- Litecoin and Synthetix’s metrics confirmed potential for additional positive factors, however LTC was overvalued

- Efficiency of Theta had been markedly stronger in 2021, however the distinction was a lot smaller in 2024

The crypto market has seen some volatility over the previous two weeks. Bitcoin [BTC] was rejected on the $108k mark, and its worth discovery section was briefly halted. Some cash that have been among the many greatest gainers within the 2020-21 cycle made a resurgence over the previous 4-6 weeks.

Measured from 04 November’s lows to their native highs, Theta Community [THETA] made 235% positive factors, Synthetix [SNX] 199%, and Litecoin [LTC] 128%. Their rallies started on the identical day and ended across the identical time, in the direction of the tip of the primary week of December. Since then, they’ve retraced by 33.9%, 43%, and 29.3% respectively.

Will these huge performers from the earlier cycle get one other probability to run increased? The comparability of on-chain metrics and worth motion supplied some insights.

MDIA drop exhibits one other interval of accumulation is required earlier than subsequent rally

Litecoin was not one of many greatest winners from the earlier cycle, nevertheless it occupied a compelling narrative just a few years in the past. Touted as “the silver to Bitcoin’s gold” and the lighter, quicker different to BTC, the tall claims didn’t translate to optimistic efficiency through the years. This was exacerbated by the arrival of newer tokens, driving LTC farther from the general public’s eye.

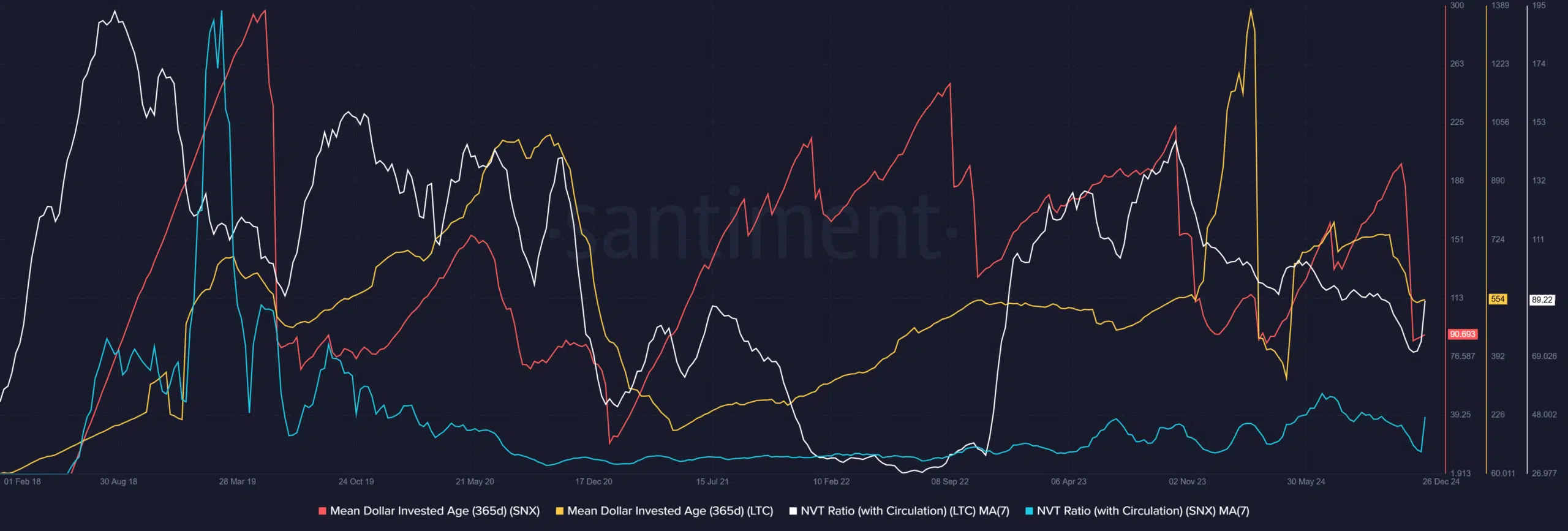

Supply: Santiment

The on-chain metrics of LTC and SNX confirmed that there was potential for additional positive factors. The Imply Greenback Invested Age (MDIA) of SNX had been falling over the previous month. This highlighted investments flowing again into common circulation and was an indication of elevated community exercise.

The MDIA of LTC rose increased in February 2024 than it did at any level within the final six years. And but, this hike, and the sharp decline that adopted, weren’t accompanied by the huge worth positive factors anticipated from new investments. Fairly, LTC remained certain to its long-term vary formation.

The Community Worth to Transactions ratio for each tokens has been trending south since June. This was an indication of upper transaction exercise and extra financial exercise on the community. Quite the opposite, the excessive NVT for Litecoin revealed the token could be overvalued in comparison with its community exercise. THETA metrics weren’t accessible on the platform.

Will THETA’s outperformance proceed?

Supply: LTC/USDT on TradingView

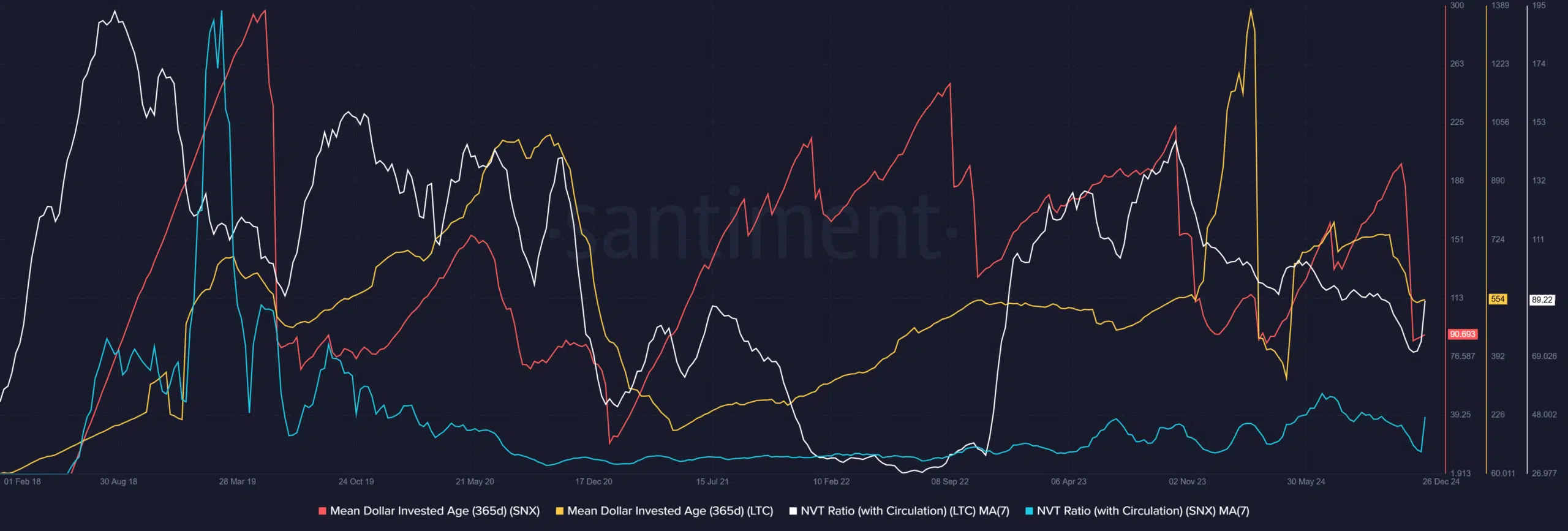

Set on the identical share scale, the worth efficiency of the three tokens displayed stark variations. Q1 2024’s rally noticed THETA heftily outperform the opposite two when it comes to worth appreciation. November’s rally was additionally barely stronger.

Learn Synthetix’s [SNX] Value Prediction 2025-26

During the last 4 years, the distinction in performances was extra obvious. Measured from Might 2020, the positive factors THETA noticed in 2021’s altcoin season far outstripped that of Synthetix token or Litecoin. The efficiency in 2024 and 2021 have been persuasive proof that Theta Community could be the very best wager among the many three altcoins.