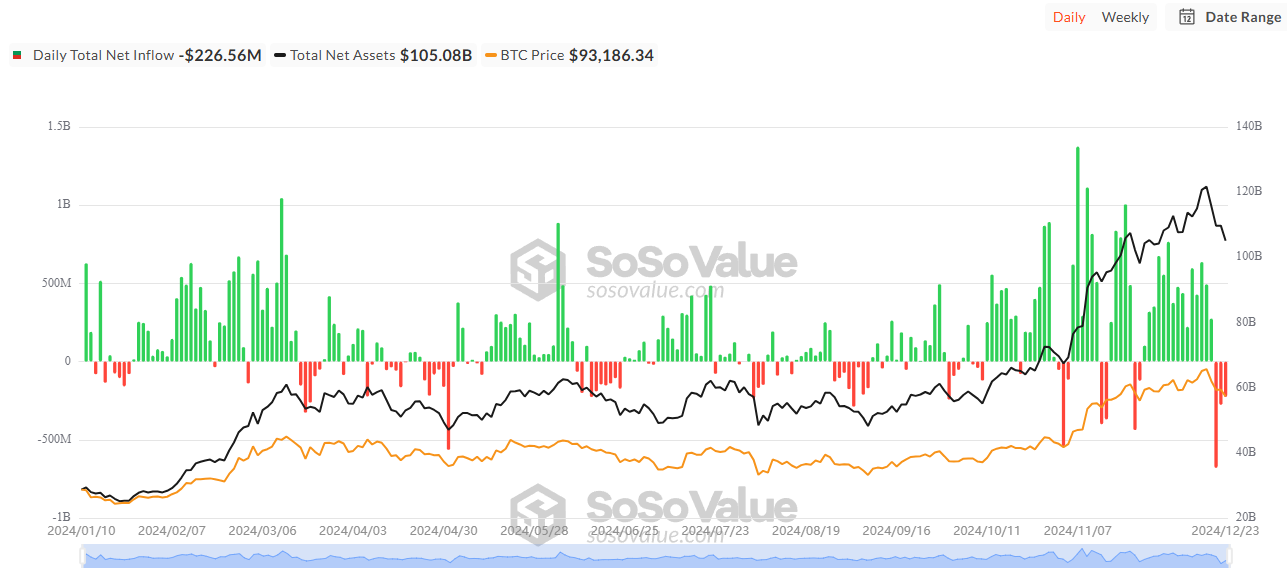

Bitcoin ETF netflows in america have recorded three consecutive days of outflows main as much as Christmas. Furthermore, these ETFs set a brand new single-day outflow document, briefly weakening Bitcoin’s upward momentum.

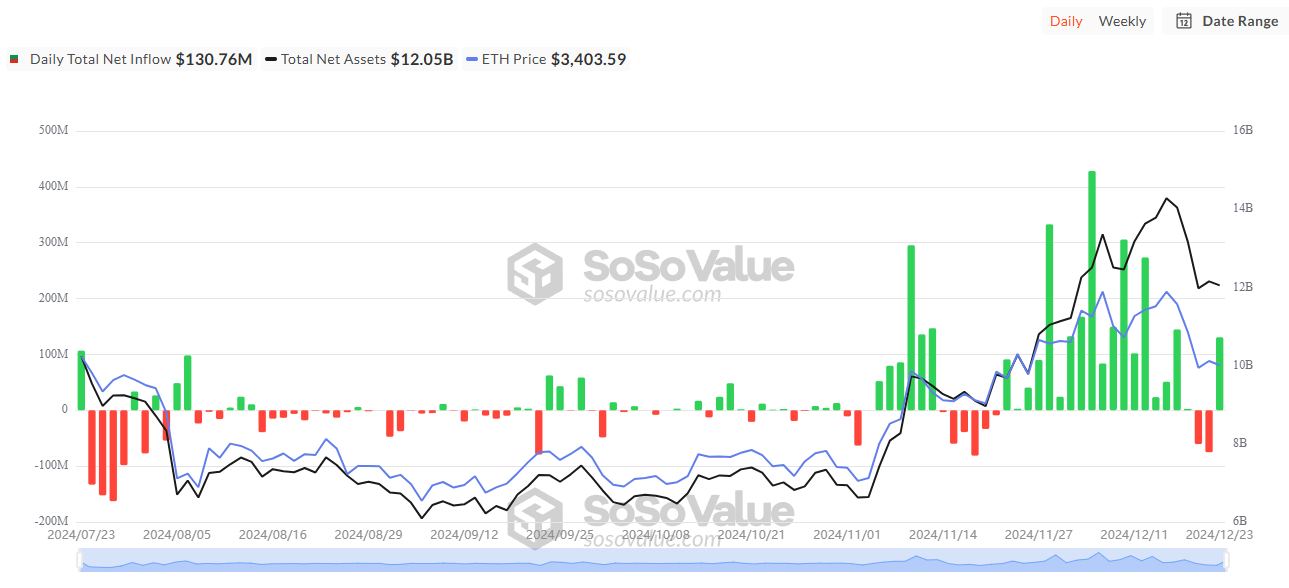

Nevertheless, Ethereum ETFs within the US confirmed constructive indicators with a internet influx.

Bitcoin ETFs Witness Internet Outflows for the Third Consecutive Day

Knowledge from SoSoValue signifies that Bitcoin ETFs skilled an outflow of almost $1.2 billion prior to now three buying and selling days. Notably, December 19 noticed outflows attain $680 million, the very best single-day outflow since Bitcoin ETFs had been accepted.

“A big outflow like this raises the query of whether or not it’s merely profit-taking or a extra structural shift in capital. The probably clarification at this stage is profit-taking, nevertheless it’s value monitoring market sentiment and institutional strikes to verify.” Investor Antonio Zennaro commented.

Previous to this, Bitcoin ETFs recorded 15 consecutive days of constructive netflows, pushing whole internet belongings from $100 billion to $121 billion. Nevertheless, the current three-day outflow contributed to a drop in whole internet belongings to $105 billion.

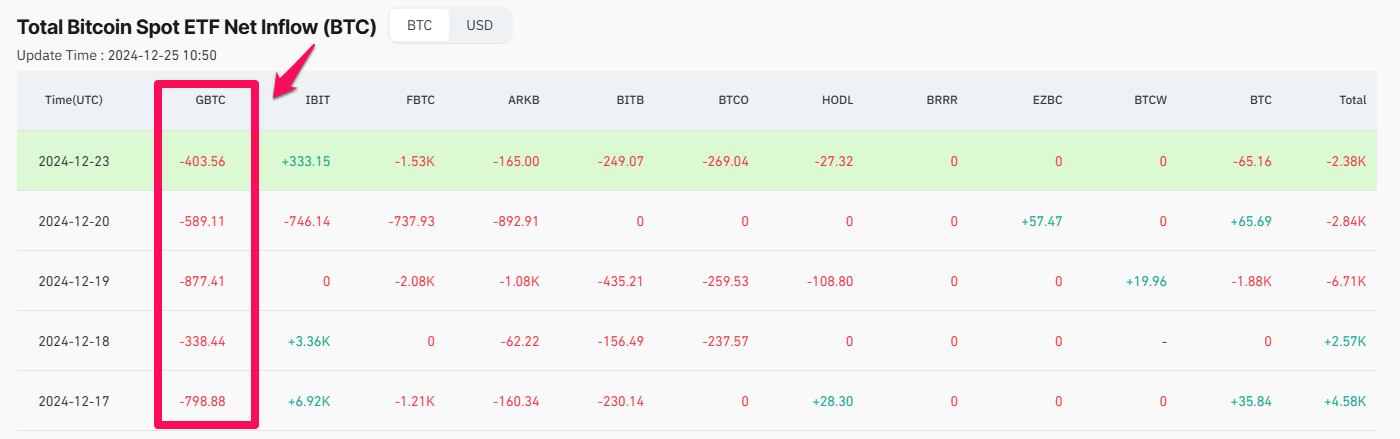

Knowledge from Coinglass reveals that Grayscale’s GBTC was a significant contributor to the outflows, having bought 1,870 BTC within the final three buying and selling days. This considerably outweighed the shopping for exercise from BlackRock’s IBIT throughout the identical interval.

Regardless of the three-day destructive netflows, investor optimism towards Bitcoin stays robust. In December, Bitcoin ETFs surpassed gold ETFs in belongings beneath administration (AUM), signaling rising confidence in digital belongings from each institutional and retail buyers.

Apparently, whereas cash flowed out of Bitcoin ETFs, Ethereum ETFs noticed inflows throughout the December 23 buying and selling session. Whereas Bitcoin ETFs skilled $226 million in outflows, Ethereum ETFs attracted over $130 million in inflows. Moreover, BlackRock’s Ethereum ETF now holds greater than 1,000,000 ETH.

Many buyers consider this might sign constructive momentum for Ethereum and altcoins, particularly after Ethereum’s value dropped from $4,100 to just about $3,100 in December.

“BlackRock’s Ethereum ETF now holds over 1,000,000 ETH. This information, paired with the truth that ETH remains to be consolidating under its all-time excessive, is an altcoin season indicator like we’ve by no means seen earlier than.” Investor Dan Gambardello commented.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.