The analysis arm of Galaxy Digital is revealing its predictions for the 2 largest crypto property in 2025.

In a brand new thread on the social media platform X, Galaxy Analysis’s Alex Thorn says he sees Bitcoin (BTC) surging by almost 100% from present ranges earlier than 2025 expires amid rising adoption of the most important digital asset by market cap.

“Bitcoin will cross $150,000 in H1 and check or greatest $185,000 in This autumn 2025.

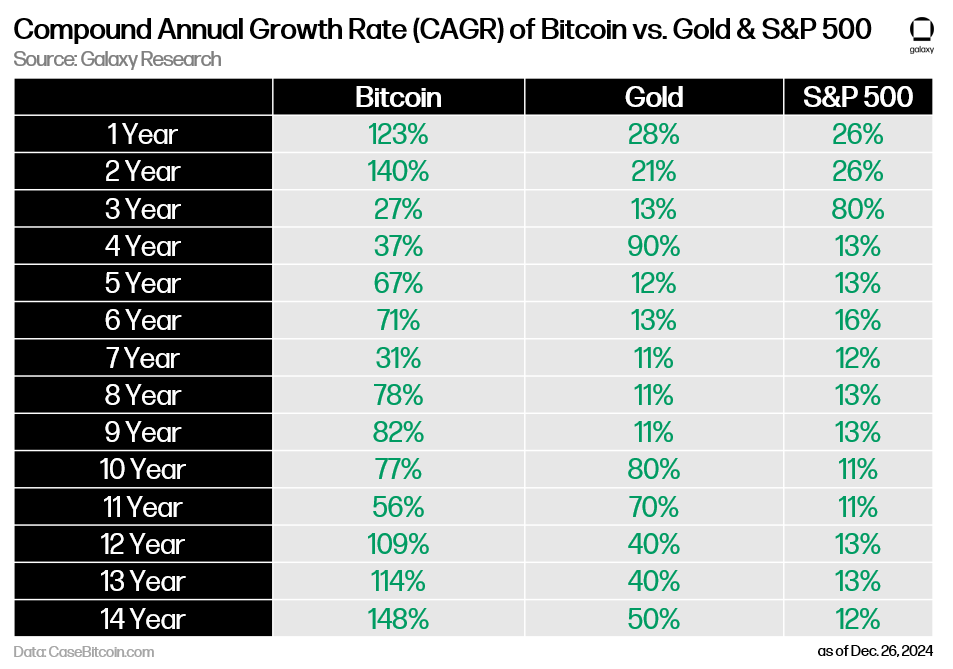

A mixture of institutional, company, and nation-state adoption will propel Bitcoin to new heights in 2025. All through its existence, Bitcoin has appreciated quicker than all different asset lessons, notably the S&P 500 and gold, and that pattern will proceed in 2025. Bitcoin will even attain 20% of gold’s market cap.”

Thorn additionally believes that Bitcoin exchange-traded merchandise (ETPs) will witness tens of billions of {dollars} in inflows subsequent yr.

“The US spot Bitcoin ETPs will collectively cross $250 billion in AUM (property beneath administration) in 2025.

In 2024, the Bitcoin ETPs collectively took in additional than $36 billion in internet inflows, making them the very best ETP launch as a cohort in historical past. Lots of the world’s main hedge funds purchased the Bitcoin ETPs, together with Millennium, Tudor, and D.E. Shaw, whereas the State of Wisconsin Funding Board (SWIB) purchased a place, based on 13F filings.

After simply 1 yr, the Bitcoin ETPs are solely 19% away ($24 billion) from flipping the AUM of all of the US bodily gold ETPs.”

Knowledge from crypto analytics agency Coinglass reveals that Bitcoin exchange-traded funds (ETFs) collectively have almost $110 billion in AUM. At time of writing, Bitcoin is buying and selling for $93,687.

Ethereum (ETH), Thorn predicts that the main layer-1 protocol will see contemporary all-time highs subsequent yr.

“Ether will commerce above $5,500 in 2025.

A rest of regulatory headwinds for DeFi (decentralized finance) and staking will propel Ether to new all-time highs in 2025.

New partnerships between DeFi and TradFi (conventional finance), maybe carried out inside new regulatory sandbox environments, will lastly enable conventional capital markets to experiment with public blockchains in earnest, with Ethereum and its ecosystem seeing the lion’s share of use.

Firms will more and more experiment with their very own layer-2 networks, largely primarily based on Ethereum know-how. Some video games using public blockchains will discover product-market match, and NFT (non-fungible token) buying and selling volumes will meaningfully rebound.”

At time of writing, ETH is buying and selling at $3,420.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Test Worth Motion

Observe us on X, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any losses you might incur are your accountability. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/WhiteBarbie/Troyan