2024 is sort of over, and it has been a comparatively good yr for the ecosystem. However what lies forward for the crypto market in 2025?

It is a urgent query that buyers might need. On this evaluation, BeInCrypto discusses insights from famend analysts in regards to the yr forward. Whereas some predict the bull market will acquire momentum, others urge warning. Right here’s a breakdown of the highest forecasts and key alerts from essential indicators.

Analyst Expection Bitcoin Rally to Persist, however First…

For Benjamin Cowen, crypto analyst and founding father of IntoTheCryptoverse, Bitcoin (BTC), particularly, may begin 2025 with a correction. Cowen suggests this might occur as a result of, in January, following earlier halving years, Bitcoin confirmed comparable conduct. He advises market members to arrange mentally for a possible pullback.

“Within the final 2 cycles, BTC bought a correction in January of the post-halving yr. In all probability worthwhile to be mentally ready for that final result. So would correspond to January 2025.” Cowen wrote on X.

This thesis, nevertheless, is opposite to a number of opinions predicting that the Bitcoin worth may rally towards $120,000 within the first month. Presently, BTC trades at $97,970. This yr, the cryptocurrency reached a brand new all-time excessive of $108,268, representing a 112% year-to-date (YTD) enhance.

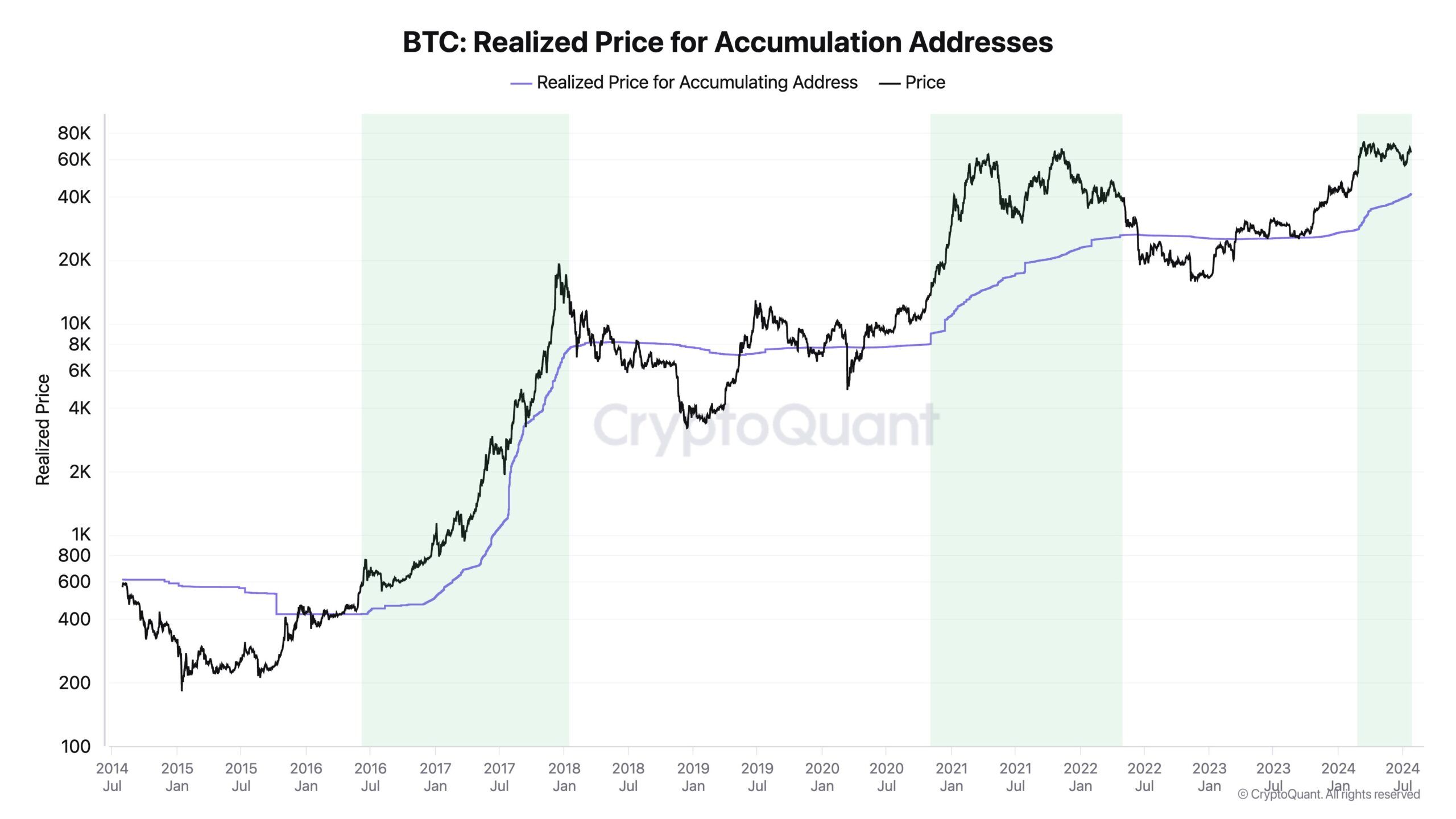

Ki Younger Ju, CEO of the analytic platform CryptoQuant, opined that the Bitcoin bull market may final till mid-2025. Younger Ju made this assertion in July, noting that BTC would possibly appeal to new capital to increase the bullish crypto market in 2025 to that interval.

Nonetheless, in November. Younger Ju modified his sentiment. In accordance with him, if Bitcoin worth ends 2024 on a powerful be aware, it may set the stage for a 2025 bear market.

“I anticipated corrections as BTC futures market indicators overheated, however we’re coming into worth discovery, and the market is heating up much more. If correction and consolidation happen, the bull run could lengthen; nevertheless, a powerful year-end rally may arrange 2025 for a bear market.” Younger Ju mentioned.

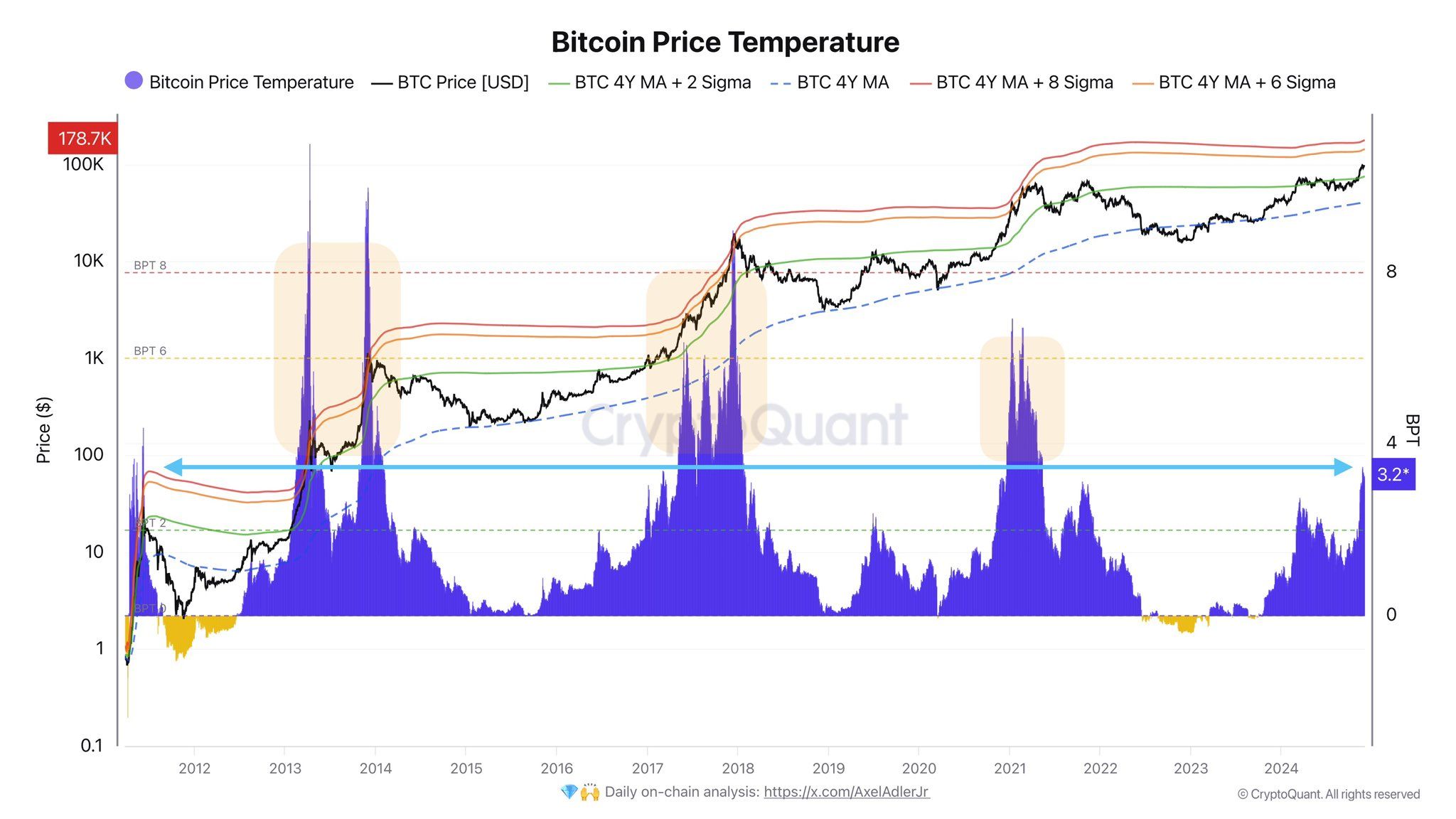

Lately, Axel Adler shared his perspective on the Bitcoin Value Temperature (BPT), which measures the space between the present Bitcoin worth and its 4-year shifting common.

Usually, Bitcoin reaches the cycle prime when the BPT studying falls between 6 and eight. On December 7, Adler famous that the indicator was at 3.2. Nonetheless, he talked about that if the studying rises to eight, it may push Bitcoin’s worth to $178,000.

“At a BPT degree of 8, the value may attain $178K per BTC. Primarily, this serves as a goal for 2025, which may materialize if the present demand for cash on the spot market persists.” Alder talked about.

Altcoins Not Left Out: Solana vs Ethereum Rivalry to Proceed

Nonetheless, Bitcoin is just one a part of the crypto market. Subsequently, you will need to have a look at different belongings and the potential macroeconomic view that would occur for crypto in 2025. On the identical time, you will need to be aware that in addition to Bitcoin, only some altcoins from the 2021 bull market had been in a position to attain new highs.

Nonetheless, there have been some optimistic indicators. For instance, BNB and Solana (SOL) climbed to new peaks, whereas XRP’s worth confirmed robust efficiency throughout this final quarter. Some comparatively new altcoins, comparable to Sui (SUI), Mantra (OM), and Bitget Token (BGB), additionally had spectacular performances.

This accolade would, nevertheless, be incomplete with out mentioning meme cash, which had a powerful maintain in the marketplace throughout this cycle. Attributable to this, specialists forecast that meme cash, AI cash, and Actual World Belongings (RWA) tokens would possibly proceed to carry out effectively in 2025.

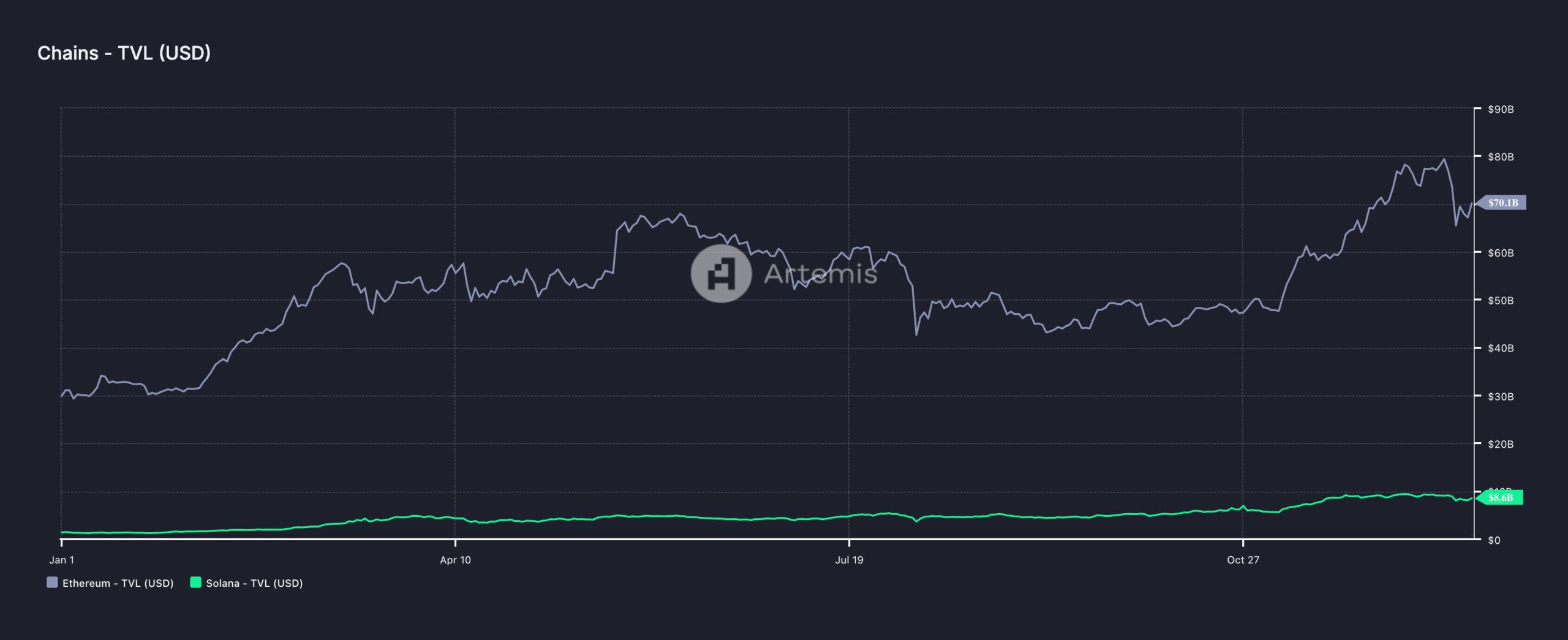

Ethereum (ETH) has, nevertheless, been a bit of disappointing. Because of this, digital asset administration agency 21Shares opined that Solana would possibly maintain consuming into Ethereum’s market share in 2025.

In its report, 21Shares attributed this forecast to low charges supplied on the Solana blockchain and the mixing of the adoption of PayPal USD (PYUSD) stablecoin. Furthermore, it emphasised that this doesn’t suggest that SOL would flip ETH’s market cap.

“Whereas we don’t anticipate a full “flippening,” Solana is primed to outperform and seize extra market share from Ethereum by means of improved UX and infrastructure.” The report said.

Regardless of that, Ethereum’s Complete Worth Locked (TVL) stays increased than that of Solana. As of this writing, Solana’s TVL is $8.60 billion, whereas Ethereum’s is $70.10 billion.

Ought to the prediction come to cross, the TVL distinction would possibly tighten. Relating to the Solana ETF software, 21Shares famous that the approval would possibly come inside the first three quarters, however it might come as 2025 closes or the start of the next yr.

“Solana’s increasing function in TradFi is predicted to set the stage for conventional monetary merchandise comparable to Solana futures on the CME or U.S.-domiciled Solana ETFs. Whereas ETF approval could not occur in 2025, the chances are anticipated to extend as we method the tip of the yr and into the primary half of 2026.” 21Shares added.

The Trump Impact and What Adoption Could Look Like

From a macroeconomic perspective, the asset supervisor anticipates that the approval of Bitcoin ETFs will spur additional institutional adoption globally. This sentiment could also be linked to Donald Trump’s election as US president.

Throughout his marketing campaign, Trump persistently promised his administration would offer clearer laws for the crypto sector. His inauguration is scheduled for January 2025, and SEC Chair Gary Gensler’s resignation may enable the market to expertise extra freedom.

Exterior of the US, South Korea is contemplating lifting the ban on crypto ETFs. If achieved, this would possibly drive buying and selling quantity to a particularly excessive worth within the Asian area. The UK can be not overlooked, with hypothesis brewing that the nation may grant retail buyers entry to crypto exchange-traded notes (ETNs).

Based mostly on the above, it seems that the crypto market in 2025 may supply extra optimistic outcomes than what has occurred this yr. It’s also doable that one other nation would possibly undertake Bitcoin as a strategic reserve asset, following in El Salvador’s footsteps.

As of this writing, the international locations with the potential to realize which might be the US and Javier Milei-led Argentina. If that occurs, then the Bitcoin worth is prone to hit new highs, and the entire market cap may surge above $5 trillion.

For altcoins, this example nonetheless appears to be like dicey. Nonetheless, if a excessive degree of capital flows into these belongings, they may additionally appear new excessive. On the identical time, buyers would possibly must be careful. Ought to the market expertise crashes of crypto platforms like in 2025, this prediction may be invalidated, and the market may fall right into a bear part.

Disclaimer

In step with the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.