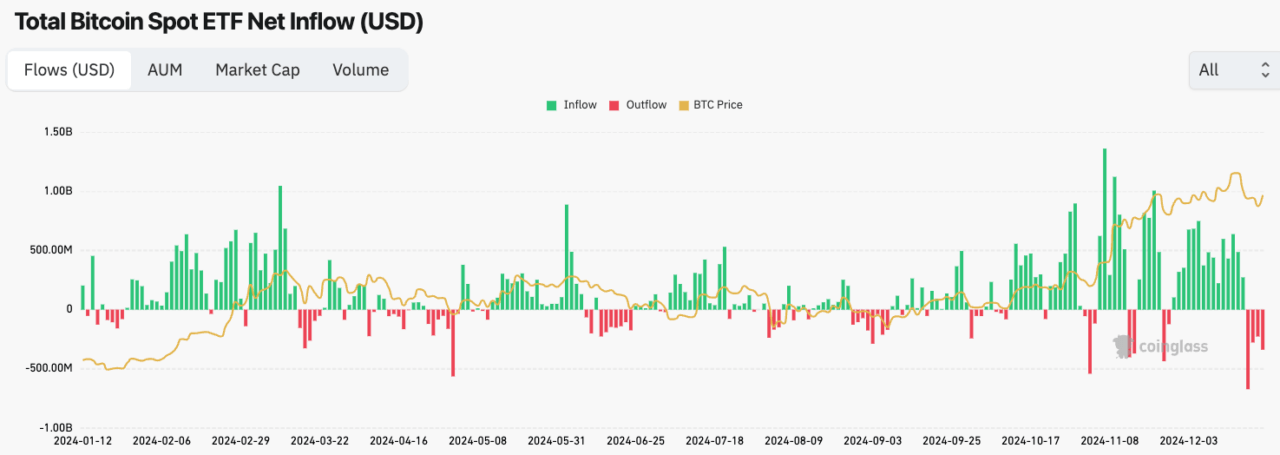

The spot bitcoin exchange-traded funds (ETFs) permitted by the U.S. Securities and Trade Fee (SEC) earlier this yr have registered greater than $1.5 billion in outflows over the past 4 days, with information exhibiting these funds’ largest-ever outflow occurred on Dec. 19 as $671.9 million had been moved out.

In keeping with information from Farside Traders, spot bitcoin ETFs’ largest-ever each day outflow put an finish to a 15-day influx streak and got here amid a big cryptocurrency market sell-off, which noticed the value of BTC drop from over $100,000 to a low beneath the $93,000 mark earlier than recovering.

The large exodus surpassed earlier file outflows recorded again in Might when the value of bitcoin dropped by greater than 10% over every week. That file, of $564 million,

Since then, these funds have suffered important outflows of $277 million on Dec. 20, $226.5 million on Dec. 23, and $338.4 million on Dec. 24.

The outflows come at a time through which Nasdaq-listed enterprise intelligence agency MicroStrategy has introduced the acquisition of a further 5,262 bitcoin at a median worth of $106,662 per BTC, with the acquisition costing the agency round $561 million in complete.

The Nasdaq-listed enterprise intelligence agency’s complete BTC holdings surpassed 400,000 BTC earlier this month after it invested $1.5 billion into the flagship cryptocurrency. The corporate’s BTC accumulation technique has impressed different firms to observe swimsuit.

One such firm is Marathon Digital Holdings, a cryptocurrency miner that has collected 44,394 BTC price round $4.1 billion, making it the second-largest company holder of the cryptocurrency.

Numerous different Bitcoin miners and even electrical automotive market Tesla have added BTC to their steadiness sheets over time to the purpose that, in keeping with BitcoinTreasuries information, a complete of 587,470 BTC are actually held by publicly traded firms. These cash are price an estimated $54.9 billion and symbolize 2.8% of the cryptocurrency’s provide.

Featured picture through Unsplash.