Solana (SOL) value reached a brand new all-time excessive on November 22 however has been in a corrective section since, at present buying and selling 27% beneath that peak. Current technical indicators spotlight blended indicators, with bearish momentum displaying indicators of easing however nonetheless dominating the market.

The BBTrend, although bettering from its latest low, stays in adverse territory, whereas the DMI means that the present downtrend is dropping power. As SOL hovers close to vital resistance at $195, its value trajectory will rely on whether or not bullish indicators achieve traction or bearish strain intensifies.

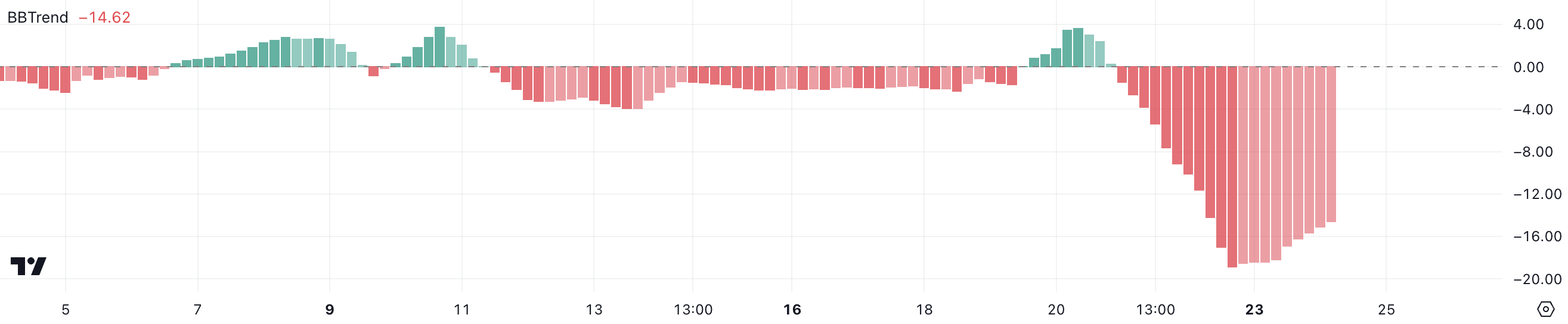

SOL BBTrend Is Nonetheless Very Destructive

Solana BBTrend just lately reached its lowest stage since August, hitting -18.89 on December 22. It has remained in adverse territory since December 21.

At present at -14.64, the BBTrend exhibits indicators of enchancment, indicating a possible shift in market sentiment. This upward transfer, whereas nonetheless within the adverse zone, means that promoting strain is perhaps easing as patrons start to re-enter the market cautiously.

BBTrend, or Bollinger Band Development, is a momentum indicator derived from Bollinger Bands. It measures the distinction between an asset’s value and the midpoint of its Bollinger Bands, offering insights into development power and path. Destructive BBTrend values point out bearish momentum, whereas optimistic values recommend bullish developments.

With SOL BBTrend rising from -18.89 to -14.64, it implies that bearish momentum is weakening, probably setting the stage for a value restoration within the quick time period. Nevertheless, till BBTrend crosses into optimistic territory, the market could stay cautious, with the worth motion possible subdued or range-bound.

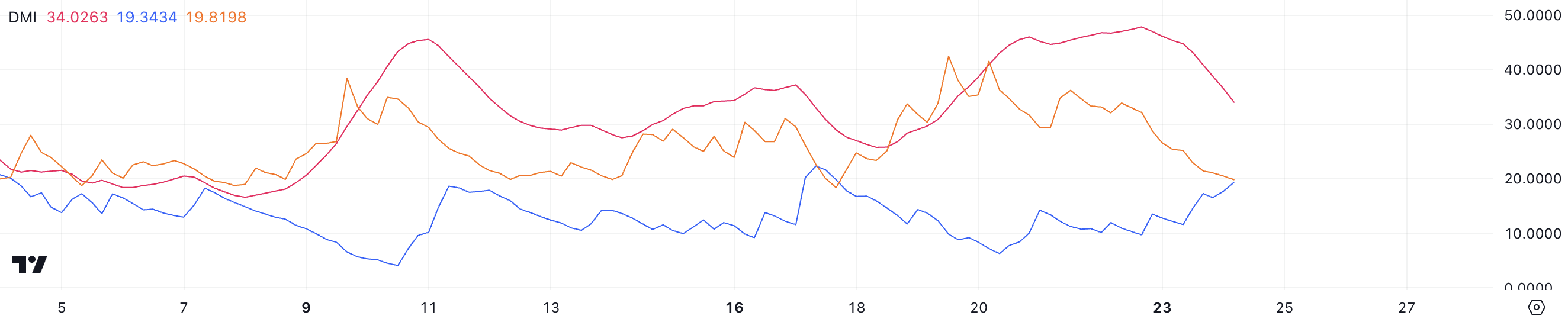

Solana DMI Exhibits an Uptrend Might Seem Quickly

The Solana Directional Motion Index (DMI) chart reveals that its Common Directional Index (ADX) is at present at 34, a pointy decline from almost 50 only a day in the past. Whereas an ADX above 25 nonetheless indicators a robust development, the latest drop means that the power of SOL’s present downtrend is weakening.

This lower in development power comes as SOL continues to exhibit bearish value motion, however the diminishing ADX may point out that promoting momentum is beginning to fade.

ADX, a key element of the DMI, measures development power on a scale from 0 to 100 with out specifying the path. Values above 25 signify a robust development, whereas these beneath 20 recommend weak or absent developments. In the meantime, the optimistic directional indicator (D+) at 19.34 and the adverse directional indicator (D-) at 19.81 replicate near-equal pressures from patrons and sellers, with a slight bearish dominance.

This mixture of a declining ADX and almost balanced D+ and D- means that whereas SOL stays in a downtrend, the bearish momentum could also be dropping steam. Within the quick time period, this might result in a consolidation section or a possible reversal if purchaser power beneficial properties traction.

SOL Value Prediction: Again to $200 In December?

SOL value closest resistance round $195 is shaping as much as be a vital stage for its upcoming value actions. At present, the Exponential Shifting Common (EMA) traces are in a bearish configuration, with short-term traces beneath long-term ones.

Nevertheless, the latest upward shift in short-term EMAs hints at a doable golden cross, a bullish sign that would point out a development reversal.

If Solana value efficiently breaks the $195 resistance, it may goal $204 subsequent, with the potential to climb additional to $215, marking a big restoration.

On the draw back, if the BBTrend stays deeply adverse and the continuing downtrend beneficial properties power, SOL value may retest the $183 assist stage. A failure to carry this assist may result in an extra decline, with the worth probably dropping to $175.

Disclaimer

According to the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.