bearish sign. These indicators, typically seen as gauges of market momentum, recommend that Bitcoin might have further demand to regain upward traction.

For bulls to reclaim management and ignite a recent rally, Bitcoin should get better these important ranges. The 4-hour 200 MA at $96,500 and the 4-hour 200 EMA at $98,500 are important hurdles. Efficiently pushing above these thresholds and securing a decisive shut past them would affirm renewed bullish momentum.

Associated Studying

If Bitcoin achieves this feat, the stage could possibly be set for a large rally into worth discovery, breaking by way of psychological limitations like $100,000 and paving the best way for brand spanking new all-time highs. On the flip aspect, failing to reclaim these indicators would possibly sign prolonged consolidation or a possible retest of decrease help ranges.

Featured picture from Dall-E, chart from TradingView