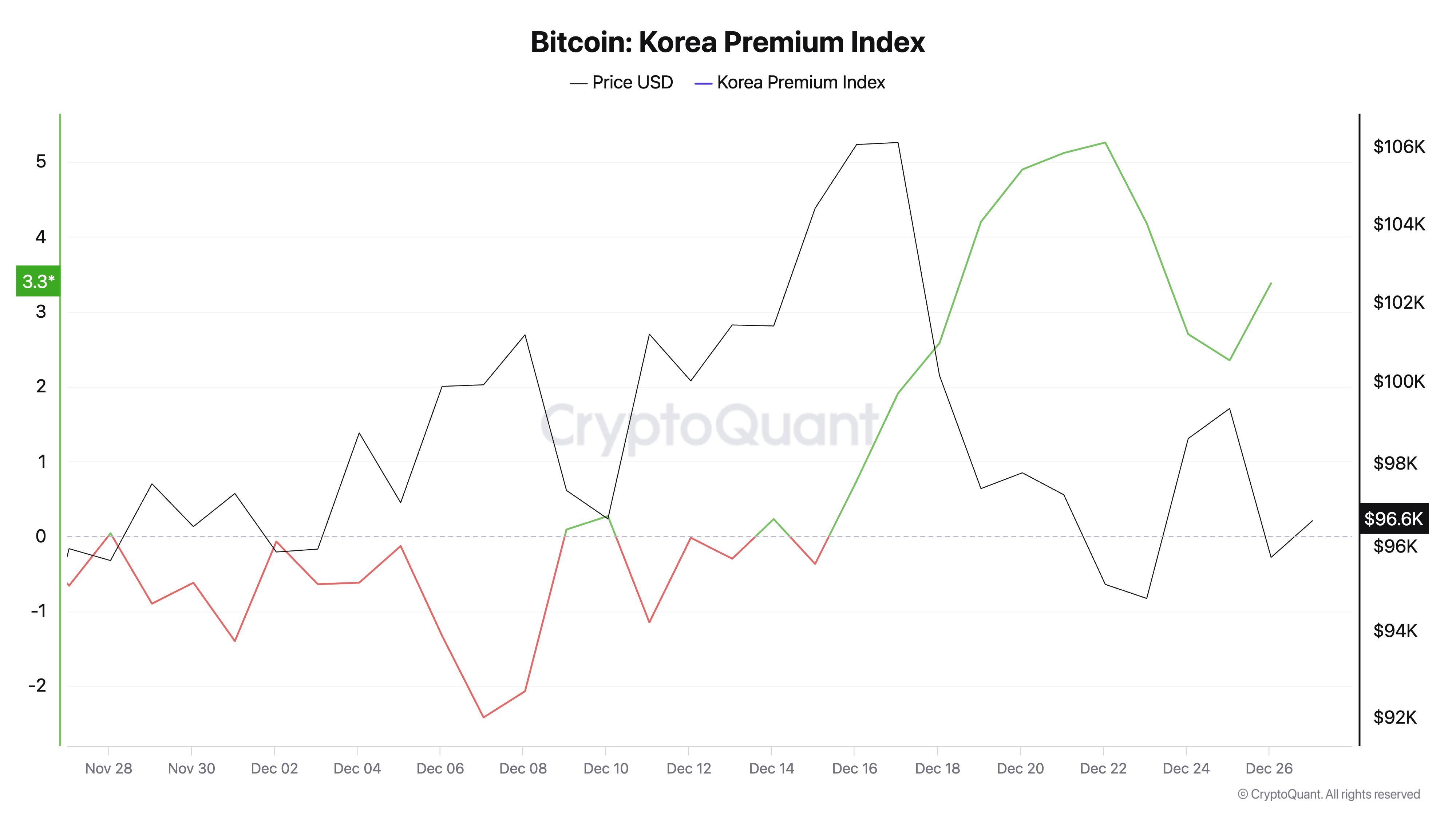

The Kimchi premium has seen a particular rebound after Christmas, recovering to three.83% on Dec. 27. Whereas that is nonetheless considerably decrease than the 5.26% recorded on Dec. 22, it nonetheless represents a major distinction in Bitcoin costs between South Korea and international markets.

The present rebound comes amidst political and financial turmoil in South Korea, marked by the impeachment of the appearing president, Han Duck-soo. This impeachment comes simply two weeks after parliament voted to question its President Yoon Suk Yeol.

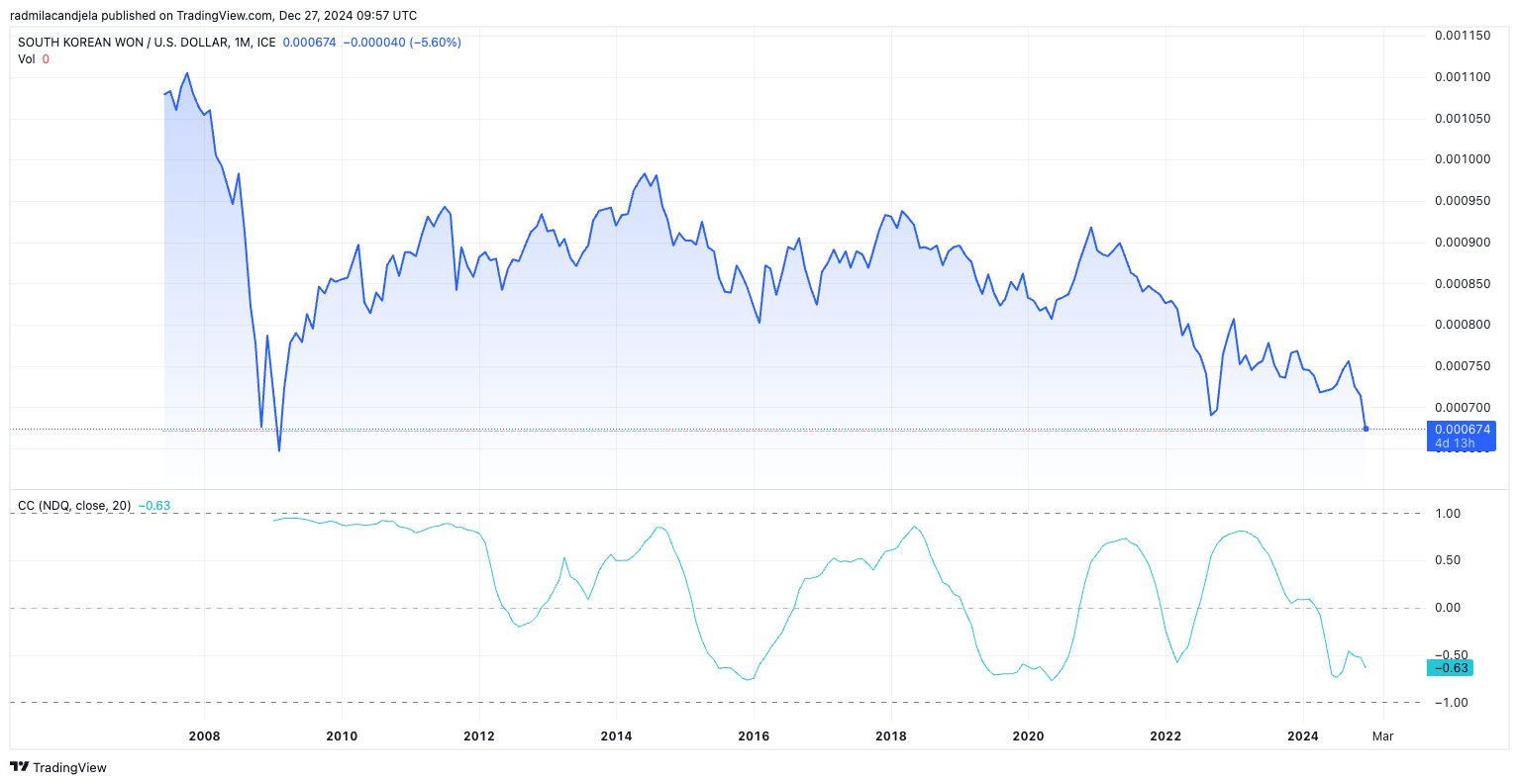

The continued political disaster created fears of financial instability, prompting heightened demand for Bitcoin. As native traders sought refuge in Bitcoin, the elevated demand drove home costs larger than international averages. The continued devaluation of the Korean received, which reached its lowest degree in opposition to the greenback since February 2009, additional fueled the rise within the premium.

The kimchi premium has been significantly unstable within the second half of 2024. Late November and early December noticed a major decline, with the premium turning unfavourable. A number of elements led to this decline, the primary one being political instability within the nation. On Dec. 3, President Yoon Suk Yeol declared he was imposing martial regulation, citing the necessity to shield the nation from political opposition. Shortly after, Yoon and officers from his authorities had been arrested and indicted on allegations of revolt, whereas Yoon is going through an impeachment trial.

The political unrest led to fears of regulatory tightening by South Korean authorities. Stricter measures on crypto exchanges goal to cut back speculative buying and selling, which weakens native demand for Bitcoin. Moreover, international arbitrage exercise performed a task in narrowing the premium. As worldwide merchants exploited the value distinction, Bitcoin inflows into South Korea elevated, balancing provide and demand. Market sentiment additionally shifted throughout this era, with South Korean merchants stepping again from speculative exercise as international Bitcoin costs consolidated.

Regardless of these adjustments, the received continued to weaken in opposition to the greenback. Provided that the devaluation didn’t instantly set off a rise within the kimchi premium, we will safely say that native market situations on the time had been extra influenced by regulatory and political elements.

By mid-December, the kimchi premium noticed a pointy resurgence. This resurgence occurred in opposition to the backdrop of extra political instability when the nation’s appearing president additionally confronted impeachment. Nevertheless, this time, fears of financial turmoil and potential capital controls led traders to show to Bitcoin as a hedge, growing native demand.

The speculative conduct usually accompanying durations of uncertainty additionally intensified, additional inflating Bitcoin costs in South Korea relative to international markets. In the meantime, the continued depreciation of the received added to the attractiveness of Bitcoin as a retailer of worth, contributing to the upward trajectory of the premium. The mix of those elements created an ideal storm, resulting in a restoration of the premium.

The influence of the kimchi premium isn’t restricted to South Korea. When the premium is excessive, it creates arbitrage alternatives for merchants to maneuver Bitcoin into South Korea, which will increase cross-border capital flows. This arbitrage exercise usually ends in short-term volatility as markets regulate. Moreover, a excessive premium can distort international Bitcoin worth indicators, as South Korea often represents a major share of buying and selling quantity. Rising premiums additionally have a tendency to draw regulatory scrutiny, as authorities goal to curb speculative buying and selling and shield retail traders from potential dangers.

On the optimistic aspect, the premium has traditionally confirmed Bitcoin’s position as a hedge in opposition to financial and political instability. The kimchi premium has historically been a barometer for South Korean market sentiment and macroeconomic situations. Throughout speculative booms, similar to in late 2017 and early 2021, the premium reached double-digit ranges, pushed by a frenzy of retail demand. In distinction, durations of unfavourable premium, like mid-2024, mirrored tighter rules and diminished speculative curiosity. The current rise mirrors these historic patterns however is rooted in distinctive circumstances, together with a political disaster and vital foreign money devaluation.

The put up Kimchi premium recovers as KRWUSD drops to 15-year low appeared first on CryptoSlate.