The market enters the ultimate days of 2024 with a brand new document for the most important Bitcoin choices expiry in historical past. In the present day, a complete of $18 billion value of Bitcoin and Ethereum choices contracts will expire.

Thrilling and sudden developments could also be forward for choices merchants and buyers.

What Does the Report-Excessive Crypto Choices Worth Point out?

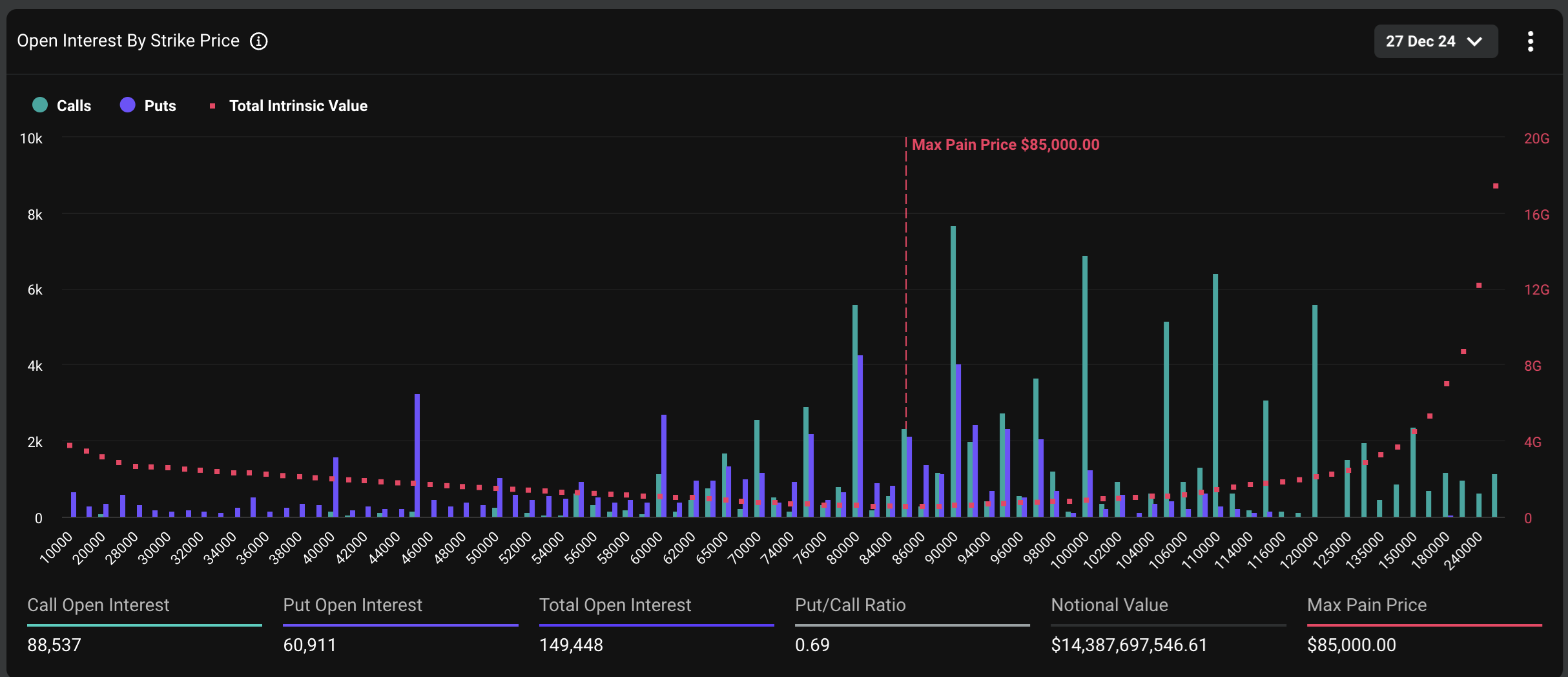

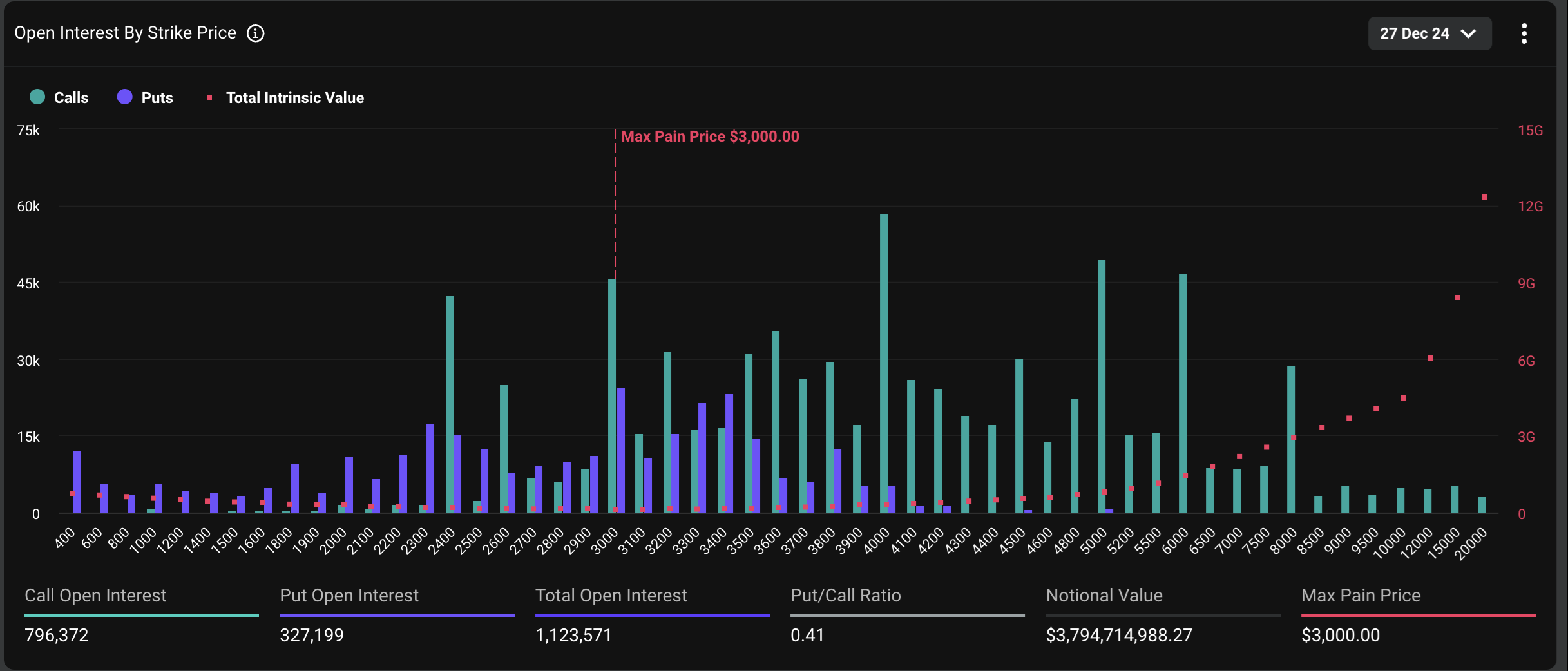

Based on information from Deribit, this Bitcoin choices expiry contains 88,537 contracts—4 occasions greater than final week. Equally, Ethereum choices contracts expiring right now whole 796,021, which is 4.5 occasions increased than the earlier week.

The full worth of expiring Bitcoin choices has reached a document $14.38 billion, whereas Ethereum’s choices whole $3.7 billion. The upper the worth of expiring choices, the higher the merchants’ expectations for revenue and the rising demand for threat hedging.

For Bitcoin, the expiring choices have a most ache worth of $85,000 and a put-to-call (P/C) ratio of 0.69. In idea, a low P/C ratio (under 1) displays optimistic sentiment, as extra name choices (bets on worth will increase) are being bought, indicating bullish expectations. Nevertheless, in comparison with historic information, Bitcoin’s P/C ratio has been trending upward all through the ultimate quarter of the yr, probably signaling elevated hedging sentiment.

“Demand for draw back safety has been rising for just a few weeks now, maybe partially fueled by gamers trying to defend their 2024 calendar yr efficiency metrics. The put/name ratio on December 27 choices open curiosity doubled from 0.35 in October to over 0.70 at present,” David Lawant, Head of Analysis at FalconX, commented.

In the meantime, Ethereum choices contracts have a most ache worth of $3,000 and a P/C ratio of 0.41. This ratio has decreased from 0.97 on the finish of October, reflecting rising bullish sentiment towards ETH.

On the time of writing, BTC and ETH are buying and selling at $96,300 and $3,300, respectively, considerably above the aforementioned most ache costs. The utmost ache worth refers back to the worth stage at which all buyers holding choices contracts (each name and put choices) expertise probably the most losses (or “ache”) at expiry.

Some buyers and analysts use most ache worth as an indicator to foretell potential worth instructions. The reasoning is that markets typically gravitate towards the worth to optimize income for choices sellers (sometimes giant monetary establishments).

“With the market closely leveraged to the upside, any vital draw back transfer might set off a speedy snowball impact. All eyes are on this expiry to outline the narrative heading into 2025,” Deribit commented.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.