LINK’s value has declined 10% prior to now 24 hours, mirroring the broader cryptocurrency market downturn. This value drop follows Ripple’s integration of the Chainlink Commonplace to assist convey its new RLUSD stablecoin on-chain.

At press time, LINK trades at $20.77. Its technical and on-chain setup confirms the potential of additional declines, and this evaluation explains how.

Chainlink Faces Double-Digit Drop as Bearish Sentiment Intensifies

On Tuesday, digital cost service supplier Ripple confirmed its partnership with Chainlink. The collaboration goals to offer safe and correct value information for RLUSD transactions on Ethereum and the XRP Ledger.

Nonetheless, the information of this integration has didn’t influence LINK’s value positively. Previously 24 hours, its worth has dropped by 10%.

Furthermore, LINK’s double-digit value decline has been accompanied by a surge in its buying and selling quantity, forming a destructive divergence. Over the previous 24 hours, the token’s buying and selling quantity has totaled $1.06 billion, rising by 28%.

When an asset’s buying and selling quantity surges throughout a value decline, it signifies heightened market exercise as extra individuals promote, probably pushed by panic or profit-taking. This indicators a powerful bearish sentiment and hints at a possible continuation of the downtrend.

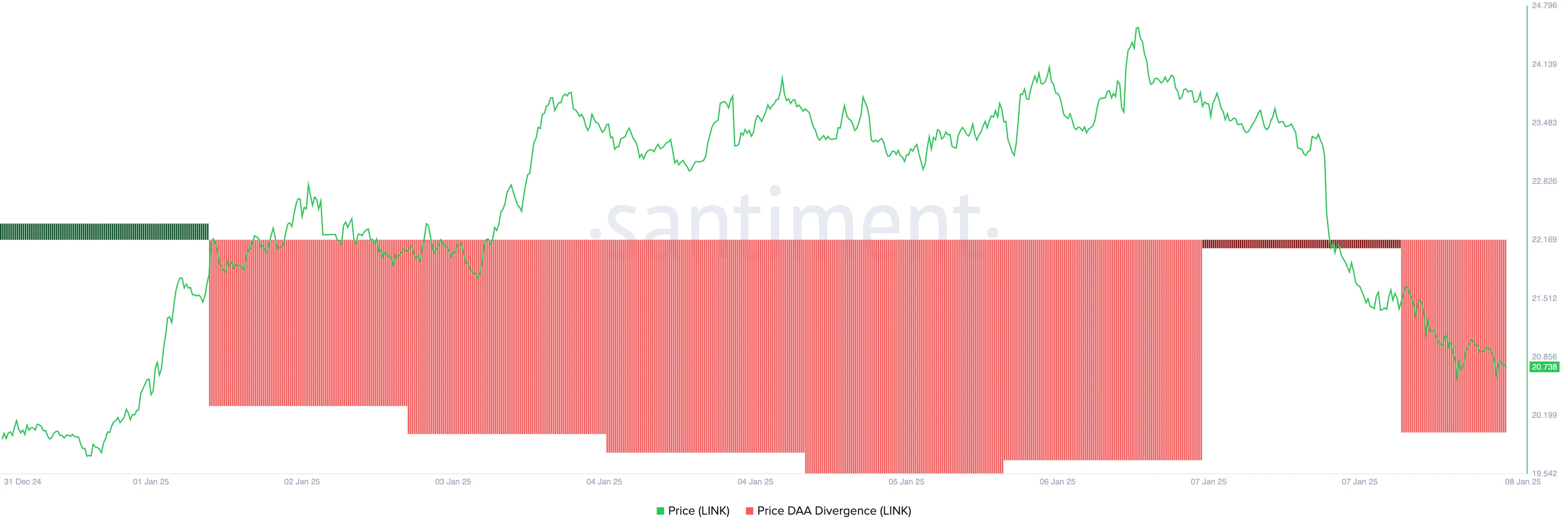

Moreover, the destructive readings from LINK’s value day by day energetic handle (DAA) divergence spotlight the low demand for the altcoin. At press time, that is -56.61%.

This metric measures an asset’s value actions with the modifications in its variety of day by day energetic addresses. When its worth is destructive throughout a value decline, it suggests weakening on-chain exercise alongside the bearish value motion. This means lowered curiosity or utility for the asset, reinforcing the downward pattern.

LINK Worth Prediction: A Decline Under $20 or a Rally Above $30?

LINK trades barely above the help shaped at $18.53 on the day by day chart. If its present downward pattern persists, this help degree can be examined. If it fails to carry, LINK’s value may drop additional to $15.81.

Nonetheless, if the broader market sentiment improves and LINK accumulation resumes, it may drive its value above $22.54 and towards the $30 value zone.

Disclaimer

Consistent with the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.