Disclaimer: The opinions expressed by our writers are their very own and don’t signify the views of U.As we speak. The monetary and market info offered on U.As we speak is meant for informational functions solely. U.As we speak isn’t responsible for any monetary losses incurred whereas buying and selling cryptocurrencies. Conduct your individual analysis by contacting monetary consultants earlier than making any funding choices. We imagine that each one content material is correct as of the date of publication, however sure provides talked about might now not be accessible.

Cardano (ADA), the ninth-largest cryptocurrency by market capitalization, has recorded vital revenue margins in its holding addresses. Regardless of ADA’s worth dipping under the $1 mark, this optimistic growth is going on.

Key Cardano metrics amid market volatility

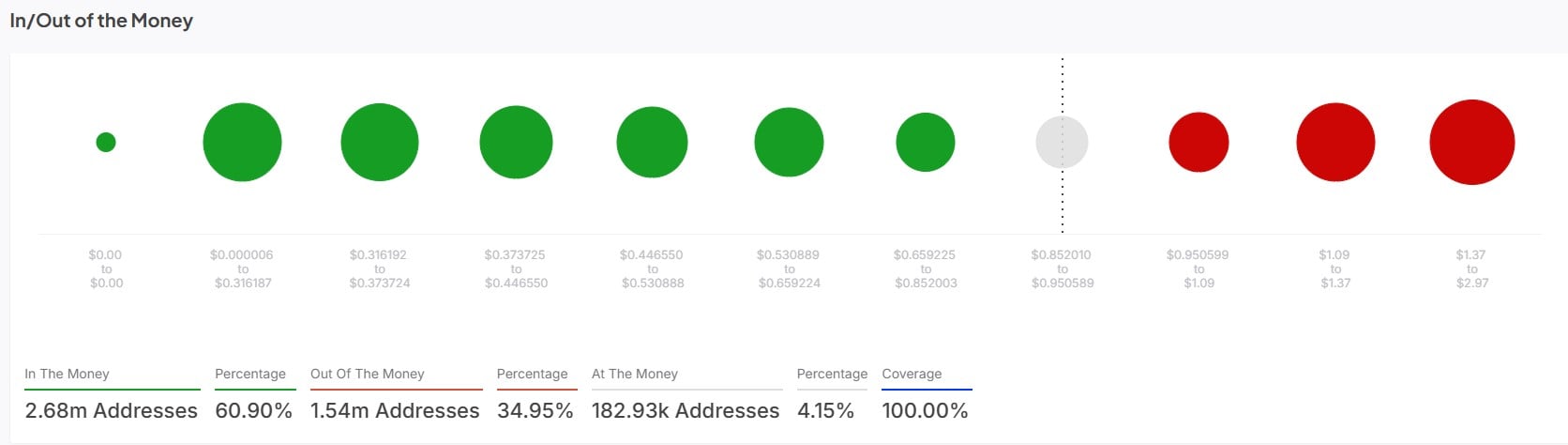

In keeping with information from IntoTheBlock, Cardano’s In/Out of the Cash chart reveals attention-grabbing developments within the efficiency of the asset.

A complete of two.68 million Cardano addresses are in revenue, representing 60.9%. This refers to addresses presently making vital positive factors. In the meantime, 1.54 million addresses are experiencing losses, or are “Out of the Cash.” This covers 34.95% of complete addresses.

Notably, the cumulative Cardano addresses stand at 182,930. That covers 4.15% of the whole wallets registered on the Cardano community.

The optimistic metrics had been recorded regardless of ADA being down by about 70% from its all-time excessive (ATH). It marks a big growth for Cardano, which has struggled to regain $1 within the final 4 days.

ADA trades at $0.8984 as of this writing, representing a 0.49% enhance within the final 24 hours.

Analysts give diverging worth predictions

The Cardano neighborhood, nevertheless, stays bullish on the asset’s potential to regain increased worth ranges.

In keeping with an earlier U.As we speak report, on-chain analyst Ali Martinez has additionally given buyers and merchants hope for a doable bullish run. Martinez famous that historic priority reveals the continuing worth correction might result in a worth surge of as much as $6. Traders must hope for historical past to repeat itself.

Nevertheless, Peter Brandt, a veteran dealer, differs in his prediction. Brandt means that ADA’s worth might drop considerably. He referred to the anticipated drop as a “potential CAR crash,” which might see ADA drop by over 40%.

The differing viewpoints emphasize the necessity for buyers and merchants to conduct their analysis. This might stop vital losses on the a part of buyers.