- BTC’s concern and greed index revealed that the market was in a “concern” section.

- Promoting stress was excessive, which might push BTC down additional.

Bitcoin [BTC] has now dropped under $95k, sparking investor fears of an extra worth decline. Because the 12 months ends, the group expects a worth hike. Nonetheless, buyers ought to stay cautious as BTC’s worth could decline additional within the coming days.

Bitcoin’s hassle continues!

As per CoinMarketCap, BTC was buying and selling at $93,99k, at press time, which was a transparent sign of the king coin struggling after it witnessed a pullback from the $100k mark. This latest worth drop has pushed extra buyers at a loss.

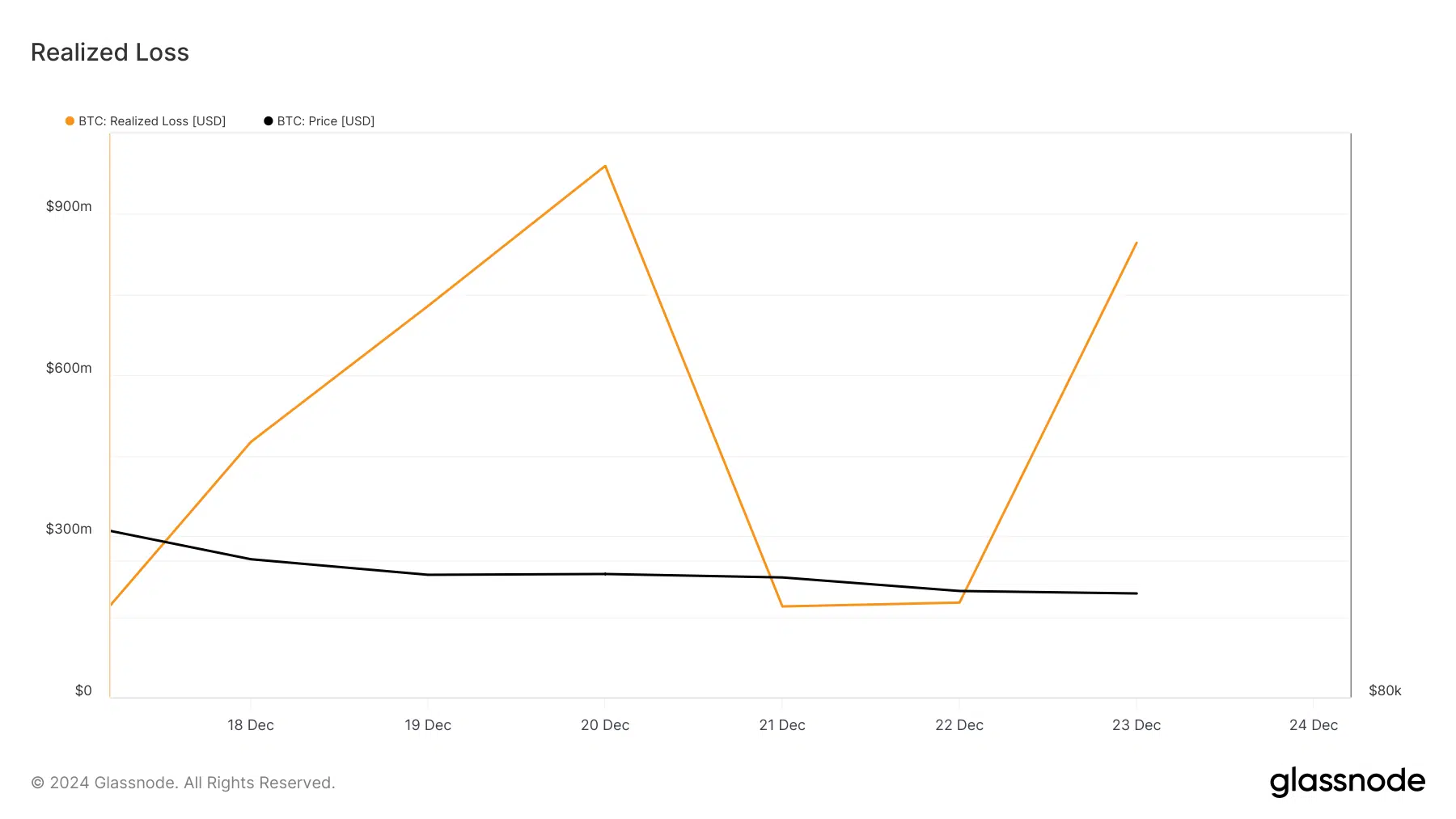

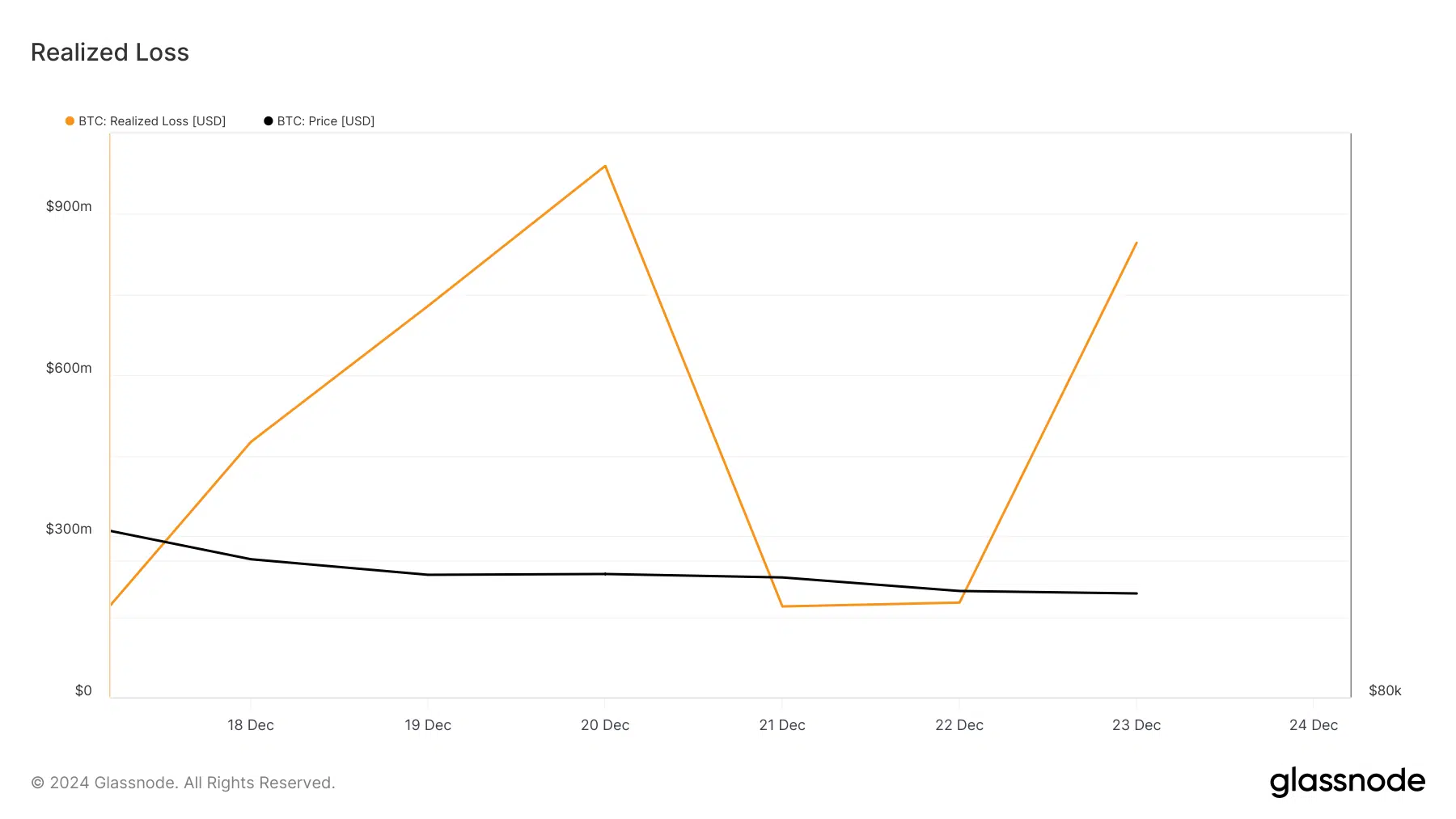

Glassnode’s information revealed that BTC’s realized loss shot up sharply in the previous few days. For initiators, the metric signifies the overall loss (USD worth) of all moved cash whose worth at their final motion was larger than the worth on the present motion.

Supply: Glassnode

Moreover, the concern and greed index, on the time of writing, had a price of 36%, that means that the market was in a “concern” section. This advised that buyers have been panicking concerning the declining worth motion, which presumably might hurt BTC extra.

Will Bitcoin drop additional?

The aforementioned metrics hinted at an extra worth decline, main AMBCrypto to analyze additional. Glassnode’s information revealed that Bitcoin’s accumulation pattern rating dropped from 0.9 to 0.7 within the final two weeks. A quantity nearer to 1 signifies excessive shopping for stress.

The decline means that buyers have been skeptical about shopping for Bitcoin, an indication of rising bearish sentiment out there.

Different metrics additionally pointed to a bearish outlook. BTC’s aSORP turned crimson, indicating that extra buyers have been promoting at a revenue. In a bull market, this will sign a market high.

The binary CDD confirmed that long-term holders’ motion within the final 7 days was larger than common. If these actions have been for promoting, it could have a unfavorable influence.

Supply: CryptoQuant

Notably, technical indicators additionally didn’t favor the bulls. For instance, the Relative Power Index (RSI) went southwards. Bitcoin’s Chaikin Cash Movement (CMF) additionally adopted an identical declining pattern.

Each these indicators hinted at excessive promoting stress which might push BTC’s worth down.

Learn Bitcoin [BTC] Value Prediction 2024-25

If that’s to occur, then BTC would possibly first check its help at $91k. An extra worth decline may end up in a plummet to $87 within the coming days.

Nonetheless, such unfavorable sentiment doesn’t usually stay out there for lengthy. So, the potential for a BTC pattern reversal can’t be dominated out but.

Supply: TradingView