The vacation spirit didn’t carry any stability to the crypto market, with Bitcoin seeing its value drop from $97,300 on Dec. 22 to $94,800 on Dec. 24. Christmas Day noticed a slight restoration, however Bitcoin consolidated again to $98,000 because it met vital resistance above $99,000.

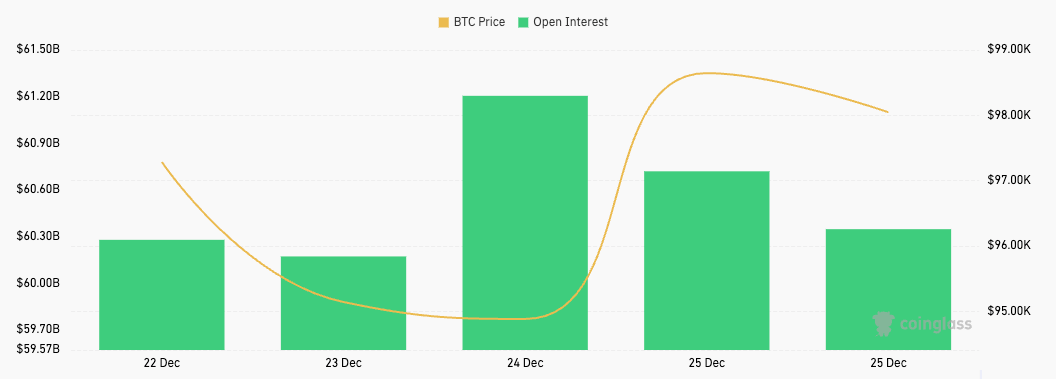

This value volatility was accompanied by equal volatility within the derivatives market. The futures market maintained comparatively steady open curiosity, starting from $60 billion to $61 billion throughout the identical interval, with a decline from $61.21 billion to $60.35 billion on Dec. 25.

This lower in futures OI alongside rising costs means that merchants are closing out leveraged lengthy positions to take earnings and cut back their urge for food for leverage as the value will increase. The timing of this drop in OI, occurring above the psychological $98,000 stage, exhibits profit-taking and de-risking by leveraged merchants.

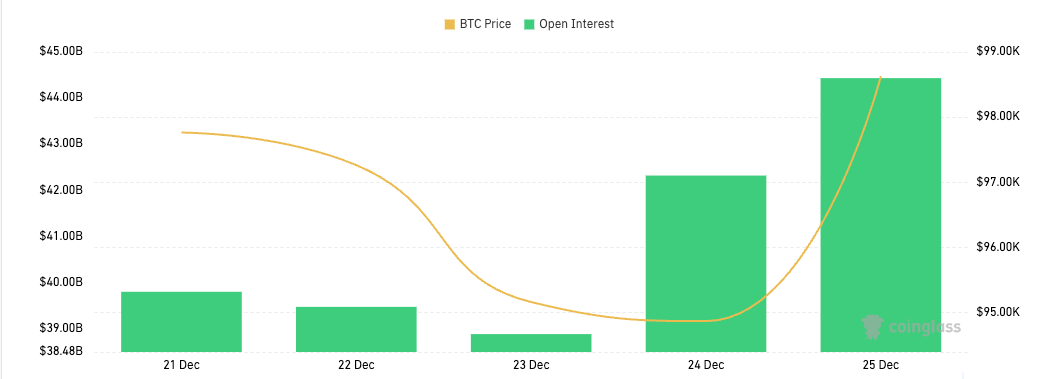

In distinction, the choices market has proven fairly a little bit of energy prior to now a number of days, with OI growing from $39.47 billion to $44.43 billion, representing a 12.6% rise. CoinGlass knowledge exhibits choices sentiment leans decidedly bullish, with calls dominating each open curiosity (63.58% versus 36.42% places) and quantity (57.22% versus 42.78% places). This distribution of choices positioning strongly suggests merchants are anticipating additional upside potential.

The divergence between futures and choices OI signifies a change in market threat urge for food. Somewhat than representing pure deleveraging, this shift suggests merchants have gotten extra nuanced of their method to market publicity. Knowledge exhibits merchants are slowly transferring away from high-leverage, unlimited-risk futures positions in favor of defined-risk choices methods that provide comparable publicity potential with superior threat administration. This conduct is particularly notable at increased value ranges, the place draw back threat turns into extra pronounced.

Skilled merchants are those driving these market shifts as they usually favor choices for exact threat administration and place sizing with precise most loss parameters. The expansion in choices exercise, significantly with advanced methods like spreads and straddles, signifies growing institutional participation and total market maturation. And whereas the futures market continues to be considerably bigger than choices, the expansion we’ve seen in choices exhibits merchants are growing extra superior threat administration methods because the market infrastructure improves.

This has vital implications for value and liquidity. With much less direct liquidation threat from futures and extra gamma-driven value motion from choices, we might even see slower, extra managed upward strikes, although sharp value actions stay doable if key strike costs are breached. The shift additionally impacts market depth, with futures markets doubtlessly exhibiting diminished liquidity whereas choices market makers tackle bigger roles, resulting in extra advanced hedging flows within the spot market.

Regardless of the widely wholesome market indicators, there are at all times dangers. The excessive absolute ranges of each futures ($60+ billion) and choices ($44+ billion) open curiosity point out vital market participation, which suggests potential for volatility. The decision-heavy positioning may speed up upside strikes and create the danger of sharp unwinding if the value drops.

The put up Bitcoin choices OI hits $44B as futures buying and selling cools appeared first on CryptoSlate.